Footasylum's 50% dive and two other misery stocks

19th June 2018 13:04

by Graeme Evans from interactive investor

Three companies with very different stories to tell - Footasylum, McCarthy & Stone and Hornby - were all reeling today after results or updates were met with fresh and significant share price falls.

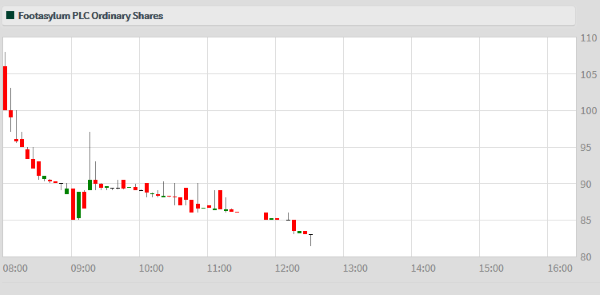

In the case of Footasylum, the lifestyle fashion retailer aimed at the 16-24 age group lost as much as half its value, even though maiden results showed the company growing at an impressive rate with a 33% jump in revenues.

In contrast, the problems at McCarthy & Stone and Hornby are now well documented. The retirement housebuilder's shares continue to be the exception in an otherwise robust construction sector, while the model railway brand is still in the grips of a seemingly never-ending turnaround battle.

For Footasylum, the stockmarket journey may have only just begun but it is already sitting on a 46% deficit to the IPO price last autumn, when it was valued at £150 million with a similar price multiple to high street giant JD Sports Fashion.

Source: interactive investor Past performance is not a guide to future performance

The founders of JD - David Makin and John Wardle - are behind the explosive growth of Footasylum, which has mushroomed to 65 stores and a significant online presence since opening its first store in March 2006.

Adjusted profits for the year to February 24 rose 4% to £8.4 million, but margins were squeezed by 120 basis points and the company has also warned that tougher trading conditions are hurting in the current financial year.

It continues to work on additional store upsizes alongside new store openings, which will have an impact on capital expenditure and property costs for the current year. This means that underlying earnings for 2019 will show more modest growth than in the previous financial year.

Analysts at broker Liberum said the moves to support long-term growth were sensible, even if it pushed the Footasylum story out by another year.

They said:

"Footasylum remains a high growth business, is investing wisely and the story remains very much intact, though it is clearly disappointing to be cutting numbers by 25%."

Liberum, whose price target of 280p is under review, has reduced its pre-tax profits forecast for this year from £9.6 million to £7.5 million.

The latest disappointment at McCarthy & Stone follows a noticeable decline in reservation rates as potential customers show caution in the current climate.

This impacted on the all-important spring selling season, with the group now on track for legal completions of between 2,100 and 2,300 in the year to August 31, compared with 2,302 the year before.

Source: interactive investor Past performance is not a guide to future performance

Operating profits will be between £65 million and £80 million, with the order book of £706 million below management’s expectations given it is trading from a higher number of outlets.

UBS, which has a 'sell' recommendation on McCarthy, said today's update represented a 20% to 30% downgrade to consensus forecasts.

Analyst Miguel Borrega added:

"We think the slower trading environment has been worse than expected which could put further negative pressure on earnings momentum and returns."

In addition, McCarthy is facing uncertainty over whether it will be granted an exemption from the Government's industry-wide crackdown on leasehold practices. McCarthy has previously said it expects to generate profits of around £33 million from the aggregating and forward selling of freehold reversions (ground rents) in 2018.

The company, which also announced today that chief executive Clive Fenton will step down later this year, points out that the UK's rapidly ageing population continues to underpin long-term prospects.

The share price at Hornby has long been stuck in the sidings, with the story no different today after it reported a loss of £10.1 million for the year to March 31.

Sales for the first 10 weeks of the financial year have also been lower than expected, partly due to a backlog of stock at retailers.

But the company is under new leadership, with Lyndon Davies optimistic that his first seven months at the helm are starting pay off through better relationships with suppliers, retailers and manufacturers.

He said there was a new energy across the business, having rolled back on a discounting strategy that had resulted in a loss of trust from retailers in brands that include Scalextric and Airfix.

Davies, who joined the business from Oxford Diecast, said:

"Some of our brands have lasted for more than 100 years and it is my view that they should thrive for at least 100 more."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.