Budget 2025 preview: weighing up the cost of income tax hikes

Will the government be forced to break a manifesto pledge to shore up the nation’s finances? Craig Rickman examines the details.

30th October 2025 13:38

by Craig Rickman from interactive investor

Labour leader Sir Keir Starmer with Chancellor Rachel Reeves at last month’s party conference in Liverpool. Photo: Nicola Tree/Getty Images.

Over the past week, the most significant and wide-reaching pre-Budget 2025 rumour so far has emerged.

As you may have read, Chancellor Rachel Reeves is reportedly planning to hike the basic rate of income tax, a move that is meant to be off the table for this parliament.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

In its election manifesto, Labour pledged not to raise taxes on working people, ruling out hikes to VAT, employee national insurance contributions (NIC), and notably, income tax.

Both Reeves and Keir Starmer are yet to comment on these rumours, but the prime minister’s refusal during yesterday’s PMQs to rebut the prospect of income tax reforms has added fuel to the fire.

The government has continuously stressed that it will not get drawn into tax speculation before Budget Day, set for 26 November, but has hinted that tax hikes are on the agenda.

There is now a growing consensus that breaking promises might be the only solution to shore up the nation’s finances and plug a fiscal gap that could be as much as £50 billion.

What is reportedly being considered?

Reports suggest the basic rate of income tax could be hiked from 20% to 21%, which experts believe will raise around £8 billion. Needless to say, this would increase the tax bills of millions of working people.

In September, the Resolution Foundation, a think tank previously headed up by Pension Minister Torsten Bell, proposed an alternative: cut national insurance contributions (NIC) by 2p to fund an income tax hike of the same amount, thus leaving workers in an equivalent financial position, and raising the government £6 billion. However, while workers would be unaffected, pensioners, savers and landlords would lose out.

Alternatively, the government could go after the 40% and 45% rates: still at odds with its manifesto pledge, but closer to its commitment to target those with the “broadest shoulders”. However, the question is whether the juice is worth the squeeze. According to political commentator Robert Peston, with the calculations endorsed by tax expert Dan Neidle, adding 1p to the 40p rate raises £2.1 billion, while upping the 45p rate by 1p gathers £230 million - both far less lucrative than lifting the basic rate.

There are other reasons why the government may avoid tinkering with the higher tax rates. Not only was the 45% threshold hacked from £150,000 to £125,140 in 2022, but the government is under mounting pressure to address the unfairness of the 60% tax trap, which occurs on earnings between £100,000 and the 45% band.

- Budget 2025: how pensions and ISAs could change

- Number of pensioners in 60% tax trap more than doubles in three years

Workers in this bracket suffer the gradual loss of their personal tax-free allowance, which is compounded if they’re parents of young children and lose thousands of pounds in free childcare, leaving them with less take-home pay even though their taxable income has increased. Further tightening of this area of the income tax system would be a big political gamble for little fiscal gain.

Why the government might break its pledge

In short, desperate times often lead to desperate measures. Due to a cocktail of factors, such as soaring borrowing costs, policy U-turns and tepid economic growth, the government is apparently staring down the barrel of another gaping fiscal black hole, one that might be even larger than last year’s.

There are various estimates about the size of the shortfall, ranging from £20 billion to £50 billion. Even the lowest end far outstrips the £9.9 billion headroom Reeves affords within her non-negotiable fiscal rules, the main one of which is to cover day-to-day government spending from tax receipts.

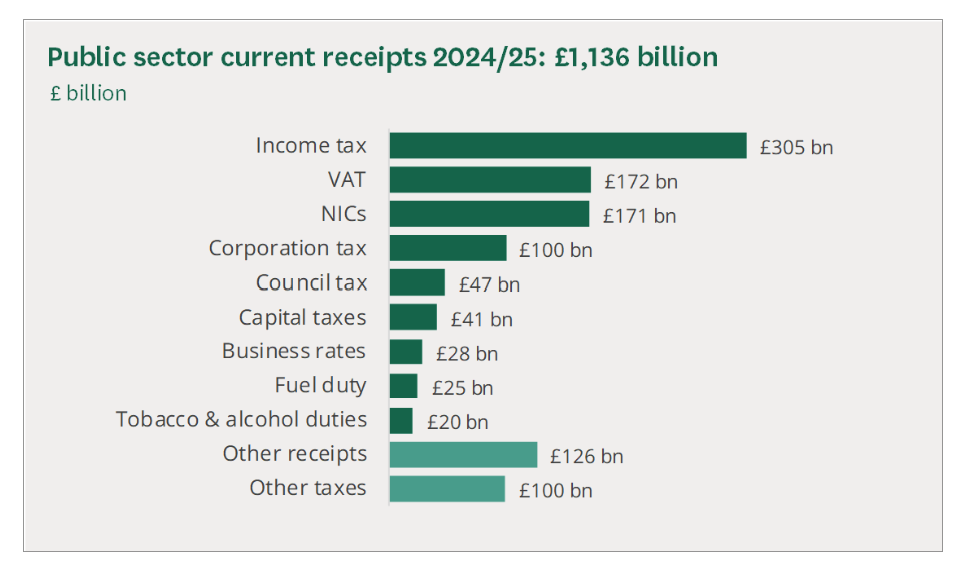

That brings us on to the income tax system, the biggest source of revenue for the Treasury. In the 2024-25 tax year, income tax receipts were £305 billion, higher than corporation tax, council tax, capital gains tax (CGT), inheritance tax (IHT), business rates, fuel duty, and tobacco and alcohol combined. HMRC estimates 39.1 million people in the UK will pay income tax during the current tax year.

Replicating receipts generated by a 1p increase to the 20p income tax rate may require the government to raid several other parts of the UK tax regime. They may, of course, be forced to do both, which will ultimately hinge on the size of the deficit.

Source: House of Commons Library

Deep frustration and damaged reputations

Raising the basic rate of income tax would be deeply controversial for several reasons.

First, as noted above, it would involve breaking an election manifesto pledge and take a further nibble of workers’ pay packets that are already being eroded by fiscal drag. Income tax thresholds have been frozen since 2021 and are set to remain so until 2028, pulling millions of people into higher tax rates as their earnings rise. The number of basic-rate taxpayers has jumped by a massive 2.9 million in the past four years.

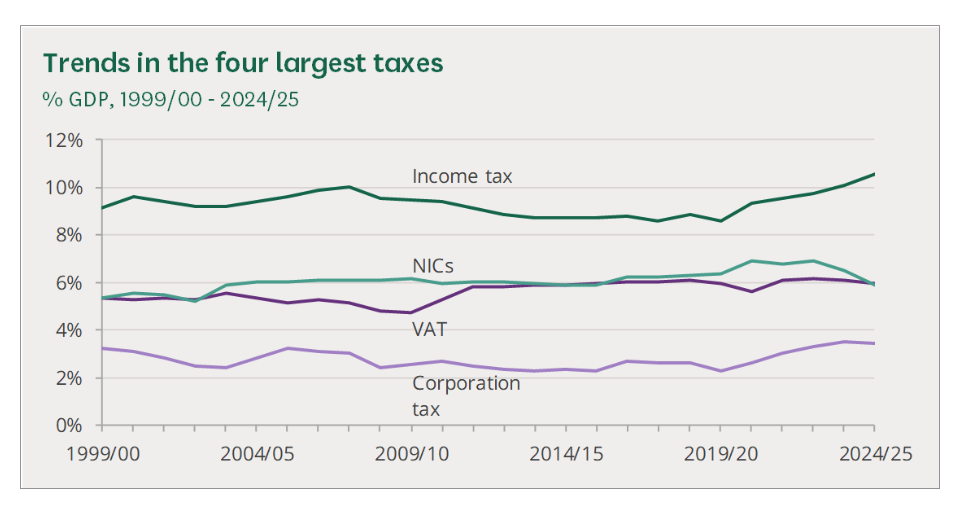

As the chart below shows, income tax receipts, relative to GDP, have been on a sharp upwards trajectory, outpacing rising revenues to the three other largest taxes: NICs, VAT and corporation tax.

Source: House of Commons Library

While NIC thresholds have been frozen for four years too, the downwards trend here can be explained by the previous government’s decision to cut rates for both employed and self-employed workers at two fiscal events on the bounce.

Second, for the average worker earning £37,000 a year, a 1p jump to the basic rate of income tax results in an extra £244 in tax - around £20 a month. Someone earning £50,270, the 40% threshold, will see their annual tax bill rise £377. While these numbers don’t seem huge in the grand scheme of things, we must consider the other financial challenges people are facing, notably the cost of living.

The consumer prices index (CPI), the UK’s main measure of inflation, has stubbornly stood at 3.8% for the past three months, almost double the Bank of England’s 2% target. When you factor in higher shopping bills, rising utility costs, steeper mortgage repayments and rents, and of course fiscal drag, it’s the aggregate of these factors that’s tightening household purse strings.

- The Autumn Budget 2025: just how painful could it be?

- Autumn Budget preview: unpacking the pension tax-free cash saga

Third, raising income tax rates wouldn’t just impact earnings and self-employed profits. Pension income, whether from annuities or drawdown (above any tax-free cash), property rents and savings interest are all taxed as income, hitting retirees, landlords and savers.

If the state pension rises in line with expectations from April 2026, the full amount will almost swallow up the £12,570 tax-free personal allowance, exposing all other income - apart from exempt sources such as ISAs - to HMRC. The state pension’s inflation-beating boost is, of course, great news for anyone age 66 and above, but if other retirement income is taxed by an extra penny in the pound, the hike will be offset to some degree.

Rowing back on a manifesto pledge would also undermine trust and confidence in a government battling ongoing resistance from last year’s tax measures. The reforms to employer NICs and IHT have been met with fierce opposition, with critics urging the government to either change its mind or pursue alternatives. And although the partial U-turn on winter fuel payments was welcomed by most quarters, the entire episode proved something for the government to forget.

What history tells us about changes to income tax rates

We must hark back to the 2007-08 tax year to find the last time the basic rate of income tax exceeded 20%. The system some 18 years ago took a different shape than it does today, with a starting rate of 10% on the first £2,230 of income above the tax-free personal allowance, which was £5,225 at the time. Income above this figure and between the 40% threshold was taxed at 22%.

The following tax year, then-chancellor Gordon Brown shook up the income tax regime, removing the 10% rate - except for savings interest which existed until April 2015 - and lowering the basic rate to 20%.

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

To find the last time the basic rate increased, we must travel back much further, half a century in fact, when Denis Healey in 1975 hiked it by 2 percentage points to 35%. Healey also jacked up the top rate from 75% to 83%, which he later raised to an unfathomable 98%.

Whatever happens in just under four weeks’ time, we can safely say things won’t be anywhere near that extreme. But due to the commitments laid out at its election manifesto, even a marginal increase to income tax rates will likely stir up more post-Budget debate than any other measure included in the chancellor’s red book.

We should remind ourselves that this development merely adds to the tornado of rumours that have swirled aggressively since the summer. And with the event still around four weeks away, there will be plenty more to come.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.