Are more big gains on the cards for these high-flying stocks?

Investors who followed these tips are sitting on significant profits, and both companies have published excellent results. Overseas investing expert Rodney Hobson still likes them both.

13th March 2024 08:56

by Rodney Hobson from interactive investor

The good times continue to roll for credit card issuer American Express Co (NYSE:AXP) – and so does the share price. The question is whether economic uncertainty will bring a great run to a juddering halt.

In the final three months of 2023, net income leapt 23% to $1.93 billion on total revenue up 11% to $15.8 billion. Profits and revenue both set new records, continuing a chain that began in the middle of 2022. The growth plan announced just over two years ago is really paying off.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The figures were good enough to prompt Amex to raise its quarterly dividend by 17%, from 60 cents to 70 cents a share, easily covered by earnings per share of $11.21 for the full year.

It seems a minor quibble to point out that the rises in the previous quarter were even better. At that point net income was up 30% and revenue by 13%.

Let us instead ponder a record year that saw revenue up 14% to $60.5 billion and net income 11% higher at $8.4 billion. Another 12.2 million cards were added over the 12 months, bringing the total to over 140 million.

Amex reckons that the fun is not all over yet. It expects revenue growth to slip only slightly to around 10%, with earnings per share coming in higher at around $13. With card spending remaining strong and credit defaults staying low, it would be madness to argue against that prognosis, especially as the forecasts made at the start of last year were pretty well borne out. In fact, the projections are more likely to be an underestimate.

Even those economists with rose-tinted spectacles are having to face the fact that interest rates in the US, Europe and the UK will remain high for much of this year, allowing card issuers to maintain their monstrously high charges on outstanding credit balances.

- Upgrade to Wall Street forecasts fuels stock market rally

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

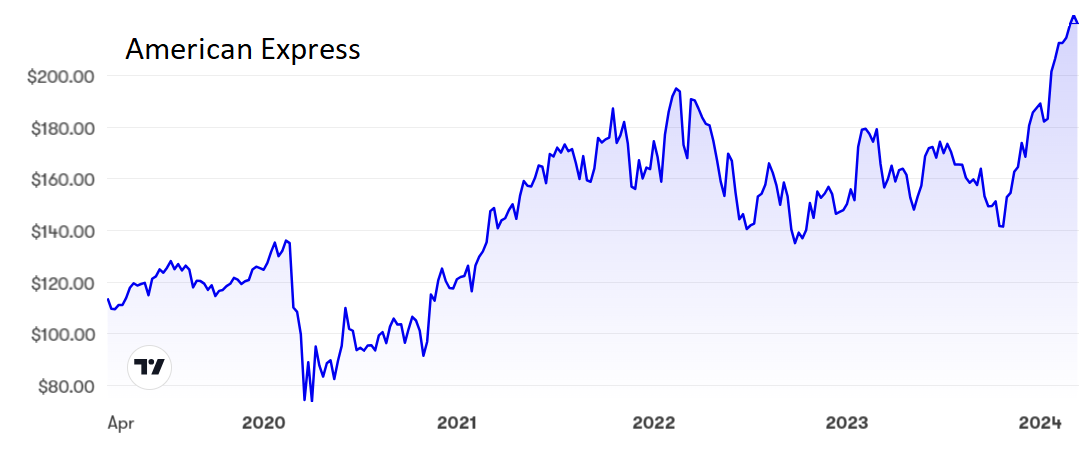

The recent performance of Amex shares fully reflects the stellar performance. They have shot up from $141 in October to $223, three times the level they sank to four years ago when the pandemic stopped people from going out and spending.

The price/earnings (PE) ratio is still just under 20, which is not overdemanding for a company with such growth prospects. However, the yield is only 1.09% despite the latest dividend increase.

Source: interactive investor. Past performance is not a guide to future performance.

Visa Inc Class A (NYSE:V) has a financial year running to 30 September. It reported what it called a solid start to its current financial year, with revenue up 9% to $8.6 billion and net income at $4.9 billion. Consumer spending remains resilient, Visa says.

Analysts expect net income to rise by more than 10%, perhaps by as much as 13%, over the current financial year, with revenue improving by just shy of double digits. This is very much in line with expectations at Amex.

- Nvidia and Scottish Mortgage made me an ISA millionaire, but now I back these funds too

- What Ray Dalio’s ‘bubble indicator’ says about the Magnificent Seven

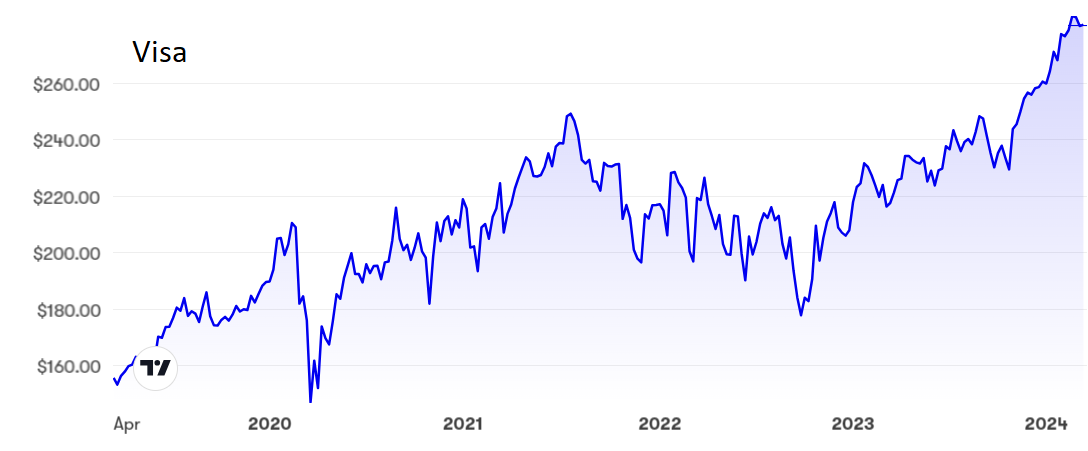

The shares have also performed well since October, rising from $230 to $284, where the PE is hefty at 32 and the yield is disappointingly low at 0.7%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I pointed outin November 2022 that Amex shares were not fully valued at $154, adding it was a good time to buy. Those who took that advice are well ahead but should hold on. Anyone thinking of buying could wait to see if they can buy on weakness, but I would not bank on that happening.

After first tipping Visa in 2019 at $180, I then advised Visa shareholders to stay in at $209, although I cautioned that there could be a ceiling at $230. I was far too cautious as that level was easily blown away but those who held on will not be complaining. I still prefer Amex but again rate Visa as a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.