An easy company to love in a terrifying industry

The challenge facing this business is awesome, but our companies analyst rates the shares a 'buy'.

24th May 2019 15:46

by Richard Beddard from interactive investor

The challenge facing this business is awesome, but our companies analyst rates the shares a 'buy'.

News that Next (LSE:NXT) is to host "click and collect" counters for Amazon (NASDAQ:AMZN) customers in its retail stores could be read two ways. It could be a sign of weakness, that the fashion and homeware retailer is so desperate to get people into its flagging stores it will even service a rival's customers. Or it could be a sign Next is facing up to the future - recognition the store network is no longer the centrepiece of its strategy, but remains an asset that must be repurposed to service an online business that already earns the majority of revenue and profit.

Next's annual report gives investors many reasons to be confident it is facing the future, and just as many reasons to be nervous because the future it is preparing for is so radically different from the past.

Retail stress

Stress testing has become a feature of Next's reporting as the company seeks to explain the challenges it faces as business shifts to the Internet. Its model peers 15 years into the future and shows what might happen if store sales fall 10% a year, and online sales grow 7.5% a year, a scenario that is somewhat more pessimistic than Next's current rates of growth and contraction.

In the not-too distant future the stores would go from being a source of profit to a net cost, servicing a much bigger Internet business. That business would be profitable, and generate £12 billion in cash over the period. By the end of the period it would operate little more than half the number of retail stores it operates today.

The expansion of Next online and the mooted contraction of its store network (it is not actually contracting yet in terms of square footage) is old news and the stress-test a refinement of last year's stress test. More remarkable are the changes going in within Next to facilitate this change.

While Next as a whole has not grown recently, two parts of it are growing rapidly. Label, which sells other brands through Next's website has grown into a £400 million business. Overseas online sales have grown into a £350 million businesses. The figures are small in comparison to Next's total revenue of over £4 billion, but profit margins are decent, and these newer businesses are a big part of the future.

When Next started Label the idea was to sell brands that did not compete with Next's own clothing brand, like upmarket Barbour, but in terms of fashion it has never been clear where Next draws the boundary between friend and foe. Label stocks a growing number of High Street brands like Superdry (LSE:SDRY), Oasis, and French Connection (LSE:FCCN).

In this year's annual report, Next has made it crystal clear. There are no boundaries. It intends to stock direct competitors:

"Our view is that we cannot shield customers from other people's products online, eventually they will find them, one way or another. Preventing our competitors trading on our website could, at best, slow down the advance of competition but it only puts off the inevitable."

The growth train departs from platforms 1 to 5

The word "platform" first appears in last year's annual report, where Next talks, as so many companies do, about its online platform. This year, though it is much more explicit. Next is becoming a platform business, putting its capabilities at the service of rival brands.

It is using its warehouses and network to stock and fulfil online sales of rival brands, and integrating its systems with their warehouses. It beguiles us with the notion that the distribution network may only be one "platform layer". The other four are its digital marketing and website capability, its huge finance business nextpay, and large customer bases in the UK and overseas, perhaps it proposes to put these to use earning profit for other companies too.

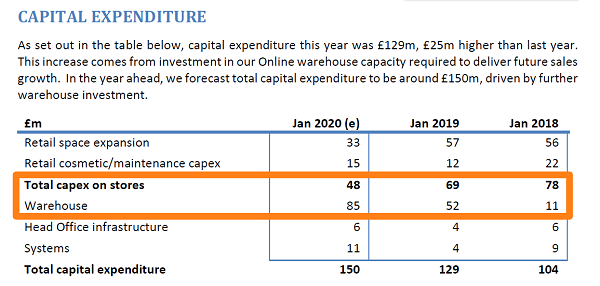

It is impossible to overstate the awesomeness of the challenge ahead. Only three years ago Next admitted to having fallen behind its best online competitors in terms of distribution and online marketing, and although it is investing heavily in its warehouses and website technology, it still says it has much to learn.

Source: Next annual report, year to January 2019

As a retailer in a competitive market Next has always had to give something back to customers in terms of competitive prices, but it is preparing for a new level of financial restraint. Gone is the notion of maximising profit. The new mantra will be to share it. It says once it has achieved profit margins of 16% (which it is), it gives any surplus back to Label customers and partners. Last year, it reduced the commission it charges to partner’s brands. Next wants to be their most profitable sales channel, more so even than their own stores and websites.

In the competitive Internet environment the spoils go to the most efficient, and Next will have to be very efficient if it is to maintain 16% profit margins while rivals are prepared to work for less.

The future Next describes is Darwinian, but warehouse automation and digital marketing are not major parts of its DNA so it has been incubating these capabilities, genetically engineering, you might say, its business model. Over a longer period, arguably, its ability to adapt, is proven. Next Directory, the wildly successful catalogue operation started in 2003, morphed into Next Online, which now earns the majority of revenue and profit and gave Next a head start on the Internet. A trial to sell sportswear in 2006, evolved into Label, an important part of the future of Next Online.

Survival of the fittest

Next actually describes the way it works in evolutionary terms:

"..improvement that comes from a myriad of independent experiments, most of which fail but some of which succeed."

By sticking with the successful experiments it does a lot of things really well. The thrilling thing about Next is we can see this in the way it communicates with its staff and shareholders through its annual report.

Next shop windows are different too. My local Next is located right next to Marks & Spencer (LSE:MKS) and the difference is quite literally light and shade.

At Christmas, Next fastened speakers onto the inside of its windows piping carols onto the pavement. It puts prices on the mannequins in the window display. Internet rival ASOS (LSE:ASC) has got into spat with customers about returns, which are all too routine in some cases and expensive for the company. Next quietly and efficiently receives 80% of returns through its store network.

But shareholders in Next are chasing a moving target that is pinned on a restless competitive landscape. Scoring Next is nigh on impossible, and, to be honest, an ongoing project...

Does Next make good money?

The company reported a strong first quarter in May, but says it is too early to change full-year estimates of very modest growth. For the last three years revenue has been flat, and profit under pressure, but Next remains highly profitable and cash generative.

Score: 2

What could prevent it from growing?

It is not growing! The Internet is weakening the brand and nullifying the value its prime locations, which means Next must fully embrace a future online. The challenges are awesome.

Score: 0

How will it overcome these challenges?

The good news is Next already earns most of its sales and profit online, but to thrive it has decided it must sell other brands. The change in mindset is extreme but not sudden and provides clarity: It must reduce store costs, invest in its warehouses and websites, and become more international. In all of these regards, it is performing well.

Score: 2

Will we all benefit?

Yes. Next has immenself experienced management led by Lord (Simon) Wolfson, who has a substantial shareholding. It is very good at communicating with shareholders and staff, encourages staff to own shares, and is continuously evolving to give customers what they want.

Score: 2

Are the shares cheap?

At just shy of £56, the debt-adjusted price/earnings (PE) ratio is 16.

Score: 1.2

Next is an easy company to love in a terrifying industry. The challenge is awesome and the company's response is awesome too.

I feel rather small in the glare of this awesomeness, and full of self-doubt. But a score of 7.2 out of 10 suggests Next might be a good long-term investment.

Richard owns shares in Next.