Why consolidating your investments makes sense

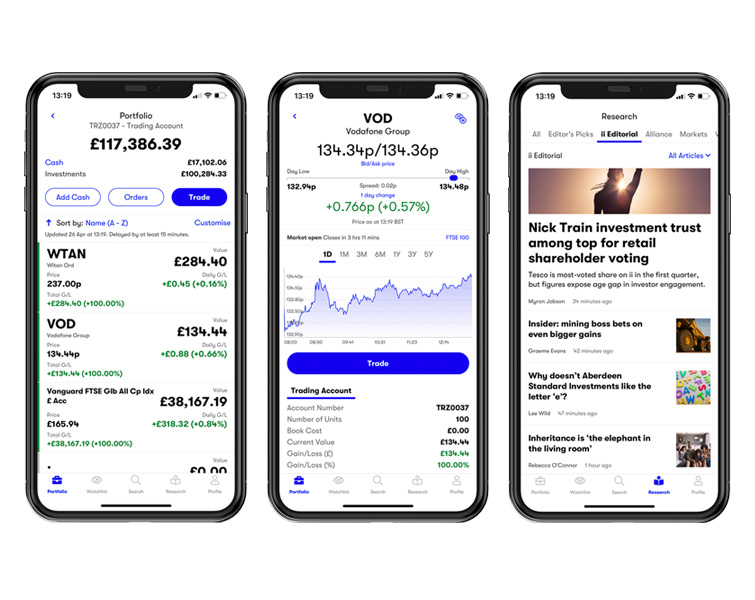

Having all your investment accounts in one place means convenience and flexibility. You can see all your investments at a glance and easily keep track of their progress.

Better still, you could make big savings on fees. With ii, our subscription plans start from just £4.99 a month and includes our Stocks and Shares ISA and Trading Account, plus free regular investing.

Important information - investment value can go up or down and you could get back less than you invest. If you're in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Please remember, SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial advisor before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

A simple example

- Simone has £50,000 in an ii ISA. This costs her £11.99 per month on ii's Investor plan, which is £143.88 per year in total.

- She also has a Trading Account with another provider. With a balance of £50k and annual fees of 0.45% for holding funds, she pays another £225 a year for this account.

- If Simone moved this account to ii, she would continue to pay the flat fee of £143.88 per year, and save £225.

| Accounts | Cost with ii's Investor plan (annual) | Typical competitor % charge (annual)* |

ISA | £143.88 | 0.45% (£225) |

ISA + Trading Account | £143.88 | 0.45% (£450) |

Example does not include trades (your first monthly trade with ii is free with our Investor plan).

*0.45% is based on the Hargreaves Lansdown charge for holding funds up to £250,000.

See how much you could save in the long run

The charts below show how much you could save over 30 years by keeping all your investments with ii. What starts as a small difference can have a big impact over time.

* Analysis shows you could be better off over 30 years of investing due to our low flat fees. This is just for illustration if all other factors were the same. The advantage of lower flat fees over time means that you could be significantly better off in the long run. By how much will always depend on your personal circumstances.

What investments can I transfer?

How to transfer to ii

It’s quick and easy to start your investment account transfer. Make sure you have the details of the account(s) you want to transfer to hand.

Open an account

It only takes a few minutes. Existing customers can log in and add an account.

We’ll take it from there

We will work with your current provider(s) and give you regular updates on progress.

Things to consider before transferring your investments

- Are there any exit fees, charges, penalties and benefits that could have a detrimental impact on your investments?

- Transferring in cash

- As an investor, you will be out of the market for a time.

- Selling and repurchasing investments could mean paying additional charges.

- Transferring existing investment holdings

- There could be a period of time when the investments cannot be accessed and, as an investor, you might not be able to respond to market movements.

- Transferring pensions

- Please check that you won’t lose any safeguarded benefits if you transfer. This could include guaranteed annuity rates or lower protected pension age than the Normal Minimum Pension Age (rising from 55 to 57 in 2028).

- Before transferring, we recommend seeking advice from a suitably qualified financial advisor or free, impartial pension guidance from MoneyHelper or (if you are 50 or over) Pension Wise.

If you are unsure about any of the above, we recommend seeking the advice of an independent financial adviser.

Trading while you transfer

If you want to trade while your transfer is in progress, most providers will be able to facilitate this as long as your investments aren’t in the process of being re-registered.

You should contact your current provider to place your trade(s). Don’t forget to keep both them and us updated on the changes to the investments in your account. We can’t be held liable for any missed opportunity if you choose not to trade while your transfer is in flight.

Taking an income from your pension while you transfer

You may not be able to take an income from your pension during your transfer. For more information on this, you should speak to your current provider. If you think you will need to take benefits within a specific timescale, you are transferring at your own risk and we can’t be liable for any loss.