BP’s $25bn decision to cut Rosneft ties

28th February 2022 11:44

by Victoria Scholar from interactive investor

As Western governments take drastic measures against Russia, oil major BP is ditching its tie-up with Russia’s Rosneft. Our head of investment comments on the significant cost to BP, the soaring oil price, rouble and central bank activity.

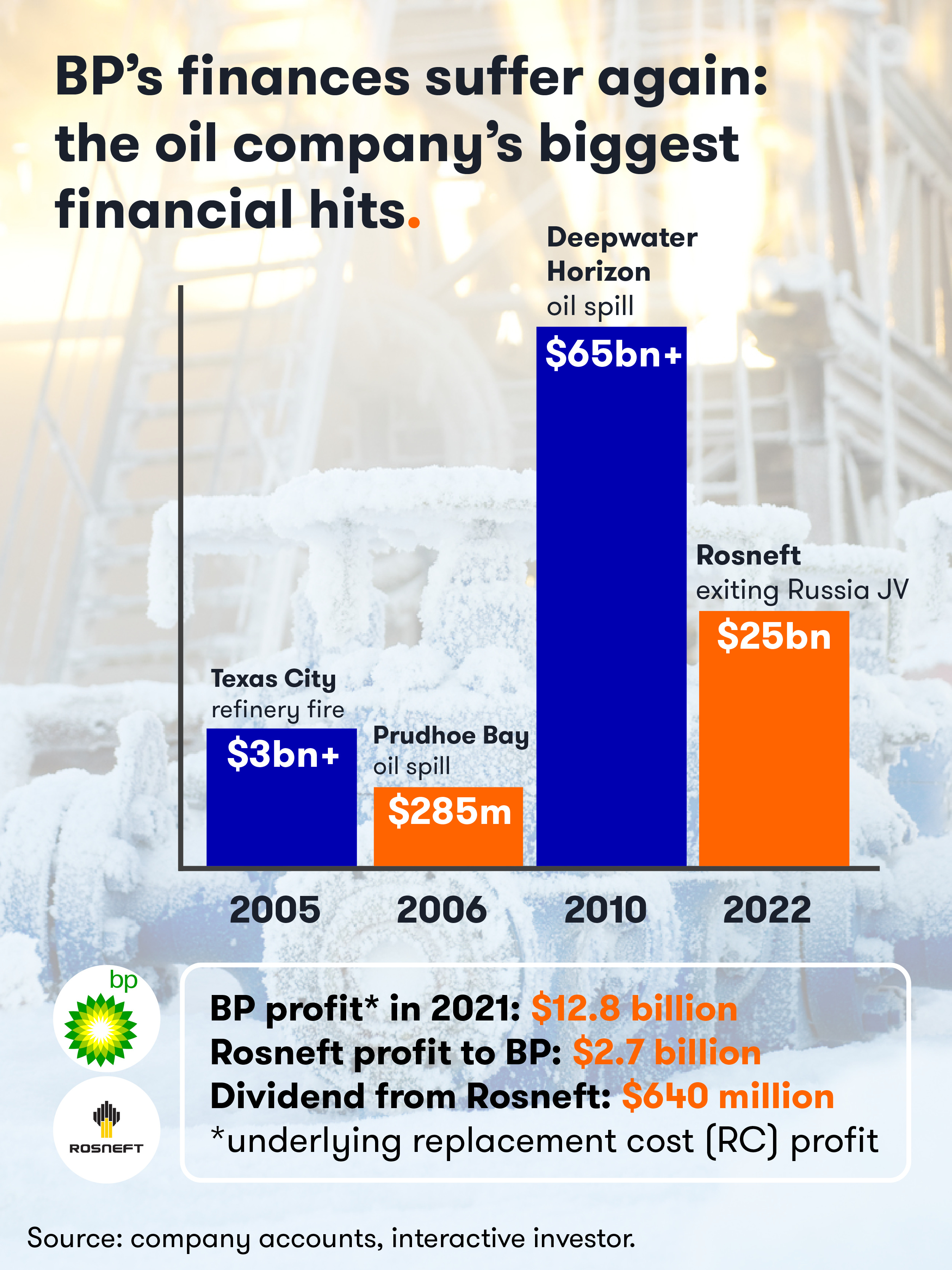

Oil major BP (LSE:BP.) has shed more than 5% after announcing plans to divest its 19.75% stake in Russian oil giant Rosneft (LSE:ROSN), costing the British oil giant up to $25 billion as CEO Bernard Looney steps down from Rosneft’s board.

Other companies such as Societe Generale (EURONEXT:GLE) and Credit Suisse (NYSE:CS) have also been reportedly attempting to create some distance by halting Russian commodity trade finance deals. Energy group Equinor (NYSE:EQNR) said it would start to divest its joint ventures in Russia, and Daimler Truck (XETRA:DTG) is suspending all cooperation with Russia’s Kamaz.

- When markets fall heavily, here's what to avoid doing

- The funds, investment trusts and ETFs with exposure to Russia

BP’s potential $25 billion charge from exiting Rosneft highlights the stress facing companies with heavy exposure to Russia. It is becoming clear that attempts by the US and Europe to disentangle itself from Russia and freeze out its economy will have significant consequences for Western companies and economies too. However, the downside for BP was capped by sharp gains in oil prices, which should continue to support its bottom line if Brent continues its upward trajectory.

Stocks and oil markets today

With the exception of basic resources, all sectors across Europe are trading in the red, with financials leading the declines. Developments over the weekend have prompted fears that the geopolitical crisis is deepening, with the DAX is Germany underperforming, down more than 2%, while the FTSE 100 is trading down by close to 1%, heading towards the next major support level at 7,400.

Stocks such as Deutsche Bank (XETRA:DBK), Societe Generale and UniCredit (MTA:UCG) have all shed more than 7% amid fears about what cutting certain Russian banks out of the SWIFT system could mean for its European counterparts.

Oil prices have jumped more than 4% after President Putin put nuclear weapons on ‘special alert’ as tensions between Ukraine and Russia escalate even further.

- The financial impact of the Russia/Ukraine conflict

- Check out our award-winning stocks and shares ISA

Brent crude is trading firmly above $100 and WTI is above $95, while natural gas and heating oil are also sharply higher amid broader gains across the commodities complex.

With the US and Europe removing some Russian bank from the SWIFT system, there are concerns about the potential for further supply disruptions at a time when the imbalance between demand and supply already favours a bullish outlook for oil. Putin’s decision to put nuclear forces on high alert has also created nervousness about the supply impact. Despite surging prices, OPEC+ is expected to stick to the script with its drip feed approach at this week’s meeting again adding to the upside pressure in the market.

Rouble crashes to new low

The Russian rouble has touched a fresh all-time low, plunging nearly 30% before later paring some declines, following a series of aggressive measures against Russia such as cutting some banks from the SWIFT payments system and imposing fresh sanctions.

- Sea of red across global stock markets as Russia invades Ukraine

- Ukraine invasion triggers FTSE 100 slump

Western economic punishments for Putin’s aggression against Ukraine have unsurprisingly destroyed Russia’s financial assets, which are bearing the brunt of the market sell-off as Russia looks increasingly isolated from the rest of the world.

Russian rates double

Russia’s central bank has responded by doubling interest rates to 20% from 9.5% as it looks to stem losses for its freefalling currency, citing a drastic change in external conditions.

The central bank could announce further measures later today such as limited on deposit withdrawals with Governor Elvira Nabiullina due to speak on Monday afternoon.

- Stockwatch: a defensive play for worrying times

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

In normal circumstances, this would be considered a very dramatic move in interest rates. However, for Russia this is merely a sticking plaster that has failed to bring about much of a change in direction for the rouble.

With a whole host of measures taken by the West last week and over the weekend, Russia’s economy and currency look increasingly paralysed with further pressure likely to come for its financial markets with international investor confidence in Russia completely shattered.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.