Don’t wait for ‘pot for life’ pension reform

interactive investor reveals thousands are already transferring their pension.

29th November 2023 09:18

by Alice Guy from interactive investor

- Taking control: four of the five most-transferred pensions moving to interactive investor over the past year are from traditional life and pension providers.

- Savers with £50,000 could be charged up to three times more with interactive investor’s largest platform competitors.

- The difference in charges is even starker at higher pension levels (up to 4.6 times more at £250,000, eight times more at £500,000 and 11.5 times more at £1 million).

- It is a reflection of the opacity of charging in the industry that so many pension savers are paying so much more for what is essentially the same product.

The ‘pot for life’ (or lifetime pension) reforms were arguably the biggest announcements in the Autumn Statement, but interactive investor data shows that savers are already taking control of their pension wealth.

Pension transfer data reveals that thousands of people are transferring their pension to interactive investor, the UK’s second-largest investment platform for private clients, with many consolidating and benefiting from a switch away from percentage fees - which take more of your wealth as it grows - to interactive investor’s flat-fee structure.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Over the year from 1 November 2022 to 24 November 2023, four of the five most-transferred pensions moving over to interactive investor are from traditional life and pension providers.

The top five pensions being moved over, in rank order (by volume), are from: Hargreaves Lansdown, Aviva, Scottish Widows, Standard Life and Aegon.

Completed transfers in by provider from Nov 2022 – to Nov 2023, ranked by number of transfers in

1 | Hargreaves Lansdown |

2 | Aviva |

3 | Scottish Widows |

4 | Standard Life |

5 | Aegon |

6 | Legal and General |

7 | Fidelity |

8 | Royal London |

9 | AJ Bell |

10 | Nest |

Source: interactive investor. Data includes completed SIPP transfers in between 1 Nov 2022 and 24 Nov 2023

Alice Guy, Head of Pensions and Savings says: “The new lifetime pension proposals could be a game changer for the UK pension system, but changes could take years to implement with many practical details to iron out. In the meantime, we’re stuck with a clunky system where pension savers change pension provider each time they move job and build up multiple pension pots across their working life.

“The good news is that you don’t need to wait for the lifetime pension to take control of your pension wealth. In fact, thousands of pension savers are already taking action to get interactive with their pension, consolidating their workplace and private pensions, and potentially saving thousands in pension fees in the process.”

(Flat) fees matter

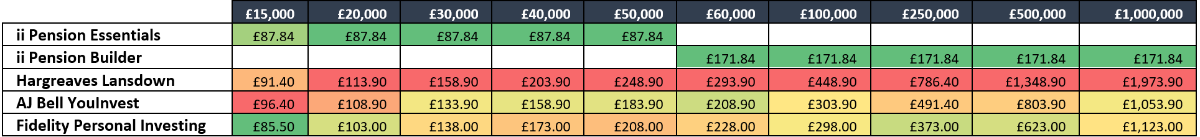

interactive investor asked platform consultancy the lang cat to compare flat fees levied on interactive investor’s Pension Essentials and Pension Builder plans with SIPP plans offered by its largest competitors, which adopt percentage-based charging.

interactive investor charges a flat fee, which means you get to control your costs and keep more of your wealth, even as the value of your portfolio increases, helping you reach your financial goals quicker.

The illustration below is based on a pension portfolio with 50% funds and 50% direct equities (or investment trusts), with two fund trades and two equity trades, as well as 12 regular equity trades and 12 regular fund trades.

Using the scenario above, a saver with a £50,000 pension pot would be charged almost three times more if they invested the same amount in the same way with Hargreaves Lansdown (which charges a percentage fee) than they would under interactive investor’s Pension Essentials plan.

In pounds and pence terms, this translates to an annual fee of £248.90 with Hargreaves Lansdown, over 2.8 times more than £87.84 with interactive investor.

The charges would snowball over the years as the portfolio grows. Under the same assumptions, Hargraves Lansdown customers with a £250,000 pension pot would pay over 4.5 times, or £615, more a year in charges compared to interactive investor’s Pension Builder customers (£786.40 for Hargreaves Lansdown vs £171.84 for interactive investor).

The difference in fees rises to over£1,177 for a portfolio worth £500,000 (£1,348.90 for Hargreaves Lansdown vs £171.84 for interactive investor).

Even those with relatively modest pension pots can benefit from the switch to flat fees. Someone with a £20,000 portfolio could save up to £26 a year, rising to £161 for pots worth £50,000 (under the same scenario).

Source: the lang cat. The yearly costs in the table assume portfolios of 50% funds and 50% equities with 2 fund trades and 2 equity trades per year, as well as 12 regular equity trades and 12 regular fund trades.

Alice Guy says: “The independent research shows that diligent long-term investors can make life-changing returns even from relatively ‘normal’ starting points. It also exposes the percentage-fee pricing gambit that has gone unchecked for too long.

“The top pension providers are struggling to compete with interactive investor’s incredible value flat fees and thousands of pension savers are voting with their feet and transferring their pension to interactive investor.

“Percentage fees take a bigger and bigger bite from the cherry as your pension wealth grows, meaning you are actually being penalised for regular investing and good performance. In contrast, interactive investor’s flat pension fees mean that you will pay the same amount in platform fees, whether your pension wealth is £60,000 or £650,000.

“It’s worth remembering that transferring your pension won’t be right for everyone. Older pensions taken out before April 2006 include an option to take more than 25% as a tax-free cash lump sum. Other older plans can come with guaranteed annuity rates (GARs) that are higher than those currently available on the annuity market. So, there’s some weighing up to do.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.