Bond investors: The hunt is on for decent yield

Bonds are expensive, but there are still pockets of decent yield to be found.

23rd January 2020 10:29

by Ceri Jones from interactive investor

Bonds are expensive, but there are still pockets of decent yield to be found.

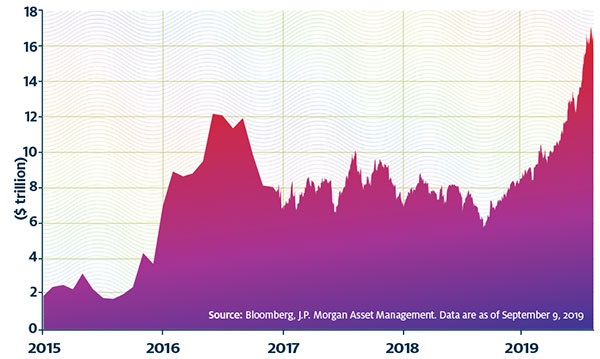

Last year was a year of economic disruption and political upheaval. In the investment arena, this uncertain climate is most vividly reflected in $17 trillion (£13.2 trillion) of bonds worldwide that currently yield negative returns. Investors are paying governments and, in some cases, companies for the privilege of lending them money – a far cry from buying bonds for income.

As long as equities in developed countries remain expensive and central banks continue their bond-buying, this topsy-turvy situation could persist throughout 2020. Low interest rates boost demand for bonds, and central banks are keeping rates at low levels as this reduces borrowing costs and encourages spending.

Falling interest rates

The US Federal Reserve has cut interest rates three times this year with the aim of meeting its ambitious full-employment and inflation targets. The Bank of Japan is also focused on its 2% inflation target and is buying up billions of its government’s bonds to keep long-term rates at zero, while the European Central Bank (ECB) kept rates at zero in October and has not ruled out negative rates in future.

Central bank manipulation of interest rates was introduced in 2008 to deal with the financial crisis. Over the following decade, rapid price moves in bonds encouraged investors to buy them primarily for their potential price gains, rather than their security and interest payments. Meanwhile, equities that traditionally were purchased mainly for capital gains have been increasingly bought for their dividends. This strong demand has driven up the Bloomberg Barclays Global Aggregate Total Return bond index by about 8% over 12 months; most US Treasuries now yield less than the average S&P 500 stock.

In fact, bond prices have risen to such giddy heights that it is hard to see any further appeal. An investor who buys negative-yielding bonds is after all certain to get back less than they paid, including both interest and principal, if the bond is held to maturity.

“It’s difficult to find value in bonds today,” laments Juliet Schooling Latter, research director at Chelsea Financial Services. “Every part of the asset class looks expensive and yields are extremely low. Given the uncertainty in the world today, a manager who has full flexibility to invest in any type of fixed income is favourable. I like the M&G Global Macro Bond, Jupiter Strategic Bond and TwentyFour AM Dynamic Bond funds.”

However, bonds will always be safer than equities. When the chips are down, bonds are repaid first, while equities linger at the bottom of the pecking order for repayment, so bonds may remain attractive to investors who fear a recession.

Fund and wealth managers have been moving into short-dated or lower-duration bonds – five- to seven-year maturities for the most part – that offer more compelling risk-adjusted returns relative to longer-dated bonds.

Negative-yielding debt mushrooms

Shorter-duration bonds

Shorter-duration bonds provide some insulation against the risk that interest rates might rise. This could be particularly pertinent as governments move towards fiscal expansion and meet the costs of their spending and infrastructure investment by competing for savers’ cash, which in turn will drive up interest rates. In the case of corporate bonds, shorter durations also narrow the window for a disruptive competitor company to emerge and threaten a business’s profits.

Financial adviser Chase de Vere has retained its weightings in fixed interest because of central bank action. “In this environment, we still believe that bonds can provide a degree of protection within an investment portfolio,” says Ben Willis, head of portfolio management.

“With volatility within bond markets increasing, short-dated bonds provide a modicum of price and yield stability.”

The most compelling yields in fixed income are to be found in emerging market debt, where it is possible to earn 6% to 10% a year – a reasonable reward for the high levels of volatility in some of these markets (see below).

For retail investors, this suggests a short-duration play such as the Ashmore Emerging Markets Short Duration fund, which invests in bonds with a duration of between one and three years. Ashmore is an emerging market specialist with decades of experience in the region.

Investment-grade corporate bonds offer about 0.6% more than government bonds, but there is default risk. So far, the default stage of the cycle has failed to materialise, but only for unhealthy reasons, such as covenant-lite lending (loans issued with fewer restrictions on the borrower and fewer protections for the lender) and artificially low interest rates. These conditions suggest companies that fail may experience little recovery value.

Not all companies whose debt is rated below BBB (the lowest investment-grade rating) fit with the normal preconceptions, however. Some would have no trouble borrowing from banks and are happy with their leverage because they have strong and steady earnings. They may have been given a low credit score owing to the size of their debt, but it may be a deliberate ploy to improve tax-efficiency or boost return on equity. A good active fund manager will have identified these companies. For example Paul Causer of Invesco has almost 60% of his Invesco Corporate Bond in BBB bonds. The fund currently yields 2.5% a year.

Renewable energy and infrastructure also offer fixed income-like revenues. Paul Flood, portfolio manager at Newton Investment Management, has been upping exposure to operational renew- able energy assets that have fixed, inflation-linked revenues representing up to 50% of their earnings and power prices making up the rest, so their sensitivity to the economic cycle is limited. “To decarbonise the world’s power generation will require up to $50 trillion of capital over the next 30 years, which in our view should provide support for the asset class as companies compete for access to that capital,” he says.

Passive plays: How to buy the asset class

Indexing does not work as well for corporate bonds as it does for equities. When an equity performs well, for example, its share price rises, and you end up owning more of it, but with a bond, you buy more of those companies that are issuing more debt, usually for the wrong reasons. The exception is for exposure to broad government bonds or specific government bonds such as UK gilts.

1) Emerging market bonds were amongst the most popular ETF investment categories in 2019. There are a myriad different indices. Some demand a level of liquidity, while others are more flexible and add diversification and potential yield enhancement, such as the iShares JP Morgan USD Emerging Markets Bond ETF (LSE:IEMB), which is based on the broad JPMorgan EMBI Global Core Index, with holdings in 50 countries, including Russia, Mexico, Poland, Hungary, South Africa, the Philippines and Argentina. Around three-quarters of the ETF is in emerging government debt, with most of the rest focused on high-yielding corporate bonds. Its expense ratio is 0.4%.

2) At the lower end of the risk/reward scale is the Legal & General Emerging Markets Government Bond (US$) Index fund, which tracks the JPMorgan Emerging Markets Bond Plus index, made up of hard currency government bonds. Debt in this index must meet a minimum face value outstanding of $500 million (£387 million) and strict criteria for secondary market trading liquidity. The fund has a low charge of 0.29%.

3) Commodities and other inflation-sensitive assets are quasi-fixed interest alternatives. For a broad basket of commodities including energy and agriculturals, consider Invesco LGIM Commodity Composite ETF (LSE:LGCF) and Legal & General All Commodities UCITS ETF (LSE:CMFP).

Emerging market debt

In emerging markets, it’s best to choose an active fund manager for whom this is a core capability, as a generalist is unlikely to be able to devote the resources necessary.

Emerging market debt can provide exposure to high growth and high income, and may also help to diversify away from developed market debt and equities. Issuance was at near-record levels in the autumn, but the markets had no difficulty digesting it. Corporate fundamentals are generally improving across the region and could continue to re-rate in 2020.

Emerging market bonds are denominated in either the country’s local currency or US dollars. Currency appreciation can account for 30-50% of a bond’s yield if it is bought in local currency. The pound has been weak this year while emerging market currencies have strengthened, which has helped local currency bonds to outperform. Hard currency bonds are more highly rated because they do not have the same volatility as local currencies.

The highly regarded M&G Emerging Markets Bond fund has been managed by Claudia Calich since 2013 and is the first choice amongst wealth managers for expo- sure to this asset class. It invests in both credit and government bonds while also combining US and local currency exposure, so is nicely diversified.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.