Colefax: Does old faithful hit the magic number?

7th September 2018 13:48

by Richard Beddard from interactive investor

This classy fabric designer is a reliable earner and returns surplus profit to shareholders. Analyst Richard Beddard discusses whether that's enough to justify buying the shares at the current price.

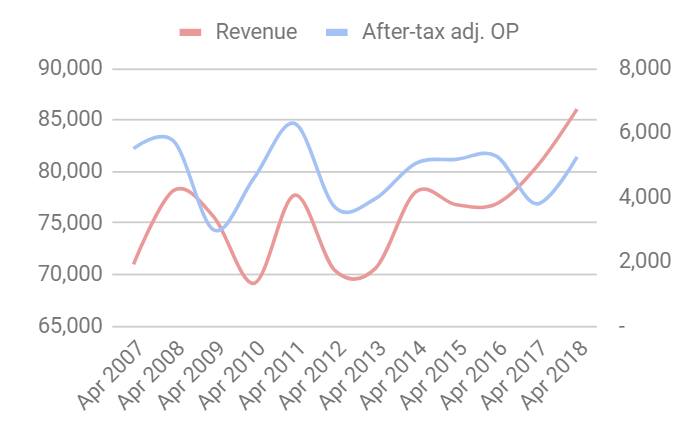

Over the last two years, revenue has risen convincingly at Colefax after a decade in which it bobbled between about £70 million in a bad year and £80 million in a good year. Much of the improvement though, is the result of lower exchange rates, which have increased the value of overseas revenue when translated into pounds.

Colefax earns most of its money from luxury fabric and wallpaper designs, and the majority of that revenue comes from the USA. A substantial amount is earned in France, Germany, and Italy too.

Source: interactive investor Past performance is not a guide to future performance

The increase in revenue in 2017 coincided with a decrease in profit. In that financial year the company took out contracts to fix the exchange rate at $1.50, which it believed might be a historic low. Britain voted to leave the EU, though, and the subsequent decline of sterling to $1.20 meant the company lost significant amounts of money, about £2 million in 2017, and £0.8 million in 2018. It is no longer hedging so if exchange rates stay low, Colefax should get the whole benefit in 2019.

Otherwise, it was business as usual in 2018. The company sells fabric mostly, but also wallpaper, to interior designers and retailers. This part of the business earned 83% of revenue in 2018. In constant currency terms revenue growth was very modest, a substantial increase in demand from the USA diluted by a flat performance in Europe and the UK, where high stamp duty and uncertainty about Brexit are deterring oligarchs from buying houses.

Profitability recovered in 2018 due to lower losses on currency hedges. Colefax’s smaller decorating and furniture businesses performed better too.

Sybil Colefax and John Fowler, the original business, decorates mansions. It earned 14% of revenue in 2018 and contributed 44% of the profit increase, partly because it is doing more work overseas. We shouldn't get too excited though. The profitability of the decorating business varies depending on when it completes projects, and in 2018 it completed a number of substantial projects. Furniture manufacturer Kingscome Sofas also had a profitable year, but since it only earns the company 3% of revenue, financially at least, furniture is a bit of a sideline.

As usual I'm scoring Colefax to determine whether it is profitable, adaptable, resilient, equitable, and cheap, criteria. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score 1

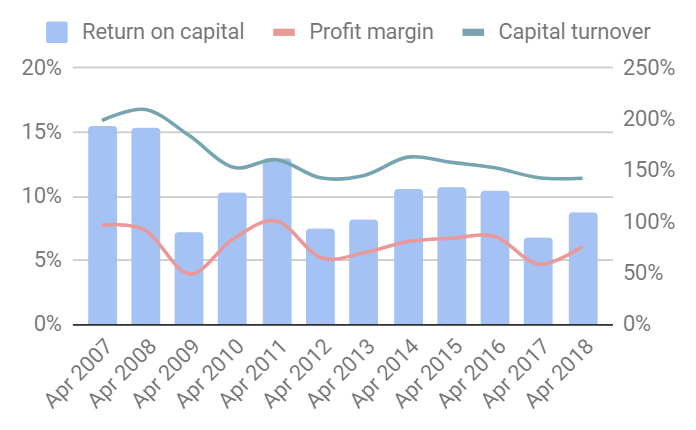

Source: interactive investor Past performance is not a guide to future performance

Colefax just about achieves an 8% return on capital even in its worst years, but it has had few a few of those: 2009, 2012, 2013 and 2017. Over the last 12 years the company has averaged a good but not great 10%. Profit margins are surprisingly thin though, for a business producing luxury goods. Colefax relies more on efficient operations than high mark ups.

It owns five fabric brands: two English (Colefax and Fowler, Jane Churchill), two American (Cowtan and Tout, Larsen) and one French (Manuel Canovas). The brands have separate design studies, which design new collections every year, but manufacturing is outsourced to over 100 mostly European suppliers and the brands have common marketing, sales, sampling, warehousing, purchasing, accounting and IT systems. By limiting the number of patterns, Colefax keeps tight control of stock and minimises wastage. Rumour has it the company’s executive chairman and majority shareholder David Green hawks end-of-line stock himself.

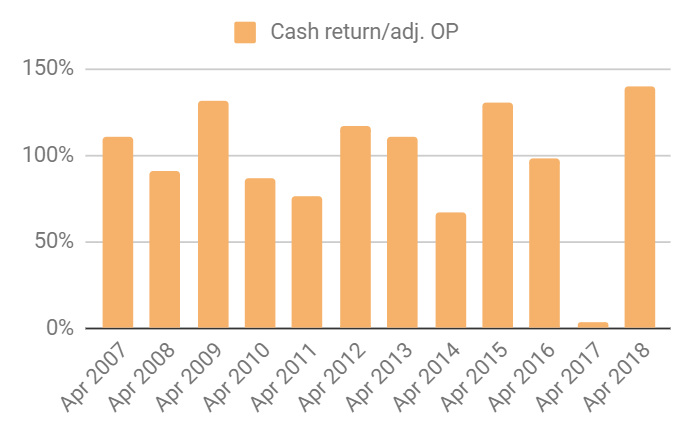

The good news is the profit is real money. Cash flow has all but matched profit over the 12-year period:

Adaptable: How will it make more money?

Score: 1

Colefax is directing most of its investment at the USA, its biggest and fastest growing market. Its policy is to use its own salesforce where sales justify it and agents elsewhere, and in recent years it has opened showrooms in Atlanta and Boston.

While Colefax says it would consider buying one of its many, mostly family operated competitors, the owners invariably expect too much money. Its last acquisition was Manuel Canovas 20 years ago.

A cheaper approach, the company says, would be to establish a new brand from scratch, or launch a sub-brand of one of the five established brands, but it has been reluctant to do this as well.

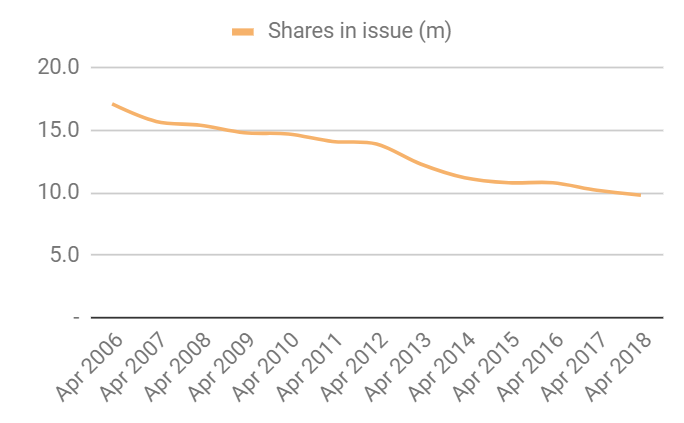

So far, Colefax has preferred to take the low risk route, launching new collections for the established brands every year, and returning surplus cash to shareholders via dividends and buybacks.

Source: interactive investor Past performance is not a guide to future performance

Its conservatism betrays, perhaps, a lack of confidence that it can earn sufficient returns from acquisitions or new brands.

Resilient: What could go wrong?

Score: 2

Having eschewed hedges, hopefully Colefax has learned its lesson and won't speculate on interest rates again. The important thing is to be consistent. Business can lose out if they hedge, and they can lose out if they don’t. Over the long term it tends to even out, unless the business succumbs to animal spirits and chops and changes its policy.

I think Colefax is a pretty resilient business, the brands are well known, and the company is protecting their exclusivity by preventing retailers from selling fabric on the Internet and focusing on interior designers. Because customers have plenty of money, they're fairly insulated from recession, although people tend to redecorate when they buy property and as we’re seeing in the UK if the mansion market is moribund, demand dries up.

While they are all upmarket, and therefore expensive by normal standards, Colefax's brands have different price points and cater to different tastes. Colefax and Fowler, for example is in traditional English Country House style, while Jane Churchill is more contemporary - and cheaper. This diversification is helping it prosper even if individual markets, like the UK, don't.

Brexit too is a worry since Colefax buys most of its fabric from the EU and tariffs, if introduced, would increase costs, as well as cutting into the 21% of revenue earned there.

Equitable: Will we all benefit?

Score: 1

I really don't know. Touched by the circles they move in, perhaps, the directors get eye-watering salaries, but they do not have Long Term Incentive Plans, which have resulted in the worst excesses at other companies.

Colefax, says very little about its staff too. The one review by an ex-employee on Glassdoor, a recruitment site lauds the firm and its CEO, and having visited the company I can imagine it has a close-knit feel to it.

Cheap: Is the firm's valuation modest?

Score: 1

A share price of 540p values the enterprise at about 16 times adjusted profit, which is probably a fair valuation for a company run as conservatively as Colefax is. Lack of growth means most of the value has come from dividends and buybacks, perhaps limiting annual returns to shareholders to about 6% at the current share price.

A total score of 6 out of 10 means Colefax falls just shy of the magic 7 that would allow me to recommend it.

Here are some of Richard's recent articles:

- Games Workshop: Verdict on this stunning performer

- System1: Testing its powers of recovery

- MS International: Can the rebound last?

- Castings: Between a rock and a hard place

- Trifast: Continuous improvement adds up

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.