10 speculative high-flying stocks beating the market

17th June 2021 11:26

by Ben Hobson from Stockopedia

Amid signs that the market is rewarding UK small and mid-caps, Stockopedia's Ben Hobson goes looking for high-quality growth plays.

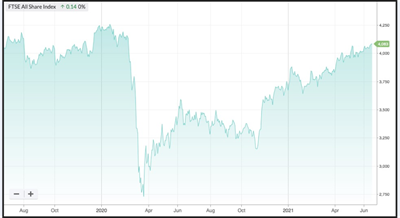

As we approach the half-year mark, many investors will be feeling upbeat about the determined recovery seen in the stock market in 2021. A 12% gain on the FTSE All-Share puts the market back within a range not seen since before the Covid crisis started.

In terms of investment styles, growth and momentum have both performed well this year. Strategies that are more aggressive in the search for strong trends in price and earnings naturally do well in bullish conditions, so it’s no surprise they’ve seen solid gains.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Indeed, what the broad index averages don’t tell you is that some areas of the market have been flying. The FTSE Small Cap (ex-IT) (SMXX) has seen a staggering 27.6% rise in the first six months of the year.

You can see the difference between the All-Share (first chart below) and the Small-Cap indices (second chart) in these two-year charts:

Past performance is not a guide to future performance.

The Small Cap index contains stocks with a market cap range spanning £40 million to £3.9 billion. As a component of the main FTSE All-Share, the regulatory regime for Small Cap constituents is tougher than it is for stocks quoted on the Alternative Investment Market (AIM). But it is, nonetheless, an index of smaller companies that tend to be based and operate in the UK.

As far as barometers go, the blistering pace among a section of UK quoted small- and mid-caps is a big clue about investor sentiment. That these shares are seeing such strong performance suggests the market is bullish on the prospects for domestic companies - particularly as the economy begins to recover.

From an investment perspective, there is a sense of déjà vu here. Over the past decade, smaller more speculative growth companies have been a very strong source of returns for investors. While the Covid crisis unsettled the market for a time, it certainly seems that these kinds of stocks have quickly started to rebound.

Hunting for high-flyers

In terms of performance, one of the strongest strategies for finding them focuses on high-quality and strong momentum in shares that tend to be at the more volatile end of the risk spectrum.

When considering which quality characteristics to look for, most would agree that solid profitability, efficiency and strong and improving finances (as measured by a high Piotroski F-Score, for example) are a must. With momentum, upward trends in both share price and earnings are also essential. Firms that are beating forecasts tend to see similar patterns in their share prices, so momentum is very important.

- Stocks that fund managers own in their AIM ISA IHT portfolios

- Don’t be shy, ask ii...why are there massive companies on AIM?

- Check out our award-winning stocks and shares ISA

Paired with slightly higher volatility, these factors have been very potent in recent years. Often, the volatility is caused by the fact that the companies are small. It means their shares tend to deviate from the market average much more than others. In bullish conditions, this volatility can be a beneficial extra catalyst to price performance. But remember that excessive exposure to high volatility stocks can be painful in bearish conditions.

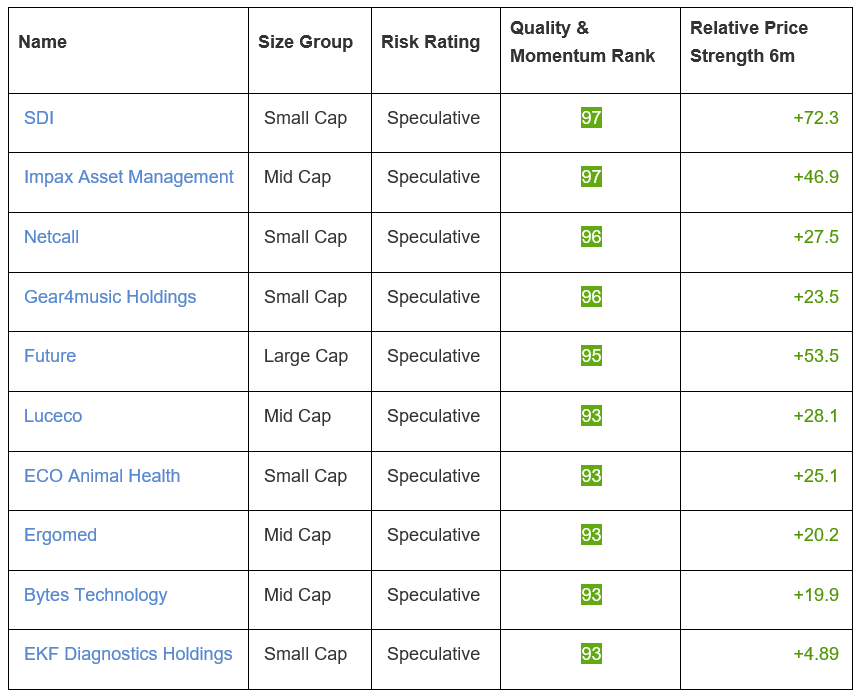

To make this search simple, we used Stockopedia’s quality and momentum ranking to find stocks that score well on both factors (the higher the rank, the better). Then we focused on those that are rated as ‘speculative’ on a Risk Ratings spectrum.

These shares have all handily outperformed the market over the past six months - showing just how much demand there is for smaller, more speculative, high quality shares. Names like SDI Group (LSE:SDI), the specialist scientific company, Impax Asset Management (LSE:IPX), the fund manager, and Future (LSE:FUTR), the publishing group, are among some of the top performers here.

Overall, with indices climbing back towards highs not seen for 18 months, there are signs that the market is rewarding UK small and mid-caps. The big winners have been high-quality growth plays that tend to be more speculative in terms of volatility.

While the combination of quality and momentum can be potent, there’s no getting away from uncertainty in the market. The popularity of these shares can push them to high valuations, and that’s a risk if market sentiment wavers and their momentum starts to change. But despite these risks, a strategy of combining quality and momentum (even at high prices) has been very strong this year.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.