This cash-rich Covid beneficiary could rise again

17th May 2023 10:32

by Rodney Hobson from interactive investor

Two warnings to sell this stock were great calls, but now overseas investing expert Rodney Hobson thinks it’s time to buy this company and its massive pile of cash.

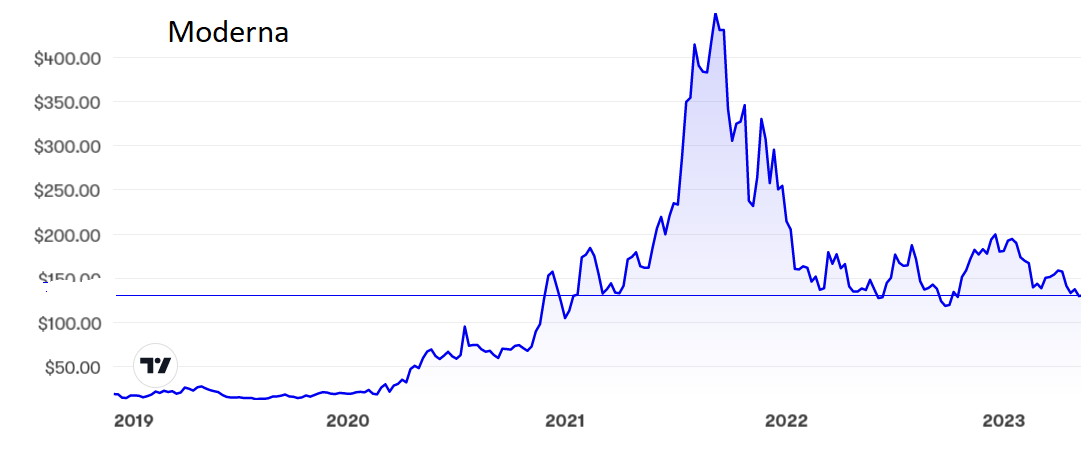

Shares in pharmaceutical group Moderna Inc (NASDAQ:MRNA) have slumped from $450 to below $130 in just 20 months, but they do seem to be settling around current levels. This could be a good time to buy at a realistic price.

Moderna is quite a young company, having been founded in 2010, and its shares were not quoted on Nasdaq until the end of 2018. It shot to prominence because its mRNA technology was quickly authorised as a Covid-19 vaccine.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

However, as Covid vaccination programmes have tailed off across the world and countries have learned to live with the lingering effects of the disease, the company’s only product authorised for use so far has gradually diminished after generating revenue of $36 billion over two years.

Even so, Moderna has other possible money spinners, with more than 40 mRNA development programs on the go, 25 of them in clinical trials in areas such as infectious diseases, cancer treatments, cardiovascular ailments and rare genetic diseases.

Investors should bear in mind that much can go wrong in these tests, such as adverse reactions, unpleasant side effects and failure to improve on existing treatments, but the success of the Covid-19 vaccine gives hope that at least some of the treatments will work well. Just one blockbuster can transform a pharmaceutical company.

- Watch our video: the US shares we own that will outperform Big Tech

- Watch our video: how to beat the US stock market

The best hope is for a combined coronavirus/flu jab that could gain approval and be rolled out next year. It would, Moderna hopes, lead to at least $8 billion of annual sales in the respiratory vaccine market by 2027, with at least half that figure converted into free cash flow.

Source: interactive investor. Past performance is not a guide to future performance.

The company has used the Covid bonanza to build up a cash pile – $18 billion at year end – to see it through the intervening period.

Meanwhile, Moderna is coping better than expected, turning in net income of $79 million in the first three months of this year against expectations of a loss. Shareholders should not start to celebrate yet, though. Net income was $3.7 billion in the same quarter last year. Quarterly revenue is now down to $1.83 billion compared with $6.1 billion in the previous first quarter when sales were boosted by a sudden surge in Covid cases.

Moderna continues to expect $3 billion Covid vaccine revenue in the second half. It reckons sales in the US will hold up around current levels and it is in talks about contracts in Europe and Japan, two other key markets. However, it sees 2023 as little more than a transitional year before hoped-for sales of new vaccines for respiratory illnesses kick in.

- Three American mega brands to keep buying and one I'd sell

- US results season has been a success so why aren’t stock prices higher?

The shares rocketed throughout 2020 and most of 2021 on hopes that Moderna would make huge profits from the pandemic. That spike now stands as a warning not to put too much faith into a single product that could have a limited lifespan. It also shows the dangers of getting carried away by stock market euphoria and jumping on the bandwagon just before the wheels fall off.

The shares have settled around $150 since early last year, and at the current $125 are now on a reasonable price/earnings ratio of 11. There is no dividend and it could be some time before Moderna is in any position to pay one, so this is not yet a stock for income seekers. Even if all goes well it could be another four years before cash starts to roll in again.

Hobson’s choice: in the past I have warned investors to sell at $245 and again at $140. It is time to think of buying at last. The downside looks limited to $118, the lowest point in recent months, but if you do take the plunge, consider taking profits anywhere above $180, as reaching $200 looks a step too far for the moment despite most analysts setting a target price above that level.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.