Diverse Income lags benchmark as hedge against FTSE falls turns sour

9th August 2022 11:54

by Sam Benstead from interactive investor

The small and mid-cap Super 60 income trust still has an envious long-term record despite a disappointing year.

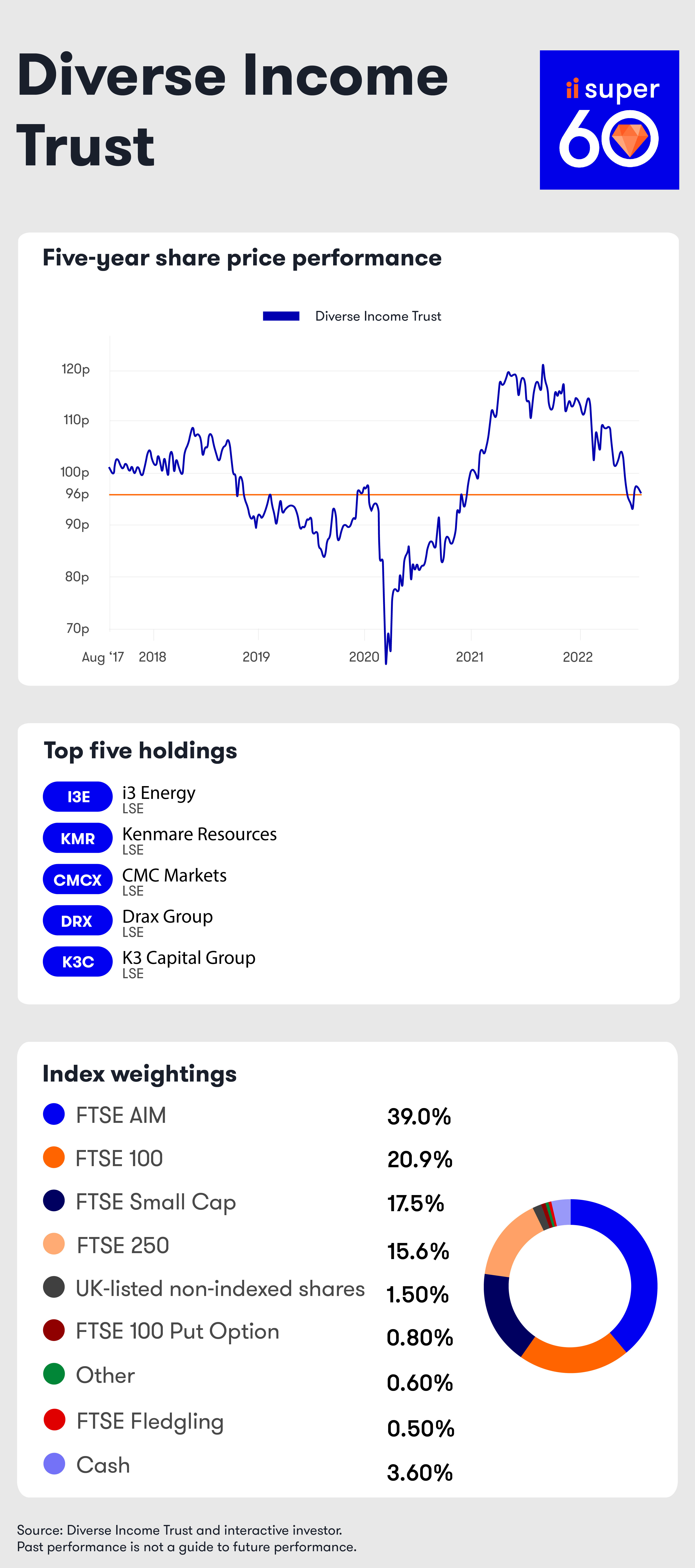

UK equity income investor Diverse Income Trust delivered a net asset value (NAV) total return of -3.4% in the year to 31 May 2022, below the 4.7% gain of the Numis All-Share Index, its benchmark.

But taking into account the widening of the small and mid-cap specialist’s discount to around 7%, shareholders were left with a share price total return of -10.5% over the reporting period.

Long-term performance is still strong for the interactive investor Super 60 recommended trust, however. Since listing in April 2011, its NAV total return including compounded dividend income was 228%, which compares to 141% for the peer group (UK Equity Income trusts) and 90.2% for its benchmark.

- Find out about: Free regular investing | Interactive investor Offers | ii Super 60 Investments

Chair Andrew Bell said the trust’s exposure to smaller companies was a relative headwind this year, having boosted returns the previous year.

Bell said: “The weakness of sterling boosted the returns of larger UK quoted companies, which earn most of their earnings overseas, hence the unusually wide disparity between the returns on the UK market as a whole and those of smaller companies.”

- Investors ignore strong returns and dump British stocks for US rivals

- Dividends soar again, here’s the sectors rewarding income investors

Despite underwhelming total returns, income investors were rewarded with a 4% rise in dividends compared with the previous year.

The board declared three interim dividends amounting to 2.7p and a final dividend of 1.2p, which if approved, together amount to 3.90p, up from the 3.75p paid the year before.

The board also made a small addition to revenue reserves, available to support future dividend growth, in case the portfolio’s dividend income is held back by rising inflation and slower growth over the year ahead.

Trust managers Gervais Williams and Martin Turner said the two main impediments to stronger performance were the bias to small and mid-sized companies and a hedge they took out on the FTSE 100 falling, known as a put. This gives them the option, but not the obligation, of selling the FTSE 100 at a set price.

They said: “The share prices of the largest UK quoted companies, that have a majority of their businesses overseas, greatly outperformed most other UK-listed stocks over the year to May 2022, in part as their earnings are enhanced when sterling is weak.

“Although global equity markets have been quite unsettled over the second half of the year under review, in fact the largest detractor to portfolio return in the period was the FTSE 100 index put option, as it bucked the global asset market trend.”

The pair said that while investing in FTSE 100 puts does have advantages during stock market setbacks, it is worth keeping in mind that setbacks happen infrequently, and more often the valuation of the hedge declines over time. A hedge comes into its own, however, when markets fall, as they did in early 2020.

Williams and Turner add: “When stock markets do suffer a major setback, such as during the global pandemic, the valuation of a FTSE 100 put option can rise to a multiple of its initial cost. This was helpful during the pandemic as it offset, in part, the decline in the rest of the trust’s portfolio valuation during the year to May 2020.

“When put options rise to elevated valuations they can be sold, and in March 2020 the trust’s FTSE 100 put option was sold, and the cash receipts from the sale were invested in additional equity income holdings at relatively low entry prices.”

In terms of positive contributions, the trust’s holdings in energy were the strongest, in aggregate adding 4% to the trust’s returns over the year, with i3Energy adding over half of this total.

The second-best contributor was utilities, with Drax and National Grid contributing over 1% to portfolio return between them.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.