Worth watching: Mode Global and Condor Gold

15th June 2021 07:44

by Alistair Strang from Trends and Targets

These two small-cap stocks have piqued the interest of our technical analyst. Here's what he thinks the price might do.

Mode Global (LSE:MODE) appears to be a company in the right place at the right time. Formed just a few years ago, their stated aim is to ‘become a financial services business delivering the products of tomorrow, today’.

Their website is alive with current buzzwords and even the classic ‘fintech’ is now presented with a capital ‘F’, obviously continuing attempts to make Fintech a real word. In fairness, it should be as one of the earlier components of the Fintech field, PayPal (NASDAQ:PYPL), continue to perform quite nicely.

Our eyebrows were raised, reading that Mode Global are already in partnership with Tencent (SEHK:700) and Alibaba (NYSE:BABA), both quite big deals.

- Watch out for these new IPOs on AIM

- IPO market: how the class of 2020 has fared

- Check out our award-winning stocks and shares ISA

Fintech, very basically, can be thought of as ongoing (successful) attempts to replace credit card companies as the method for online purchases. In this arena, Paypal can obviously take a bow, but the potentials continue to be discovered.

Today, watching someone pay at a checkout by using their smartphone, was just another application where financial technology is increasingly used. No credit cards nor debit cards were harmed in the process, a single act which must be truly frightening to the entrenched players in the field of retail shopping. It’s easy to suspect some of the major banks must be nervously looking over their shoulder, when new start-ups appear, their size able to make the transition from “good idea” to “let’s try it”, faster than traditional bank customers can type their code into an ATM.

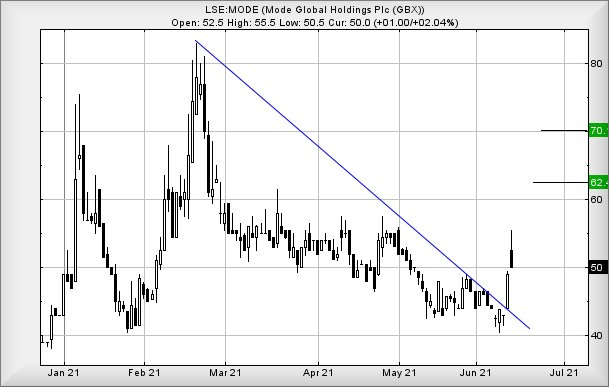

We’ve run the numbers against Mode, and the immediate share price prospects looking fairly useful. From our perspective, we can allocate 56.5p as a potential trigger level. In the event this level is exceeded, gains toward an initial 62p look possible with our longer-term secondary (or later that day, if good news is involved) calculating at a very possible 70p.

Visually, the share needs trade above 83.5p to enter ‘illogical’ territory where we can no longer work out upward numbers. In reality, we suspect we shall need to revisit the company should the 70p level be exceeded.

Source: Trends and Targets. Past performance is not a guide to future performance

Condor Gold

We’ve received a few emails asking us to look at Condor Gold (LSE:CNR). Their share price is presently trading around 46.5p and appears to be adhering pretty firmly to the Blue downtrend on the chart, regardless of what’s actually happening to the price of gold.

Invariably, this behaviour tends to result in a situation where movement, if triggered, tends be faster than the panic rush to change channel if anything to do with the Scottish football team comes on TV.

On the chart below, we’ve painted a little circle around a share price movement recently. This surge to 52.5p, quickly reversed below the trend, gives what should be a reliable starting point, as movement above this level works out with an initial ambition of 61p. If exceeded, our secondary calculates at 75p and visually, both target levels make quite a lot of sense.

Perhaps Condor shall prove worth watching. We’d panic, if it managed below 35p.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.