Are these three flashy stocks worth paying extra for?

16th November 2022 07:49

by Rodney Hobson from interactive investor

A couple of European stocks are in favour right now, but an American rival might also be worth considering, believes overseas investing expert Rodney Hobson.

No matter where you are in the world, there are always some people willing to pay extra for luxury – and who have the cash to do so. It means revenue at American upmarket clothing maker Ralph Lauren Corp Class A (NYSE:RL) is up despite the tough economic climate. A pity the same cannot be said about profits.

Revenue rose 5% to $1.58 billion in the three months to 1 October, Lauren’s second quarter. That beat analysts’ forecasts, as did net income, which nonetheless tumbled 22% to $150.5 million as higher costs squeezed profit margins from 13% to 9.5%.

- Find out about: US Earnings Season | Top US Stocks | Interactive investor Offers

Lauren expects revenue to grow on average at 4.9% over the next three years but that may not translate into higher profits, even though the company has a habit of beating expectations. Sales have slowed down in the two biggest markets of the United States and China, and it looks a tough call to pass higher input costs on to customers in higher prices. Margins could be squeezed further despite a deliberate move further upmarket.

On the positive side, Lauren is bouncing back strongly in Asia after repeated lockdowns caused the company to close more than a third of its Chinese stores.

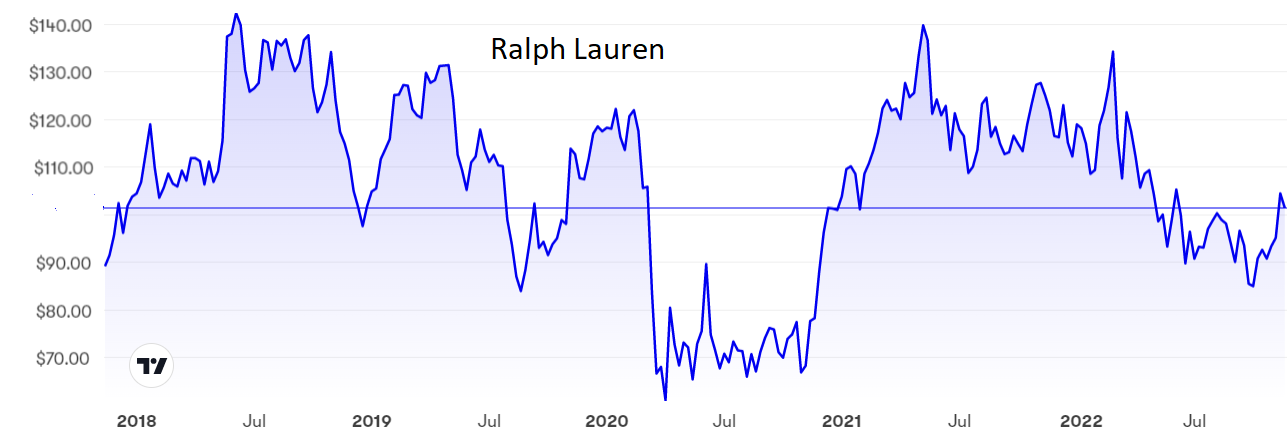

The shares have been on a rollercoaster over the past few years, ranging between $70 and $140. After sliding back since February, they seem to have established a solid floor at $90 but are struggling to hang on above $100, where the price/earnings (PE) ratio is a pretty average 14 while the yield is 2.84%, not bad but not breath-taking either.

Investors may do better to switch their attention to France, where manufacturers of luxury goods have been faring better, with sales in China holding up quite well.

Source: interactive investor Past performance is not a guide to future performance

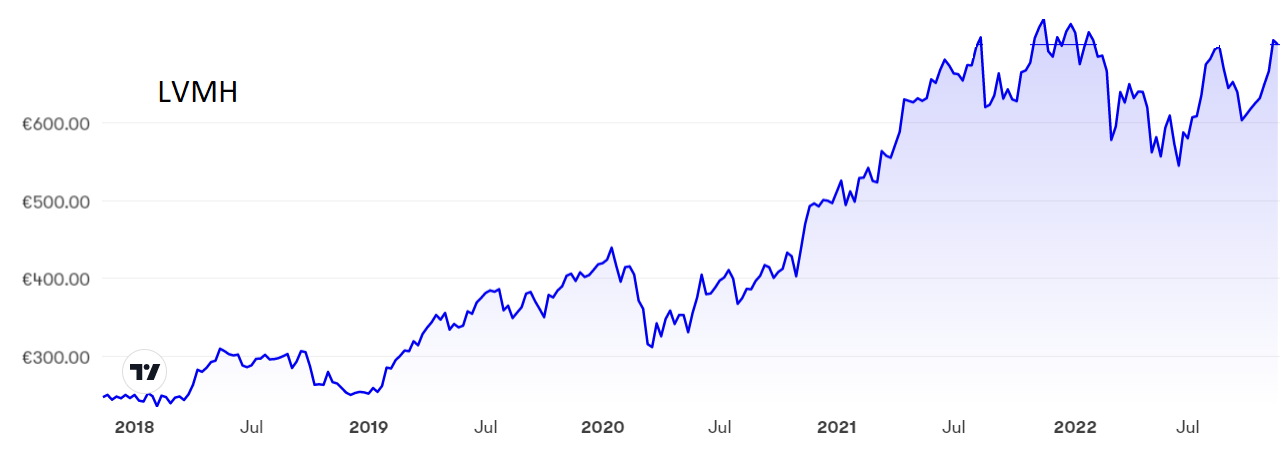

In October, Edmond Jackson produced an excellent analysis of LVMH Moet Hennessy Louis Vuitton SE (EURONEXT:MC)Stockwatch: two stocks for tough times?, rightly rating the stock a hold. The shares have perked up a little since then but seem to be once again restricted by a ceiling just above €700.

Source: interactive investor Past performance is not a guide to future performance

An alternative is Hermes International SA (EURONEXT:RMS), which reported strong revenue growth across all its markets in the third quarter, an impressive performance in the economic circumstances.

Revenue rose an outstanding 33% in the three months to 30 September to €3.14 billion, admittedly helped by favourable foreign exchange movements, but even on a constant currency basis the luxury goods maker was 24% ahead.

- Terry Smith tech-buying spree continues with Apple purchase

- Stock markets rocket after shock US inflation data

There was much in the statement to like. Growth was spread across the globe, with sales in the Americas a whopping 36% higher, and even the comparatively sluggish European market was a respectable 11% ahead. The largest division, leather goods and saddlery, fared best with sales up 21%.

The company sensibly warns that there are too many economic and political imponderables to make an accurate assessment of prospects for the rest of this year, but it is sufficiently confident to assume that revenue will continue to grow strongly.

Source: interactive investor Past performance is not a guide to future performance

The shares had a great run to a peak of €1,675 in November last year but have come off the boil lately, presenting a possible buying opportunity. However, the shares are not cheap at €1,450 where the PE is a massive 52 and the yield is only 0.55%.

Hobson’s choice: Ralph Lauren just about merits a buy rating, although cautious investors may prefer to hold off to see if they can get in below $100. LVMH is still a hold but could be worth considering if the shares fall back. The same can be said of Hermes. While there is no cause for holders to get out, it is difficult to make a case for buying unless the shares slip back to around €1,300.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.