The investments that will keep growing – even during a recession

21st June 2022 12:59

by Sam Benstead from interactive investor

An economic slowdown does not have to mean a hit to profits. These business areas are well positioned to keep growing, writes Sam Benstead.

With recessions globally becoming more likely as interest rates and inflation rise, the outlook is stormy for investors.

If economies contract, then consumers and businesses will spend less, which will hit corporate profits and therefore share prices.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

But an overall slowdown in the global economy masks what is really going on beneath the surface. While some industries will be under a lot of pressure, others could be thriving.

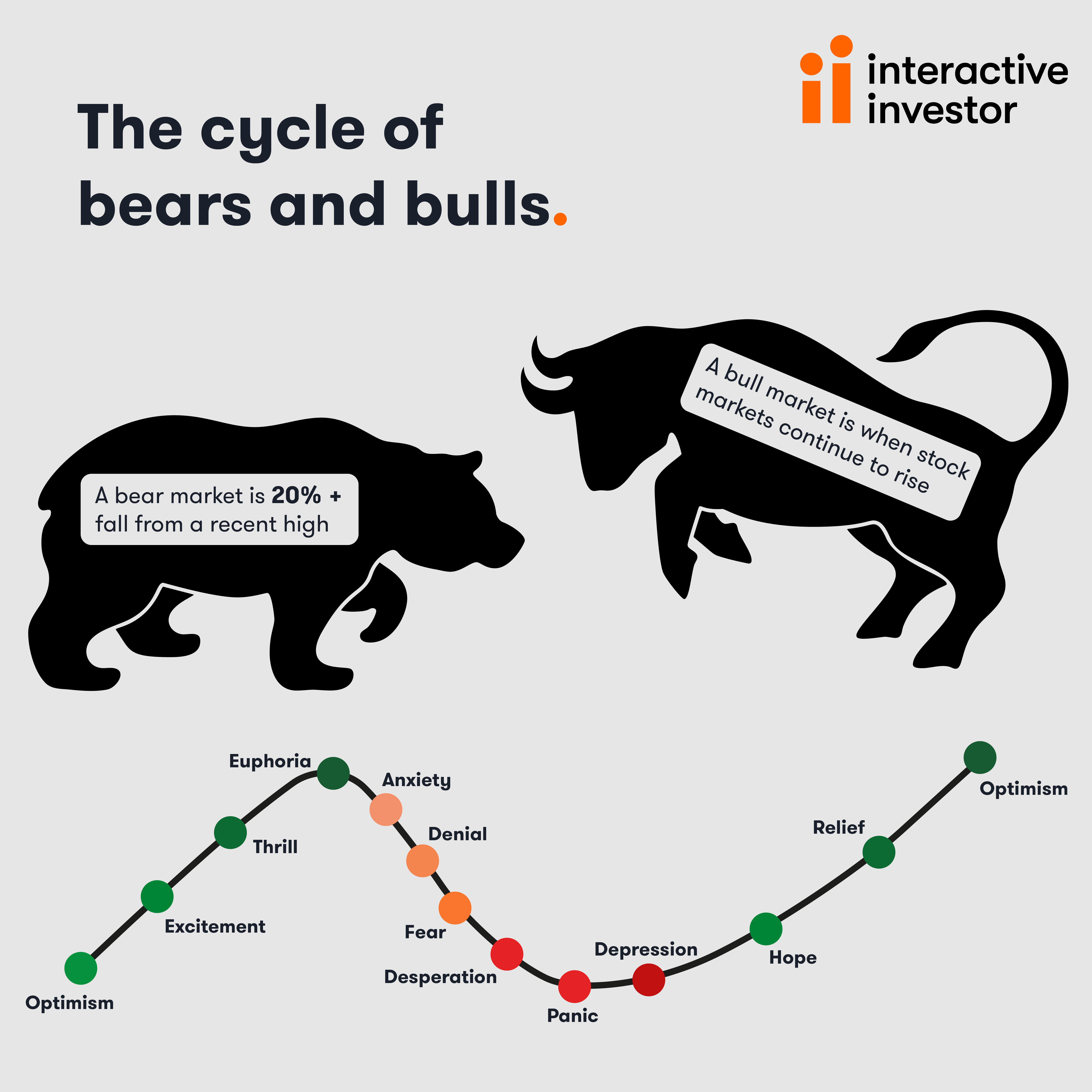

Investors who can identify winning sectors when others are panicking and selling stocks indiscriminately can set themselves up for success in the long term.

We spoke to fund managers about which investment areas they backed to keep growing revenue and profits even during a recession.

Semiconductors

One area fund managers are favouring is semiconductors. These are the computer chips that power electronics, from laptops and phones to smart speakers and electric vehicles.

While consumer devices continue to be a booming area, the sector is also seeing growing demand from data centres, which power computer programmes run remotely in the “cloud” by technology giants such as Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT).

Taiwan Semiconductor Manufacturing (TSMC), the world’s largest maker of chips, told investors in April this year that the year-on-year growth rate for the first three months of the year for data centres and electric vehicle-related chips was 26%. This compares with just 1% growth for smartphone demand, showing that chip demand can keep growing regardless of a slowdown in consumer spending.

- A tactic to ride out the inflation storm using these funds and trusts

- US stocks enter bear market, but there’s a silver lining for funds

- Listen to The Richard Hunter Interview - tech stocks and comparisons to the dot-com bubble

Demand from cloud computing is now at a similar level as that of smartphones, according to TSMC, but the sector is growing far more rapidly as everything moves online. The biggest clouding computing firms, Amazon, Google and Microsoft, are all reporting near 40% growth rates in revenue. They say that even during recession, companies will prioritise their IT spending as it makes their businesses run more efficiently.

Within semiconductors, George Crowdy, co-manager of the £3 billion Royal London Sustainable World Trust, argues that companies supplying electric vehicles will keep performing well.

He said: “Lots of car companies are pivoting to electric vehicles, which increases demand for semiconductors. One stock we own that is benefiting is Texas Instruments (NASDAQ:TXN). It is the world’s largest analogue semiconductor company, making 99 cent chips that are used in basic technology, such as car seats.

“It is low-level tech, but extremely important. One-third of its sales come from cars and another third comes from other manufacturers, which will also be resilient in a recession.”

- Recessions are becoming more likely – here’s how to invest

- How Terry Smith is investing as markets crash

Gerrit Smit, manager of the £1.6 billion Stonehage Fleming Global Best Ideas fund, says that while semiconductor demand can be cyclical as it relies on consumer spending, the companies that provide equipment to the semiconductor makers, such as Samsung and TSMC, were a good bet as they had a long pipeline of orders to fulfil.

He said this included Dutch firm ASML and Cadence Design Systems, an American company.

Cloud computing

Linked to semiconductors, Crowdy is very bullish on cloud computing. This is where companies outsource their computing needs to other firms, generally Amazon, Google and Microsoft.

He said: “We are still very early in cloud adoption as only 30% of the computing workload is currently run remotely by big tech – this is therefore an enormous opportunity.

“Amazon Web Services is the market leader but may face the biggest slowdown risk as it powers lots of start-ups, which could come under pressure as demand for high-risk technology stocks falters in the face of rising interest rates.

“Microsoft will be safer as it focuses on running the computing infrastructure for large enterprises, which will be safer in an economic slowdown. The third player is Google, which does a bit of both, large and small companies. It is smaller so high growth will be easier for it.”

Ben Rogoff, manager of the Polar Capital Technology Trusts, adds: “Cloud computing continues to deliver strong growth at extraordinary scale, with the three dominant vendors now having a total annual revenue of $140 billion (£115 billion), up 41% year over year.

- Bargain Hunter: Baillie Gifford trusts are cheap, time to buy?

- Listen to our interview with Scottish Mortgage

“Strong cloud growth means investment in data centres, which should underpin demand for semiconductors.”

Smitt adds that “digital revolution” stocks, such as Microsoft and Google, are large, diversified businesses that also benefit from selling cloud computing services.

He said: “Microsoft stands out for the diversification of its business services and 70% recurring revenue. Alphabet (Google) may see a slowdown in advertising income in a recession, but it also has YouTube, the Android mobile phone operating system, and its ‘other bets’ division, where it is experimenting with driverless cars and drug discovery.

“Google can also keep talent in ways that Amazon and Facebook can’t, as shown by high-profile executives leaving those businesses recently.”

Software

For Crowdy, stocks that have high levels of recurring revenue will also be good in slowdown as companies will be unlikely to cut off their subscriptions. Established software companies will therefore be able to keep growing profits and revenue, he argues.

He said: “You want deeply integrated software that has already cornered a market, such as Adobe (NASDAQ:ADBE) for creative programmes or Autodesk (NASDAQ:ADSK) for architectural design.”

While there have been a wave of new software companies launched recently, such as Zoom (NASDAQ:ZM), he said these were not interesting to him as their subscriptions can easily be switched off by employers.

“People train to use tools from Autodesk and Adobe at university. These are programmes that will keep being used in a downturn and will be bigger in 10 years than they are today,” he said.

- Which ‘wealth preservation’ trust has protected investors best?

- Investors are turning to income funds, but is a trick being missed?

Nevertheless, these companies have fallen in tandem with other technology stocks this year, despite offering resilience in a recession. This is an opportunity to buy cheaper, according to Crowdy.

He said: “Quality companies have lagged, and cyclical and cheap companies have done well. We expect this to reverse though if economic growth slows. I would much rather own a great business as we head into a downturn over a cheaper and more vulnerable one that could see its profits collapse,” he said.

Healthcare

Another area to watch, according to Smit, is healthcare stocks. Due to the growing backlog of surgery caused by the pandemic, he said companies that provide essential medical equipment would be a safe bet.

This includes Stryker, which makes hip and knee replacements, and Intuitive Surgical, which makes robots used in surgery.

- ‘Unprecedented’ sell-off in biotech sets up recovery opportunity

- Ian Cowie: an investment trust I intend to own forever

Shares have fallen 29% and 46% this year as investors sold expensive “growth” stocks and bought cheaper “value” ones. But Smit reckons that companies with consistent and growing demand, even though they are expensive relative to earnings, will be strong investments during a recession.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.