10 value stocks with solid momentum

Get an extra edge with a strategy that finds well-priced shares just as the market starts to take notice.

26th February 2020 10:53

by Ben Hobson from Stockopedia

Get an extra edge with a strategy that finds well-priced shares just as the market starts to take notice.

Finance academics have played a vital role over the years in figuring out what works (and what doesn’t) in the stock market. They’ve been helped by a massive rise in the availability of huge datasets plus a hell of a lot more computing power to analyse them.

These days, quant analysts and data scientists are some of the most in-demand personnel in investing. Yet it wasn’t always that way, and the leap from finance theory to money management hasn’t always been a natural progression. But one man who showed how to do it is Josef Lakonishok.

From theory to find management

Lakonishok doesn’t have the same swashbuckling profile of some money managers. But that belies his success. Over several decades, his work on a whole range of areas helped shape what we know about important drivers of returns, such as ‘value’ and ‘momentum’.

His researched stressed the influence of flawed investor behaviour on stock prices. Through his work he found that investors tend to be far too reliant on using the past as a means of predicting the future. Because of that they develop a ‘mindset’ about a company and end up paying too much for its shares.

Mixing value and momentum

Like many value investors, Lakonishok credited the work of Benjamin Graham for shaping his ideas. But rather than simply trawling for value, he worked out a way of finding well-priced shares just at the moment when the market was starting to notice them.

Lakonishok found that whatever definition of value you use, value stocks consistently beat glamour stocks by wide margins. So he suggested using valuation ratios like price-to-book, price-to-earnings, price-to-cash flow and price-to-sales to find stocks that look cheap against their sector average.

The extra edge he gave his strategy was that he wanted to see evidence of positive momentum in his value shares. That meant positive price momentum over six months, better than expected earnings or upgrades to analyst forecasts.

In the early 1990s, Lakonishok and his academic colleagues Andrei Shleifer and Robert Vishny put their findings to work and started LSV Asset Management. It now manages $120 billion in value equity portfolios.

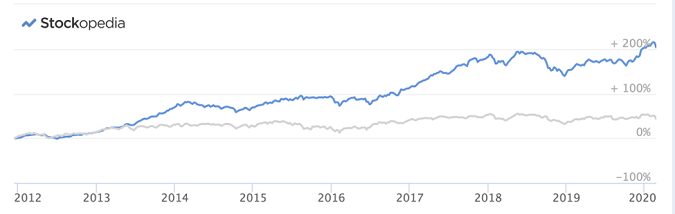

Josef Lakonishok Momentum Screen: December 2011 - February 2020

Over the past eight years, a screen based on Lakonishok’s rules, tracked by Stockopedia, has produced solid results. The theoretical returns are pre-costs based on a quarterly refreshed portfolio, but they’re instructive of how the strategy has performed over the medium term. The last 12 months has been notably strong.

It’s worth remembering that Lakonishok’s mix of value and momentum means that you could be coming across firms that have a chequered track record and are just beginning to recover. Here are some of the stocks currently passing those rules:

| Name | Mkt Cap m | P/E Ratio | Relative Strength % 6m | Relative Strength % 3m | EPS Surprise % Last Year | Sector |

|---|---|---|---|---|---|---|

| Reach (LSE:RCH) | 538.7 | 6.2 | 90.6 | 89.3 | 4.07 | Cyclicals |

| Rank (LSE:RNK) | 1,252.10 | 15.3 | 82.7 | 30 | 5.41 | Cyclicals |

| International Personal Finance (LSE:IPF) | 367.3 | 5.5 | 79.9 | 21.4 | 3.87 | Financials |

| Caledonia Mining (LSE:CMCL) | 101.2 | 3.7 | 72.9 | 49.5 | 21.89 | Materials |

| Persimmon (LSE:PSN) | 10,154.40 | 11.4 | 61.9 | 23.2 | 3.32 | Cyclicals |

| Belvoir (LSE:BLV) | 62.3 | 15.8 | 58.1 | 44 | 0.85 | Financials |

| MTI Wireless Edge (LSE:MWE) | 33.4 | 15.2 | 57.5 | 0.73 | 26.67 | Technology |

| Ariana Resources (LSE:AAU) | 36 | 8.7 | 54.3 | 35.2 | 57.14 | Materials |

| Taylor Wimpey (LSE:TW.) | 7,364.90 | 10.9 | 49.4 | 25.4 | 0.26 | Cyclicals |

| Springfield Properties (LSE:SPR) | 156.6 | 11.9 | 48.8 | 35.4 | 4.38 | Cyclicals |

The recent market dip has taken the edge off some stellar performances. However, the focus on six-month price momentum means it takes a bit more than a momentary slip to shake-out shares from this screen. If markets continue to trend down, then any momentum-based screen will start to suffer - this one included.

As it is, Lakonishok’s combination of value and momentum picks up shares across a range of sizes and sectors, including like Reach (LSE:RCH), Rank (LSE:RNK), International Personal Finance (LSE:IPF), Caledonia Mining (LSE:CMCL) and Persimmon (LSE:PSN).

In search of value stocks on the move

Lakonishok’s value approach was a nod to the age-old problem that it’s very hard to know when the market will re-rate a share. His academic background led him to focus on behavioural finance explanations for the value phenomenon. As such, he recognised the power of momentum as a signpost to those stocks that are most likely to rebound. He is considerably wealthier than most academics as a result!

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.