2020 could be transformational for this tech behemoth

Having underperformed the market over five years, things could change for this biggie next year.

27th November 2019 10:50

by Rodney Hobson from interactive investor

Having underperformed the market over five years, things could change for this biggie next year.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

As the technological revolution took off at the end of the 20th century, there were genuine fears that International Business Machines (NYSE:IBM)was being left behind with the dinosaurs. But the company has reinvented itself, offering a variety of IT services, software and hardware with operations in 175 countries, and looks a solid, reliable performer in a sector where the finger of fortune can be very fickle.

Once IBM was a target for those who thought that it was too big and powerful and ought to be broken up; now that kind of accusation is directed against the likes of Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) and Facebook (NASDAQ:FB). The regulatory heat is off IBM.

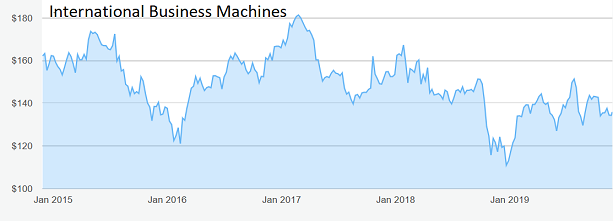

Source: interactive investor Past performance is not a guide to future performance

Results this year have admittedly not been great. Earnings per share in the first nine months were down 12% from $7.37 in the same period of 2018 to $6.45 and net income fell 15%, although the falls were exaggerated by foreign exchange movements.

Revenue was hurt by weak performances in three divisions: services, global technology services, and global financing. IBM also had to digest the $34 billion acquisition in July of cloud technology specialist Red Hat.

- Why we just bought more of this tech fund

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

IBM does expect a stronger fourth quarter, although investors have to take that on trust. It forecasts earnings per share to be at least $10.58, up from $9.51 last time. While that will still leave the total for the year below last time, it does mean that the year ends on a promising note and next year the company will be up against less demanding comparatives. Also encouraging is that free cash flow is strong and should hit $12 billion.

There are also great hopes that adding Red Hat to IBM’s industry expertise, and its access to markets across the globe, will lead to the creation of the next generation of hybrid multicloud platforms, which allow businesses to store and manage data and computer applications on their own premises and also on private and public computer clouds.

IBM’s cloud income has grown from 4% of group revenue in 2013 to 25% in the third quarter of this year, and it reckons that Red Hat will add two percentage points of compound annual growth in revenue for at least five years. Red Hat’s revenue in its latest financial year was $3.4 billion, up 15% year on year. That rate of growth has continued into its 2019-20 financial year. IBM’s cloud revenue is running at about $19 billion a year. Analysts believe that the outlook for cloud data centres generally is improving.

- You can find all our coverage of the world's biggest companies and share price movements here

- Looking to diversify your portfolio? ii’s Super 60 recommended funds is full of great ideas

The hope is that a new arrival on IBM’s board, Thomas Buberl, who has overseen digital transformation at two European-based international insurance giants, AXA and Zurich Insurance, will bring extra insight in this area. He joins in April.

In a separate development, IBM’s Japanese arm is to work with Panasonic Corp to improve semiconductor manufacturing. The two companies will jointly develop a data analysis system that will be incorporated into Panasonic devices to significantly reduce the number of engineering processes required.

IBM shares have had a pretty erratic ride over the past few years, touching a high of $181 and hitting a low of $111 just before Christmas last year. A recovery petered out at $151 this summer and the shares are now fluctuating around $135. The yield of 4.8% is attractive and the price/earnings ratio of 15.6 is not particularly demanding, especially compared with other large companies quoted in New York.

Hobson’s choice: Next year could be transforming for IBM. Even if it turns out to be quite ordinary, the downside for the shares looks limited to $130. Buy up to $139, which has proved both a ceiling and a floor in the past five months.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.