Battle of the $200bn drug giants: there’s only one winner

9th February 2022 08:49

by Rodney Hobson from interactive investor

Both these companies have delivered solid returns for shareholders, but our overseas investing expert believes there is a clear choice about which one to buy.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Think pharmaceuticals, think Covid vaccines has been the mantra for nearly two years for investors looking to make profit from the pandemic misery. However, the tide is turning and the rapid rise of share prices in companies making Covid-19 vaccines is coming to an end.

As the world learns to live with the virus, drug companies offering a wider range of treatments look much more attractive compared to their peers. The phenomenon of an ageing population among richer nations that can afford expensive treatments is still with us.

It is true that many patients have been reluctant to seek medical treatment during the pandemic, so there may be some lingering downward pressure on 2021 fourth-quarter figures in the sector. However, this year should see a return to steady year-on-year growth in revenue and profits.

- No trading fees on US shares until 11 February. Click here for details

- A mixed bag for US earnings

- Stockwatch: overlooked and underpriced, a US tech giant to watch

- Apple, bitcoin, and the US dollar

One worry is that cash-strapped governments will make a more serious effort to force down prices charged by drug companies. Just before Christmas, the outcome of a three-year US Congressional inquiry was released in which the pharmaceutical industry was accused of raising prices of widely used drugs by nearly four times the rate of inflation over the past five years.

However, despite the heart-tugging lines about vulnerable Americans being targeted and forced to ration life-saving drugs, it is hard to see this being turned into punitive action any time soon, if ever. Congress is too divided and the pharmaceutical industry too well organised.

Admittedly, Eli Lilly (NYSE:LLY) demonstrated that the sector is not out of the woods yet. While fourth-quarter revenue rose a respectable 7.5% to $8 billion, net income slumped 18% to $1.73 billion and pre-tax profits fared even worse, down 25% to $1.84 billion.

In common with many American companies, Lilly pointed to higher operating costs. It also wrote down the value of some assets as it struggled with the impact of reorganisation.

- Top 10 things you need to know about investing in the US

- Four US stocks to own for pricing power

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

Lilly has several strings to its bow, focussing on neuroscience, endocrinology and oncology as well as immunology, but chief executive and chair David Ricks’ view that Lilly has “tremendous momentum” moving into 2022 needs to be taken with some caution. Net income for the whole year of 2021 was down 9.8%, so the decline in the final quarter suggests a worsening performance.

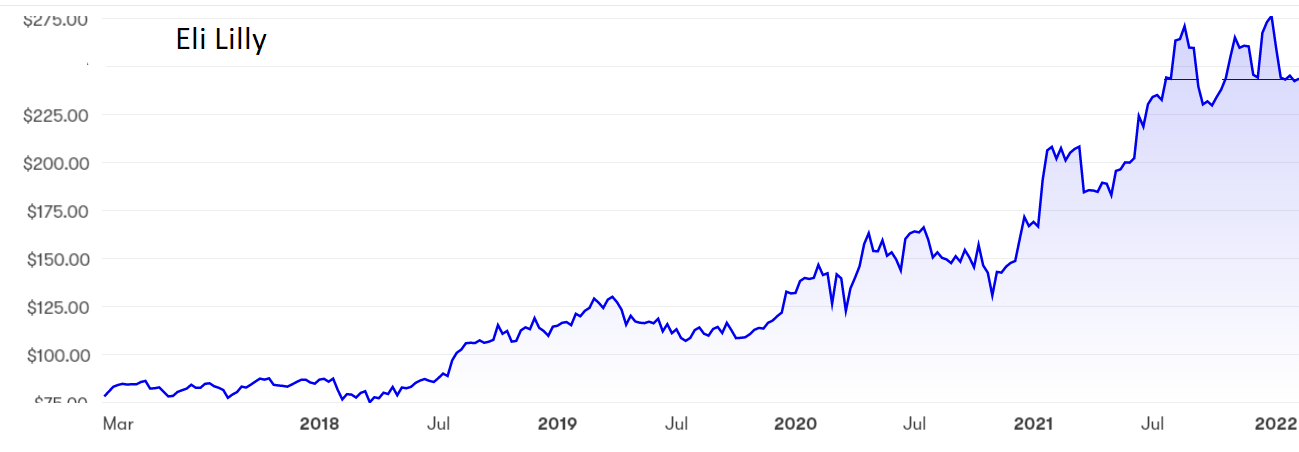

Source: interactive investor. Past performance is not a guide to future performance.

It is true that revenue is likely to continue rising but profits are more important. Much depends on a pipeline of new medicines proving successful.

Lilly shares were just below $80 four years ago, but rose steadily to $278 right at the end of last year before coming off the boil a little. They are currently at $240 where the yield is 1.4%.

- Watch our share, fund and trust tips, plus outlook videos for 2022

- US stock market outlook 2022: more record highs for Wall Street?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Figures from Merck (NYSE:MRK) were more encouraging as it swung from a loss of $2.61 billion in the last three months of 2020 to return to net income of $3.82 billion in the final quarter of 2021. Sales were up 24% at $13.52 billion.

Merck really did end the year with more momentum. It meant that full-year net income almost tripled to $12.36 billion, beating 2019’s pre-pandemic level, and sales rose 17% to $48.7 billion. The company realistically expects that momentum to carry on into this year.

Source: interactive investor. Past performance is not a guide to future performance.

There have been several promising announcements in recent weeks, including strong expected sales from its 50% owned molnupiravir oral antiviral drug, European Commission approval for a kidney cancer treatment and approval in Japan for a chronic cough treatment.

The shares have moved erratically sideways between $68 and $88 over the past four years and are now in the middle of that range. The yield is 3.4%.

Hobson’s choice: Merck is the clear choice of the two for a buy recommendation despite the erratic share price movement in recent months. It will be a big disappointment if they do not break higher this year. Take profits at Eli Lilley. The share price is based on the assumption that sales and profits will rise strongly this year. Sales may do but profits could struggle.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.