Company fundraisings: what you need to know

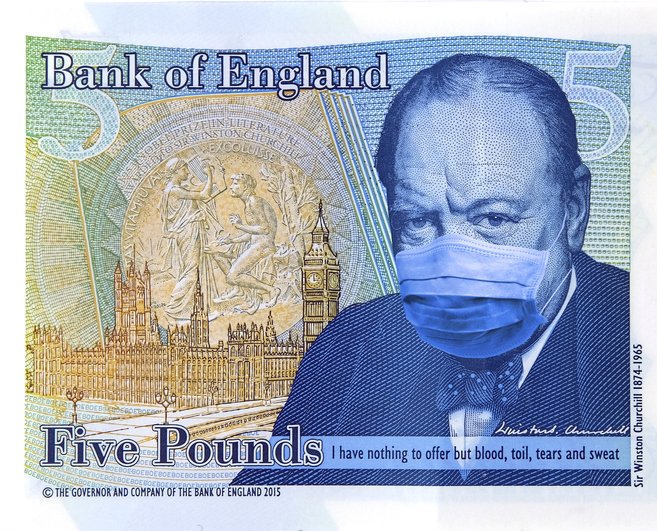

As companies raise billions during the pandemic, we explain what it means for retail investors.

3rd June 2020 15:50

by Graeme Evans from interactive investor

As companies raise billions during the pandemic, we explain what rights issues and placings mean, how the fundraising process has changed during the crisis, and implications for retail investors.

Dividend cuts and the dilution of shareholdings caused by a rush of City fundraisings mean retail investors have been hit particularly hard during the current market crisis.

The accelerated placing of new shares with big institutions has been a tactic used by numerous companies to shore up balance sheets in recent weeks, including ASOS (LSE:ASC), WH Smith (LSE:SMWH) and Hays (LSE:HAS).

But while relaxed rules on capital issuance since April have dramatically cut the time it takes to raise new funds, the flip-side is that smaller investors are often shut out of fundraisings.

- ASOS fundraising triggers 40% surge in 40 minutes

- Wheels come off at WH Smith

- ii view: Hays raising £200 million in Covid-19 fallout

As a consequence, investors are finding their stakes significantly diluted by the new shares on offer. This week, for example, Ted Baker (LSE:TED) announced plans to raise £95 million towards its transformation plan through a placing of heavily-discounted shares with institutions.

Shareholders who do not participate were told their stakes will be diluted by 74%, although the company is raising an extra £10 million through an open offer to new and existing investors.

Premier Inn owner Whitbread (LSE:WTB) took a different approach to its fundraising by choosing to generate £980 million through a rights issue, where existing shareholders will be offered one new share for every two they own.

This affords the same opportunity for small shareholders to buy discounted shares — in this case the offer was a 37.4% reduction to the 2,395p theoretical ex-rights price when adjusted for the new shares.

A theoretical ex-rights price, or TERP, is the ‘theoretical’ price at which a share will trade following a rights issue. This happens because more shares have been issued, usually at a much lower price to make them attractive to buyers. This needs to be reflected in the share price once the fundraising is closed. The size of dilution will be influenced by the number of rights issue shares acquired during the cash call.

A shareholder who chooses not to buy the shares is still able to sell the rights, with this nil-paid price being the difference between the issue price and ex-rights price. The deadline for acceptances from Whitbread shareholders is 11am on Tuesday 9 June, ahead of dealings the next morning.

The Whitbread fundraising will have taken three weeks to complete, whereas many companies have been able to jumpstart the process by going directly to institutions and without the delay of having to publish a detailed prospectus.

All shareholders usually have equal rights over new issues above 5-10% of the total share capital, but this threshold has been temporarily raised following guidance from the Financial Conduct Authority and the Pre-Emption Group.

Recognising the need for greater flexibility during the Covid-19 crisis, the industry body said investors should consider supporting issuances of up to 20% of share capital, up until September.

- Ted Baker's heavily-discounted £95 million fundraising

- ii view: Compass launches £2 billion fundraising

- Whitbread dives on shock £1bn rights issue

- Find out more by visiting interactive investor's Knowledge Centre

WH Smith was one of the first companies to take advantage of the new guidance when it placed 15 million shares with institutional investors at a 4% discount of 1,050p and representing 13.7% of its share capital prior to the placing. In the same week, ASOS raised proceeds of £247 million from a placing at 1,560p involving 18.8% of its share capital.

The confidence generated by the fundraisings has benefited all shareholders, with WH Smith shares trading at 1,315p by the end of the April and ASOS doubling to 3,211p by today.

There were at least 35 fundraisings in April and May, with the £2 billion raised by catering company Compass not just the biggest but the first to include retail shareholders. This was made possible by the PrimaryBid platform, which enables companies to include a retail element alongside the usual institutional placing.

This approach is now much more commonplace, with airport and railway caterer SSP Group (LSE:SSPG) today using PrimaryBid for an unusual share placing worth up to £26.8 million. The cash raised will enable the Upper Crust owner to offset the dividend payment that had already been approved by shareholders before the crisis began back in February.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.