Buying back some of 2020’s best funds

8th August 2022 13:59

by Douglas Chadwick from ii contributor

Saltydog Investor is reacting to rising markets by investing in some top-performing ‘mixed asset’ funds.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In the second quarter of this year, from the beginning of April to the end of June, nearly all the Investment Association (IA) sectors had negative returns. The worst, UK Index-Linked Gilts, went down by 20%. Then there were the Technology and Technology Innovations, Latin America, and Financial and Financial Innovations sectors, which all lost 16%. Another six sectors that fell by more than 10%.

The best-performing sector was China/Greater China, which made 10%.

In July there was a significant change in momentum. The funds in the China/Greater China sector went into reverse, and in the end the sector finished the month down 8.3%. However, most of the other sectors made gains.

The leading sector was North American Smaller Companies, which gained 10%. The Technology, India and North America sectors all went up by more than 8%.

Past performance is not a guide to future performance.

When the North America and Technology sectors are doing well, it has a knock-on effect for certain funds in the Global, Flexible Investment, and Mixed Investment sectors, which tend to invest in similar companies.

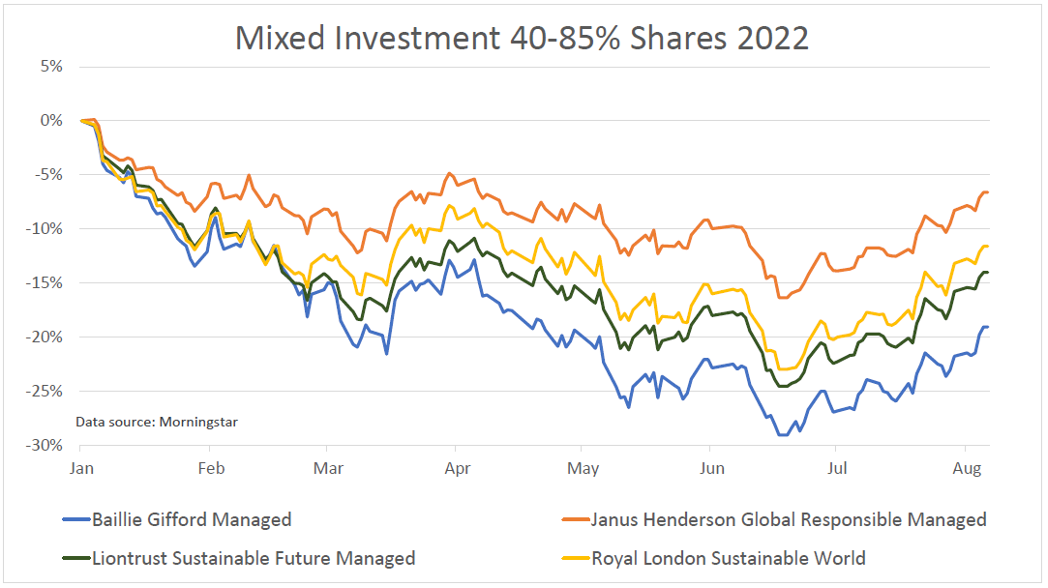

We saw this when the US technology stocks rallied after the coronavirus crash in 2020. Funds such as Janus Henderson Global Responsible Managed, Royal London Sustainable World, Liontrust Sustainable Future Managed, and Baillie Gifford Managed, regularly featured at the top of our fund performance tables for the Mixed Investment 40-85% Shares sector. This in turn was the leading sector in our ‘Slow Ahead’ group. These funds became the mainstays of our demonstration portfolios and were only sold at the beginning of this year.

- How the cost-of-living crisis is changing the way pros invest

- The investments that will keep growing – even during a recession

They then went out of favour for a few months, along with almost everything else, but all of a sudden have started to appear in our weekly analysis again. When we looked at the numbers last week, they were showing four-week returns ranging from 6.5% to 8.5%. The graph below shows how much they have fallen this year, but also how much they have rebounded in the last month.

Past performance is not a guide to future performance.

Our ‘Tugboat’ portfolio invested in the Janus Henderson Global Responsible Managed fund a couple of weeks ago and last week added the Royal London Sustainable World fund.

For most of this year, our demonstration portfolios have been predominantly in cash, but recently we have been venturing back into the markets. In the last fortnight we have also invested in funds from the Sterling High Yield, UK All Companies, North American Smaller Companies, Commodities and Natural Resources, and Specialist sectors.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Saltydog will be away next week, returning on 22 August.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.