Dogs of the FTSE update: Our 10 high-yield shares in 2019

It's been a mixed performance for the FTSE 100’s high-yield Dogs, as the index as a whole storms ahead.

28th May 2019 10:53

by David Budworth from interactive investor

It's been a mixed performance for the FTSE 100's high-yield Dogs, as the index as a whole storms ahead.

The dramatic rebound in stock markets in the first quarter of this year was a surprise - albeit a pleasant one. But for our 2019 Dogs of the Footsie, the year has been all about a race to keep up – one that, so far, they are losing.

As at 1 May the portfolio of unloved companies lined up on 1 February had delivered a decent return, but our canine compadres were nonetheless trailing the index by a significant margin.

Overall, the Dogs recorded a 1.8% rise in share price terms in the three month period, compared with a 5.9% gain for the FTSE 100. On a total return basis, including dividends, the Dogs were up by 4.3%, but the index as a whole was up by 7.6%.

For readers new to the Dogs strategy, the approach involves investing in the 10 FTSE 100 stocks with the highest historic divided yields, based on past dividend payments. Followers invest equal amounts in those 10 stocks and hold them for a year.

Over time this simple strategy has been successful. The Dogs have beaten the FTSE 100 in 12 of the 18 years in which we have been running the portfolio. Last year the Dogs triumphed again, and they have outpaced the index over three, five and 10 years, as well as over the 18-year life of the portfolio.

Steelmaker shines

This year's Dogs are a fairly eclectic mix of companies, so as you would expect, the performance of individual stockholdings over the past quarter has been mixed. The star performer so far is Evraz (LSE:EVR), perhaps the only company in the portfolio that isn't a household name.

The Russian miner and steelmaker's shares have been buoyed by strong 2018 results that delivered a net profit of $2.5 billion (£1.9 billion), compared with $759 million the year before. According to the company, its robust growth last year was due to favourable market conditions, as well as continuing efficiency and cost initiatives.

Evraz raised its dividend to 40 cents a share. However, the group operates in a highly cyclical business, so it will be interesting to see whether the good times last.

Standard Life Aberdeen (LSE:SLA) has also had a good three months, though this appears to be a reflection of its lowish share price and high dividend yield rather than any positive catalysts.

Overall, there was a 60/40 split between risers and fallers. One of the stocks in the doghouse was British Gas owner Centrica (LSE:CNA), which was down by 23% in share price and total return terms.

Centrica has been haemorrhaging customers to rivals offering more competitive deals. What's more, concern that increased price regulation in the UK will hit the company's profits has grown. Housebuilder Persimmon (LSE:PSN), tobacco company Imperial Brands (LSE:IMB) and BT (LSE:BT.A) were also down, but their losses remained in single digits.

Selection changes

The Dogs strategy counts on investors buying and holding their selection for a full year, but it can be started at any time.

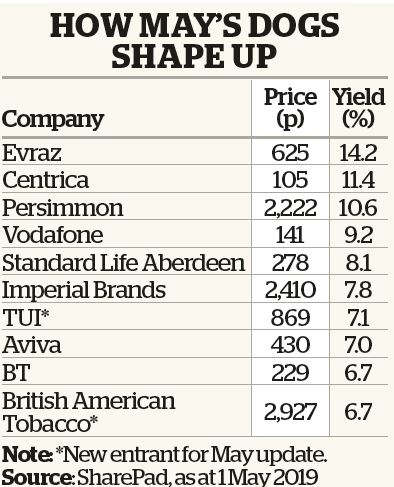

The line-up of highest-yielding businesses as at 1 May is shown in the box above.

This list incorporates two replacement Dogs. Out has gone WPP (LSE:WPP), the advertising and communications giant, which struggled last year to regain its footing after the exit of its former chief executive, Martin Sorrell. A strong bounce in its share price in April helped push down WPP's yield and force it out of the running for new starters. Marks & Spencer (LSE:MKS) has also been ejected.

Replacing them in our canine pack is the travel operator TUI (LSE:TUI), which issued a profit warning in March, after being forced to ground its Boeing 737 Max planes due to safety concerns. The company's management expects the grounding to cost the firm €200 million this year if the planes are allowed back in the sky by July. If not, the impact will be more severe.

Dependable dividend payer British American Tobacco (LSE:BATS) joins TUI in the newstarter portfolio.

Line-ups can change without notice, however. If a starting investor had assembled the current Dogs on 14 May, Vodafone (LSE:VOD) would have failed to make the cut, as the firm took an axe to its dividend, reducing the payout by 40%. This resulted in the yield falling to around 6%.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.