Covid-19 winners and losers: Airline shares book gains

Optimists are chasing some stocks higher today on hopes of a quicker-than-expected return to ‘normal’.

19th May 2020 15:01

by Graeme Evans from interactive investor

Optimists are chasing some stocks higher today on hopes of a quicker-than-expected return to ‘normal’.

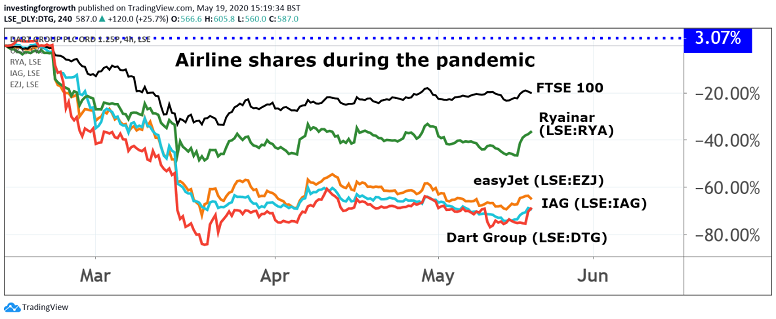

The fear of missing out on cheap-looking travel stocks ensured investors kept International Consolidated Airlines Group (LSE:IAG) and Jet2holidays owner Dart Group (LSE:DTG) on the boil today, despite a retreat for the FTSE 100 index.

Progress towards a Covid-19 vaccine by US biotech firm Moderna (NASDAQ:MRNA) had helped to boost global markets yesterday, with London's top-flight closing 4% higher last night. Rising hopes that Italy and Greece might be able to reopen their economies in time for some of the summer tourism season also meant that easyJet (LSE:EZJ) and BA owner IAG both saw their shares jump 11% on Monday.

IAG built on those gains today by rising 6% to 200p, while AIM-listed Dart jumped another 20% on top of last night's 14% rise. Other travel stocks including Carnival (LSE:CCL), TUI (LSE:TUI), and Ryanair (LSE:RYA) surrendered initial gains this morning, but still consolidated rallies achieved yesterday.

Low-cost airline easyJet had a bumpier session, with its shares 3% lower at one point after its lunchtime disclosure that a highly sophisticated cyber-attack had resulted in the email addresses and travel details of nine million customers being accessed.

Despite this week's improvement, valuations in the travel sector remain heavily depressed, with IAG shares no better than where they were in mid-March following a fall from February's 642p.

Source: TradingView. Past performance is not a guide to future performance.

The same is true in the commercial property sector, which has been battered by falling rental income amid the impact of the lockdown on retail and office occupancy. The vaccine news ensured Land Securities and British Land were higher for a second session in a row, up 3% today despite the wider FTSE 100 index slipping back below the 6,000 threshold.

They were joined by retailer JD Sports Fashion (LSE:JD.), which rose 4% to 565.4p to continue the recovery for its shares from less than 300p in mid-March.

The blue-chip risers board also featured Dublin-based DCC (LSE:DCC) after the support services business bucked the income gloom by increasing its final dividend by 2.6% to 95.79p a share.

The company, which operates in the liquefied petroleum gas (LPG), commercial fuels, technology and healthcare sectors, said its “diverse and resilient” business model meant it was in a strong position to withstand Covid-19 uncertainty. Shares rose 4% to 6,206p, still short of the 6,500p target of UBS analysts.

- UK banks: what City experts think of Lloyds, Barclays, RBS and HSBC

- Stockwatch: is it finally time to buy BT shares?

- Imperial Brands shares: still a buy after dividend slashed?

Outside the top-flight, N Brown (LSE:BWNG) shares jumped by 20% to 22.5p after the online fashion retailer announced new financing arrangements with its lenders, as well as an improvement in trading since the “sudden and significant” decline experienced in March.

It described a 25% decline in product sales for the last six weeks as “creditable”, adding that significant growth in home and gift categories had been offset by weakness in apparel sales.

Household cleaning products firm McBride also cheered investors after reporting that demand from its private label customers had continued to be above the levels seen prior to March. The group's aerosols business has also benefited from sales of new hand sanitiser products.

McBride shares rose 6% to 60.6p as the company said profits for the year to 30 June were likely to be 15% ahead of current market forecasts, which had been for a figure of £18.6 million.

There was encouragement for Quixant (LSE:QXT) investors after the technology business reported a tentative recovery in demand for its wager-based gaming and sports betting division. With its Densitron business also performing well, the group said it was well placed to take advantage of longer-term opportunities as they arose.

Quixant, which works in the gambling and broadcast industries, added that its cash reserves and borrowing facilities were sufficient to withstand the current crisis, causing shares to jump 22% to 110p — the highest level since mid-March.

- 10 equity income gems as Covid dividend cuts bite

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Homeware business Portmeirion (LSE:PMP) also sounded a resilient tone in a trading update issued ahead of its annual meeting today. Its shares were 6% higher at 402p as the maker of the Spode and Royal Worcester brands said it had reduced its cash burn to less than £1 million in the current quarter as it comes to terms with the temporary closure of retail outlets worldwide.

It continues to ship export orders to the Far East where retail stores have now reopened, while there has also been a significant uplift in online sales in the UK and US. This is being supported by the partial re-opening of its Stoke-on-Trent ceramics factory, which is expected to increase capacity in the coming weeks.

While the group is cautious about the immediate future, Portmeirion told shareholders that it would reinstate its interim and final dividend payments as soon as it was prudent to do so.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.