Three American mega brands to keep buying and one I'd sell

10th May 2023 09:33

by Rodney Hobson from interactive investor

These household names supply everything you need to keep a kid’s birthday party fed and watered. Overseas investing expert Rodney Hobson gives a view on each one plus a stock to sell.

We seem to have fully recovered our desire for the kind of snacks and fast food that we were forced to cut down on during the pandemic. However, not every chain has enjoyed the return to what is often criticized as unhealthy eating.

Fast food outfit Yum Brands Inc (NYSE:YUM) may have some great brands but its current performance is far from tasty. Although its four chains include well-known names KFC and Pizza Hut, it saw net income slump 25% to $300 million in the three months to 31 March, despite a small rise in revenue.

The main problem was that spending on a spate of heavily promoted offers failed to attract sufficient numbers of new customers. This is particularly worrying at a time of risings costs of ingredients, energy and labour.

- Discover more: Buy international shares | Transferring a Stocks & Shares ISA | Most-traded US stocks

Failure to match analysts’ expectations took the shares off their recent peak at $142, but even so they are still around $137, where the price/earnings (PE) ratio is quite challenging at 32 while the yield is only 1.7%.

Source: interactive investor. Past performance is not a guide to future performance.

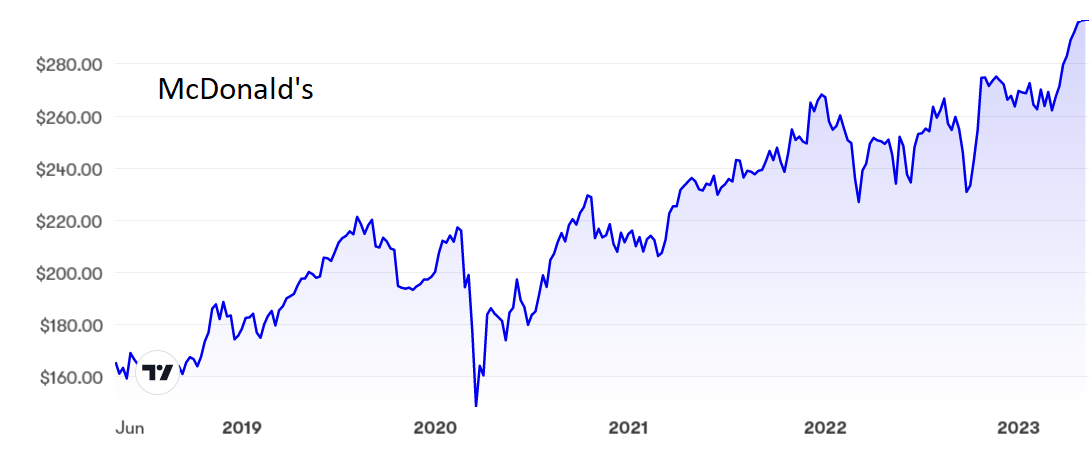

Contrast this with the much superior performance at larger rival McDonald's Corp (NYSE:MCD) as comprehensively analysed by Keith Bowman ii view: McDonald’s sales stay robust during cost-of-living crisis . The home of the Big Mac has hardy stinted on promotions and advertising, yet it is managing to pass on price increases.

The better results are admittedly reflected in the share price, currently at a new high just under $300, but the fundamentals are equal or superior to those of Yum, with a PE also at 32 but a yield closer to 2%.

Source: interactive investor. Past performance is not a guide to future performance.

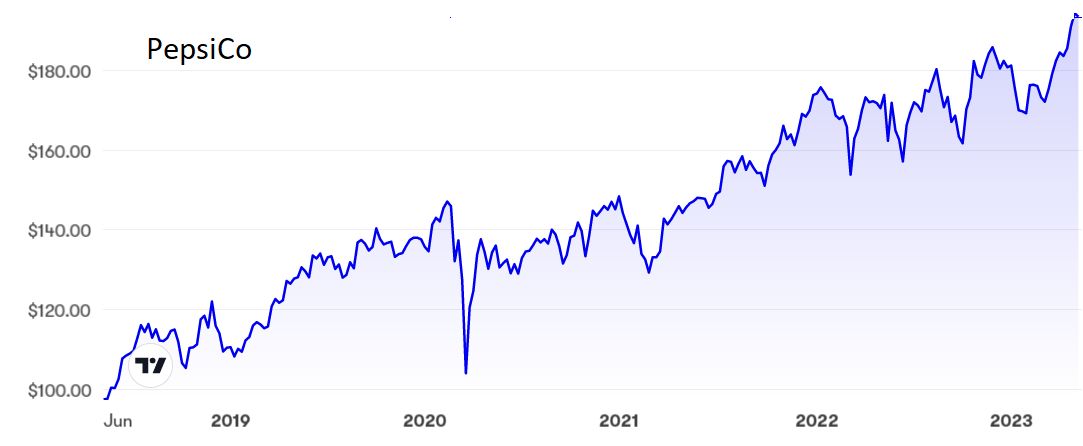

Soft drinks and snacks group PepsiCo Inc (NASDAQ:PEP), like McDonald’s, beat expectations with revenue up 10% to $17.9 billion, although net income disappointed, more than halving to $1.93 billion. However, this was entirely due to a distortion caused by a one-off gain from the sale of fruit drinks in the previous year. Underlying profits were comfortably higher despite stiffer manufacturing and distribution costs.

- Stockwatch: bulls, bears and a global banking crisis

- A hedge fund icon’s steadfast stance on the US dollar

- Investors pile back into funds as markets rebound

Pepsi described demand for its eponymous cola, 7Up lemonade and Walkers crisps as resilient and it raised its guidance for revenue and earnings to 8% and 9% respectively for the full year.

The shares have doubled over the past five years to just under $200 and should continue their steady rise despite a somewhat hefty PE of 40. The yield is 2.4%

Source: interactive investor. Past performance is not a guide to future performance.

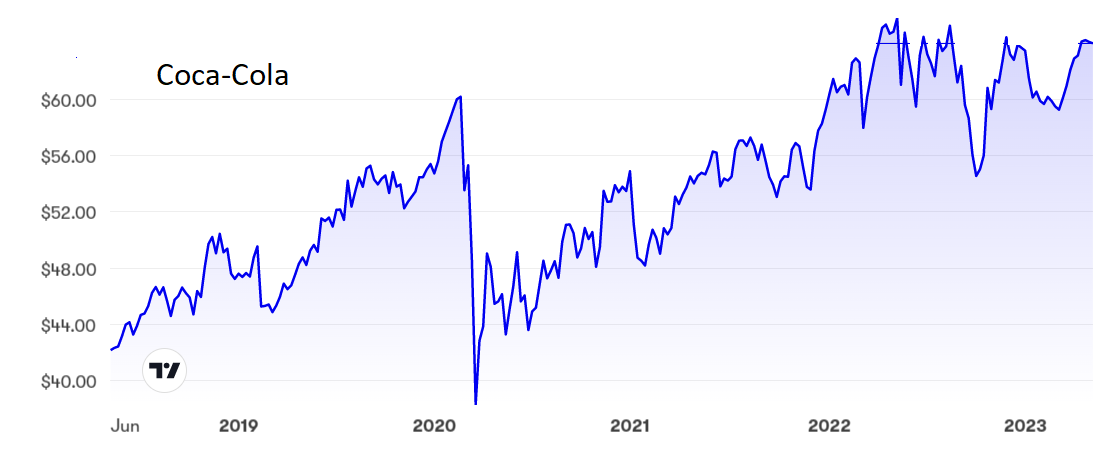

It was a similar story from Coca-Cola Co (NYSE:KO), where net income rose 11% to $3.11 billion to beat analysts’ forecasts. Revenue was 4.7% higher at $10.98 billion, again better than expected, with some increase in prices.

The shares have baulked at $65 several times over the past 12 months, but they are holding up well at $64 and could easily challenge the ceiling again soon. The PE at 28 is not too challenging for a company of this quality and the yield of 2.8% is reasonably attractive.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: McDonald’s is still a buy despite its high share price, and although investors may wish to wait for a dip before tucking in, that may not happen. Yum looks to be a sell while investors can still get out at a comparatively high price.

I have rated Pepsi as a buy several times and that assessment remains in force. Coca-Cola shares are already up 6% since I suggested putting them in an ISA two months ago, but it is not too late to buy.

Update: I warned investors on several occasions last year to sell exercise bicycles maker Peloton Interactive Inc (NASDAQ:PTON), most recently at $10 in late December. As I feared, the shares have continued their downward trend and currently stand at under $8. Revenue in its third quarter to the end of March fell, as the company had warned it would, by 22% to $748.9 million, and the current quarter will be worse still despite an expansion in sales channels and a rise in subscriptions. If you have stayed in this long, you may as well hang on and hope for the best; otherwise continue to stay well clear.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.