Need some investment ideas?

Take a look at the Aberdeen funds and investment trusts available on the ii platform.

Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser.

interactive investor (ii) is an Aberdeen company. Aberdeen will financially benefit from any investments you purchase in any Aberdeen related products which are held within your ii account. Investments will always carry a level of risk, represented by the risk rating displayed against each fund or trust, and charges may also apply – please review the relevant regulatory documents for further details.

Here are the most popular Aberdeen Investment funds being held by ii customers in an ISA, SIPP or Trading Account.

This list is based on the top 10 Aberdeen funds by total GBP value invested on the ii platform during the previous quarter (01/09/2025 to 31/12/2025).

Source: interactive investor. Data taken 31 December 2025

Here are the most popular Aberdeen investment trusts being held by ii customers in an ISA, SIPP or Trading Account.

This list is based on the top 10 Aberdeen investment trusts by total GBP value invested on the ii platform during the previous quarter (01/09/2025 to 31/12/2025).

Source: interactive investor. Data taken 31 December 2025.

Important information: These figures should not be taken as personal recommendations to buy or sell a particular investment, and are not intended as advice. Past performance is not a reliable indicator of future results.

interactive investor (ii) is an Aberdeen company. Aberdeen will financially benefit from any investments you purchase in any Aberdeen related products which are held within your ii account. Investments will always carry a level of risk, represented by the risk rating displayed against each fund or trust, and charges may also apply – please review the relevant regulatory documents for further details.

| Asset group: | Fund manager: | Risk category: |

|---|---|---|

| Equities | Gabriel Sacks, Xin-Yao Ng | 4 |

The Company aims to maximise total return to shareholders over the long term from a portfolio made up predominantly of quoted smaller companies in the economies of Asia excluding Japan.

Aberdeen Asia Focus PLC invests in high-quality, smaller companies across Asia, typically with market capitalisations up to £5bn. These are established, listed businesses that are often overlooked by mainstream funds - offering access to hidden gems in fast-growing Asian markets. Asian small caps have historically delivered stronger long-term returns than large caps, without consistently higher risk.

The Trust’s portfolio is almost entirely distinct from typical Asia indices, providing diversified exposure to companies with strong growth potential.

With over 30 years of experience and 39 analysts based across Asia, Aberdeen brings deep local insight to uncover under-researched opportunities and manage risk. As of 31 July 2025, the Trust has delivered over £2.1 million for ISA savers investing their full annual allowance since inception - the highest return of any Asia-focused investment trust in the Association of Investment Companies’ ISA Millionaire analysis.

Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser.

interactive investor (ii) is an Aberdeen company. Aberdeen will financially benefit from any investments you purchase in any Aberdeen related products which are held within your ii account. Investments will always carry a level of risk, represented by the risk rating displayed against each fund or trust, and charges may also apply – please review the relevant regulatory documents for further details.

| Asset group: | Fund manager: | Risk category: |

|---|---|---|

| Fixed income | Mark Munro | 3 |

The fund aims to achieve a combination of income and growth, whilst also aiming to provide liquidity and avoid loss of capital, by investing in bonds with a maturity of up to 5 years. The fund also aims to achieve a yield in excess of the Bloomberg Global Corporate Aggregate 1-3 Year Index (USD Hedged) over rolling three-year periods (before charges).

Access enhanced yield through global investment: The fund invests in a mix of short-duration corporate bonds, government bonds, and cash offering investors access to yield-enhancing opportunities. By investing globally, the fund taps into a broader range of bond markets, attracting potential for attractive yields, growth opportunities, or steady monthly income from current market yields.

Low risk, high quality portfolio: The fund offers high quality by focusing on bonds with a minimum credit rating of A-, aiming for strong and reliable performance. By prioritising bonds with maturities of three years or less, the fund reduces interest rate sensitivity, making it a possible option for investors looking for stability and growth.

Fast access: The fund offers the advantage of faster access to investments and redemptions with next-day (T+1) settlements, compared to the typical two or more-day periods. By investing in shorter maturity bonds and maintaining a high allocation to liquid assets, the Fund provides greater efficiency and flexibility for investors and their unique requirements.

Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser.

interactive investor (ii) is an Aberdeen company. Aberdeen will financially benefit from any investments you purchase in any Aberdeen related products which are held within your ii account. Investments will always carry a level of risk, represented by the risk rating displayed against each fund or trust, and charges may also apply – please review the relevant regulatory documents for further details.

| Asset group: | Fund manager: | Risk category: |

|---|---|---|

| Equities | abrdn Quantitative Investment Solutions Team | 5 |

To generate growth over the long term (5 years or more) by investing in global equities.

Combining the benefits of active and passive management: Our disciplined, data-driven process removes emotional bias, ensuring consistent, cost-efficient active management with the potential to deliver strong value for investors. We follow a dynamic, benchmark-driven strategy that adapts to market inefficiencies, ensuring portfolios are aligned with evolving opportunities and risks.

Proven return factors: The portfolio actively invests in stocks using proprietary measures of return premiums grounded in the solid investment rationale of Quality, Momentum and Valuation. The investment process combines these premia and applies them across all companies in the investment universe to take advantage of the breadth that brings.

A breadth of opportunity: By analysing all companies, every day, across regions, sectors, and industries, our World Equity Enhanced Index strategy delivers a globally diversified portfolio that aims to mitigates risk and capture diverse sources of return.

Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser.

interactive investor (ii) is an Aberdeen company. Aberdeen will financially benefit from any investments you purchase in any Aberdeen related products which are held within your ii account. Investments will always carry a level of risk, represented by the risk rating displayed against each fund or trust, and charges may also apply – please review the relevant regulatory documents for further details.

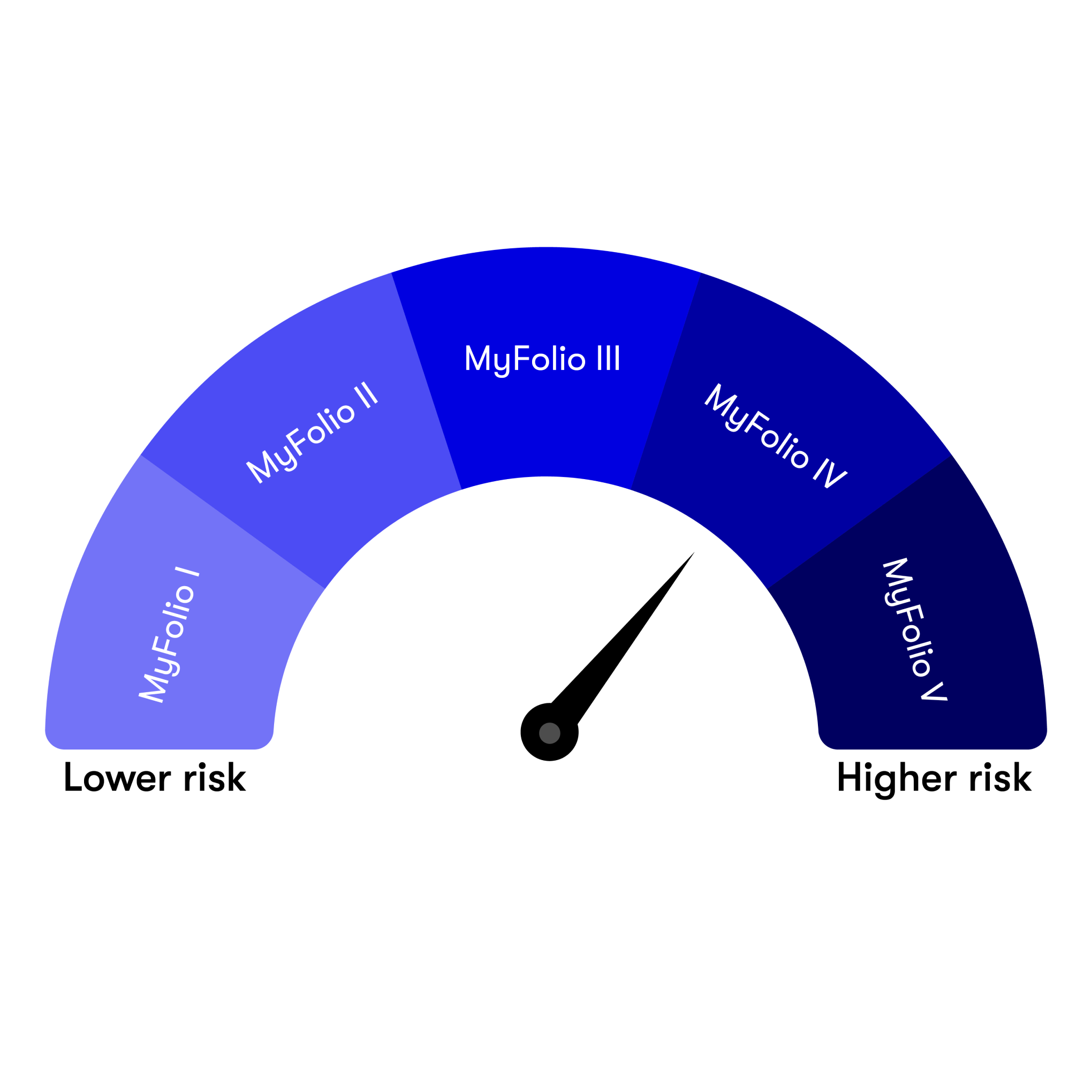

The MyFolio Index Funds are designed to make investing quick and easy. You simply decide how much risk you are comfortable taking to select the appropriate fund. Aberdeen Investments will then do the rest to manage it in line with your chosen level of risk.

The fund manager invests your selected fund across a range of Aberdeen Investments tracker funds. These funds aim to replicate the performance of indexes, like the FTSE All-Share or the S&P 500. Each fund blends defensive assets (like cash and bonds, which are generally lower risk) with growth assets (such as equities, which offer higher potential returns but come with more risk). By combining these asset types, the fund aims to deliver the best possible return for each level of risk. As you move up the risk levels, you would typically expect to see a higher proportion invested in growth assets and less in defensive assets.

There are some additional costs associated with investing in funds, but you can feel reassured by the fact an expert is taking care of your money.

Annual Management Charge - 0.20%

Designed for investors who are very comfortable with investment risk, aim for high long-term investment returns and do not overly worry about periods of poorer performance in the short-to-medium term. Ordinarily, these portfolios can be subject to the full extent and frequency of stock market fluctuations.

The MyFolio team has recently won the Best Risk Targeted Range of Funds category at the Professional Adviser Awards 2025 for the MyFolio Index Fund.

You can trade a number of Aberdeen funds and investment trusts in your ii Trading Account, ISA or Self-Invested Personal Pension (SIPP). Trading online or with our app is quick and easy, it's like trading any other investment. For any that aren't available online, you can deal over the phone by calling us on 0345 607 6001.

We have a number of available accounts for you to choose from if you’re looking to invest. With our low, flat-fee plans, access to one of the widest choices of investments in the market, and free regular investing, your favourite funds are just a few clicks away.