Are shares in this AIM success story still a buy?

A great investment already and doing all the right things, our companies analyst reviews this hot stock.

6th December 2019 15:35

by Richard Beddard from interactive investor

A great investment already and doing all the right things, our companies analyst reviews this hot stock.

It is the scourge of this job that I always seem to be writing about Tottenham Hotspur. Recently I profiled Alumasc (LSE:ALU), which had furnished the football club’s stadium with drains. Today it is dotDigital (LSE:DOTD) turn to be scored as a long-term investment. It is proudly helping Spurs with digital marketing. Maybe someday I will happen across a company helping Arsenal. It could do with it.

More than email

dotdigital makes digital marketing software. It has one product: Engagement Cloud, which developed out of dotmailer, software that helped marketers to create and send emails: the kind you get when you sign up to receive news or updates from a website. You might think everybody gets the same email, but these days marketing messages are personalised, drawing on the data companies hold on each of us. You might also think that one email would be the end of it, but it is often the first of many messages in an automated campaign, even if it remains unopened.

In 2017, dotdigital bought Comapi to accelerate its development into a service capable of managing marketing communications across all digital channels including text messages, various messaging services like Facebook Messenger, and live chat. dotdigital was after Comapi’s technology, which it subsumed into dotmailer and subsequently rebranded Engagement Cloud because a name with ‘mail’ in it no longer did justice to the software’s capabilities, let alone the company’s ambition. Having integrated Comapi, dotdigital closed down the rump of the business in the year to June 2019.

Customers for Engagement Cloud are many and varied. dotdigtal’s annual report finishes with a page of 65 customer logos, many of them illustrious British firms. They include high-flying airline and package tour operator Jet2 (owned by Dart Group (LSE:DTG)), the venerable supplier of paint and other equipment for artists, Winsor & Newton, and charities like Barnardo's.

Competitive market

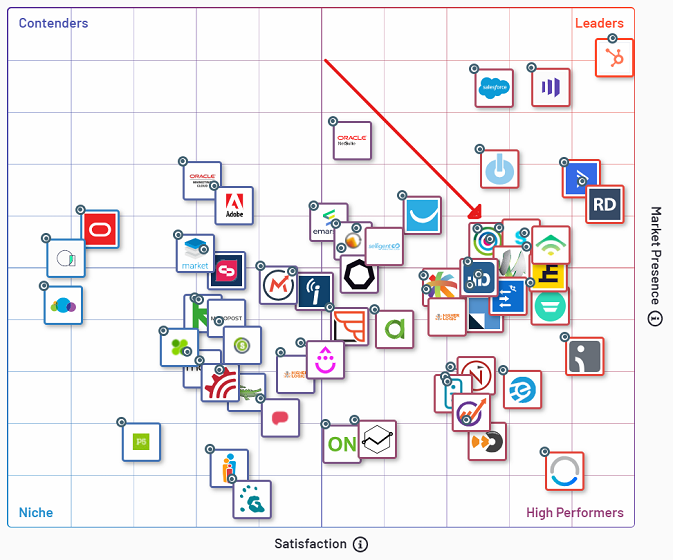

Understanding the product is one thing, working out how it stacks up against competitors is another. This is where tech marketplace G2 reckons Engagement Cloud ranks in the middle-market based on customer ratings of marketing automation platforms:

Engagement Cloud performs more strongly in this middle-market category than among small businesses and enterprise level customers (big companies with the most complex software requirements). The product does not even make it into software directory Capterra's top 20 marketing automation or email marketing software lists, which are ranked by popularity.

Enterprise Cloud is well-regarded and comparison algorithms can be flakey, but the sheer number of rivals demonstrates a bewildering level of competition.

A market this complex spawns many dependencies. Chief among them may be Engagement Cloud’s reliance on Internet Service Providers, browsers, and email programs not to block messages deemed spam. If rogue customers use the software for disreputable or illegal purposes, like phishing, it will damage the reputation of the platform and the chances of messages getting through. Engagement Cloud detects suspect accounts and emails, and dotdigital says it is proactive in suspending or terminating them.

- 12 shares for the future: From chaos to order

- Ask Money: Should I copy Share Sleuth’s successful portfolio?

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

About 50% of dotdigital’s revenue comes from integrations with ecommerce platforms, software that enables businesses to run online stores. Over half of that revenue is earned through Magento, an ecommerce platform that ships with Engagement Cloud pre-installed. dotdigital’s prosperity depends in part on Magento’s prosperity, and the willingness of the two companies to work together, but dotdigital is spreading the risk and boosting the opportunity for reward by working on other integrations, principally Microsoft Dynamics at the moment.

Since competitive advantage could, conceivably, be dented by a natty bit code in a rival product, the marketing clout of a bigger rival, or a new legal regime, dotdigital is focussed on optimising its software. The better it is, the more likely its messages will be received, ecommerce platforms will partner with it, and customers will use it.

dotfamily

The company is focusing on innovation, geographical expansion, and strategic partnerships. It is spending more on software development, it is earning more from abroad (29% of revenue in 2019 compared to 23% in 2017), and it is increasing and strengthening its partnerships.

The company is “infusing” Engagement Cloud with artificial intelligence and machine learning modules. New “commercial intelligence tools” enable customers to send emails to individuals when their past habits indicate they are most likely to open them, extract product data from images to make personalised product recommendations, and quarantine high-risk emails in danger of fouling good practice. The acquisition of Comapi in 2017 allowed dotdigital to innovate and the messaging channels it added made the product more suitable for Asia, where ecommerce is primarily conducted through mobile devices and dotdigital is seeking to grow.

Innovation is fundamental to dotdigital’s long-term prosperity, and sales to current profitability, so it is reassuring the company treats the software engineers and salespeople who will produce this prosperity, also known as ‘dotfamily’, well. Thirty per-cent of roles are filled internally, and a new share option scheme for all staff bodes well. Staff have nice things to say about dotdigital, too. On recruitment site Glassdoor, the company is rated highly and so is chief executive Milan Patel. He, incidentally, was an internal appointment.

If the company has a unique culture, it was probably encouraged by founder Tink Taylor. He is something of a digital marketing luminary. He still advises dotdigital and has stepped in as interim chairman while the company recruits a permanent one. He owns 10% of the company.

Numbers add up

The firm’s performance suggests it is doing a lot right. It has grown profitably since it floated on the stock market in 2011, achieving 48% return on capital in 2019, operating profit margins of 24%, 15% revenue growth, and 32% growth in adjusted profit.

The numbers add up except in one respect, cash flow. In 2019, dotdigital’s income in cash-terms was only 54% of its adjusted operating profit, down on the year 2018, which was in turn down on 2017 when cash conversion was 76%.

The difference is due primarily to investment. dotdigital’s innovations come at a price, hours spent developing the software. Instead of expensing the cost immediately and reducing profit by the full amount, dotdigital creates an intangible asset, which it amortises, or reduces in value over a number of years, postponing some of the cost impact and inflating the current year’s profit figure.

There is nothing wrong with this accounting, it is specifically allowed in the regulations as long as certain criteria are met. For example, there must be a “reasonable expectation” the cost will be exceeded by future revenues. It is analogous to investing in equipment and depreciating it over its useful life, and prevents us from penalising companies that are investing wisely.

To believe the figures, therefore, we must have faith that management’s expectations will come true.

Does dotdigital make good money?

Yes. Return on capital and operating margins are high and consistent since the company floated in 2011. Weaker cash flow reflects high levels of investment.

Score: 2

What could prevent it from growing profitably?

dotdigital has grown profitably but the market conjures images of the Wild West, where the laws are still being made and you need to keep your friends close and your enemies closer.

Score: 1

How will it overcome these challenges?

dodigital is innovating new features, working on new partnerships and growing sales abroad more rapidly than in the UK. On all three counts the numbers are moving in the right direction.

Score: 2

Will we all benefit?

With a founder still interested in the business, staff engaged, and executives not grossly overpaid, we probably will. One caveat: Three non-executive directors left the board in 2019, so far the company has only recruited one replacement, though it promises two more.

Score: 2

Are the shares cheap?

No. A share price of 90p values the enterprise at about £250 million, about 26 times adjusted profit. dotdigital’s earnings yield is 4%.

Score: -1.2

A score of 5.8 suggests dotdigital is reasonably priced, but there are probably more compelling long-term investments to be made. We will reveal some candidates in next week’s article, when the Decision Engine ranks all the shares I follow.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.