10 magic formula stocks for value hunters

11th July 2018 13:36

by Ben Hobson from Stockopedia

This contrarian strategy's combination of quality and value has big appeal to value investors, and typically delivers market beating returns. Stockopedia's Ben Hobson names the shares to follow.

Value investing - the part-art, part-science discipline of buying stocks that are cheap relative to what they earn or what they own - is a proven strategy, but it's also a painful one.

Look at any chart showing the performance of value strategies over many decades and you'll see undeniable outperformance. But between periods of market-beating returns, you'll also see spells of stomach-churning drawdowns. It's these moments of agony that mean many value investors - professionals included - struggle to stick with their strategies over time.

Back in 2005, an American investor called Joel Greenblatt offered a new kind of value strategy that still resonates with investors today. In The Little Book That Beats the Market, he set out an approach that blends value with quality and ranks the entire market for how relatively 'good and cheap' each company is.

Using this approach, Greenblatt said investors could easily find companies that might be genuinely underpriced. Given that this was still a value strategy, there would always be inevitable disappointments. But his so-called ‘Magic Formula’ would offer a higher probability of success.

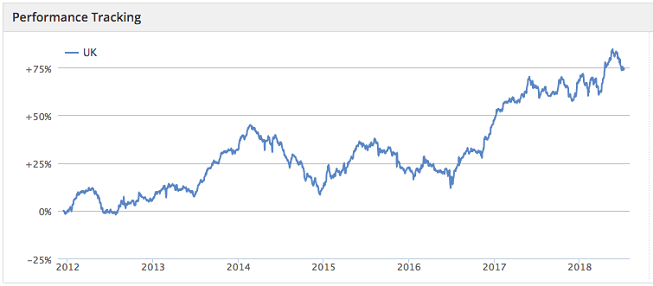

A model of the Magic Formula strategy applied to the UK market shows just how powerful - but also how variable - the results can be. Based on a 25-stock portfolio rebalanced quarterly and excluding fees, the Magic Formula has generated a 50.5% return over the past two years, but only 6.1% over the past year. Over the past six and a half years, the strategy has easily outpaced the UK market, but there have been a couple of difficult years.

Source: Stockopedia Past performance is not a guide to future performance

How the Magic Formula works

Greenblatt's strategy uses two simple ratios: the earnings yield as a measure of 'cheapness' and return on capital as a measure of 'quality'.

Earnings yield tells you how much profit a company is making in relation to its underlying value. To take account of varying levels of cash and debt in companies, a widely used way of working it out is to divide what the company earns in operating profit by its total valuation (known as the enterprise value). You can then apply this earnings yield to every company in the market to see which are offering the best value – the higher the yield, the cheaper the company and the more bang you get for your buck.

The return on capital focuses on how good a company is at generating a profit from the investment it makes in itself. Good quality companies are very efficient at delivering high percentage returns from the cash they reinvest to grow. It might be opening new stores, expanding product lines or buying new plant and equipment. The return on capital is the percentage improvement in profits relative to that investment. That makes it a leading indicator of good quality companies that can grow profitably.

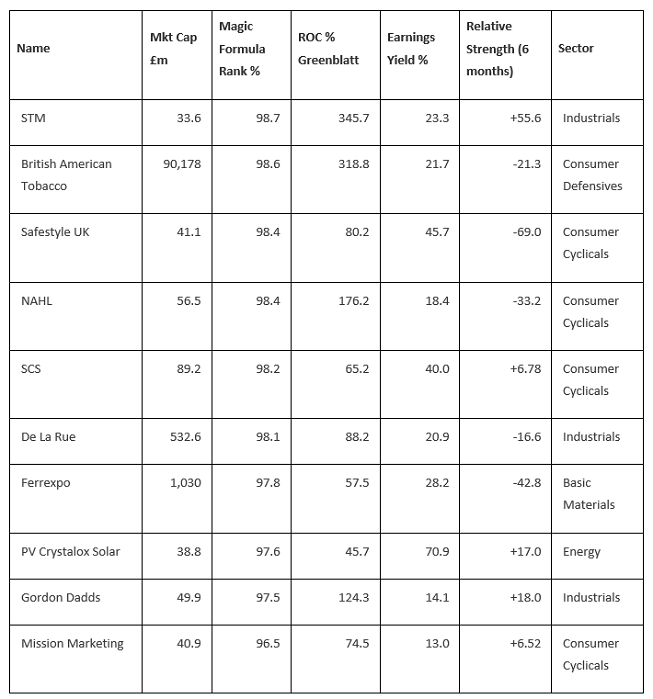

Greenblatt's strategy scores every company on each ratio and then adds the scores together to get a Magic Formula for each one. The beauty of this approach is that you can rank the market for companies with the best blend of cheapness and quality and always find results. Here is a selection of the current highest-ranking shares:

Source: Stockopedia

As Greenblatt noted, Magic Formula stocks can be unappealing and are sometimes in trouble. In these results, there are several that have significantly underperformed the market recently, ranging from the large-caps such as British American Tobacco and Ferrexpo to smaller companies like Safestyle UK, NAHL Group. Others, like De La Rue, have recently issued profit warnings.

But while the nature of Magic Formula stocks will be unappealing to some, it remains a contrarian strategy with a big appeal to value investors. The combination of quality and value embraces two of the most influential 'factors' that drive investment returns in the stock market. And while the strategy naturally endures periods of underperformance, it has a history of consistently bouncing back to deliver market beating returns.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

Interactive Investor readers can get a free 14-day trial of Stockopedia byclicking here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.