Eight trusts that are true dividend heroes

5th October 2018 15:13

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Our analysis has uncovered the trusts which have generated a solid income through thick and thin - without compromising other aspects of performance.

We can be heroes

William Sobczak, analyst at Kepler Trust Intelligence

Income has for a long time been top priority for British investors, stripped of the traditional source of income that a savings account once represented by a decade of negligible interest rates. But with bonds in a parlous state and the wheels finally coming off the buy-to-let bubble, the range of options available is increasingly narrow.

Equities have for some time now been the beneficiary of this search for yield and equity income funds have done very well on the back of this, attracting huge inflows. However, as we have highlighted in the past, many of them are investing in just a small range of companies and those companies are themselves increasingly stretching for yield - putting this refuge for the income seeker on somewhat thin ice.

With all this behind us, and mounting uncertainty about the current rally in front of us, where then is a sensible place to find it?

Bonds, bricks and other broken models...

The 'go to' for investors looking for income in previous years has been bonds. However, as can be seen in the chart below, the past 10 years have seen bonds in the UK - in this case 10 year government bonds - continue to offer historically low yields. Income investors are faced with the worst of all possible worlds - a fixed (low) income and almost certainty that they will lose capital, given that most bonds (and bond portfolios) are trading above par.

The only exception is, of course, floating rate bond funds. As we have highlighted in a recent update, NB Global Floating Rate Income Fund invests in senior secured floating rate loans, offering investors access to a low duration fixed interest portfolio with the potential for stable or rising income even in a rising interest rate environment. The quarterly dividend has seen a significant step up this year as LIBOR increases feed through with a lag, and more could be to come.

UK Government 10 Year Bonds

Source: Trading Economics Past performance is not a guide to future performance

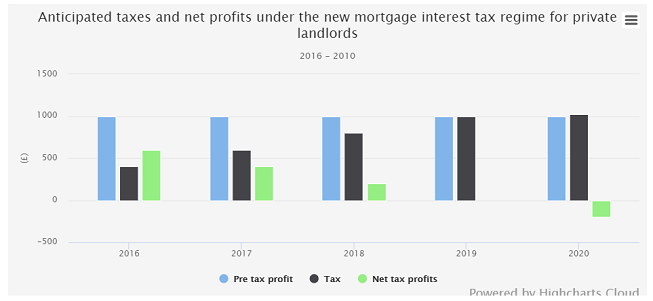

As an alternative to bonds, another common choice for investors looking for a dependable income is to invest in the buy to let market. Should one have the capital available, over the past ten years investors have enjoyed plentiful returns at rates far greater than inflation. However, changes to tax and regulation over the past two years have made the environment far less hospitable. In particular, the introduction of a 3% additional charge of stamp duty for second home buyers has had a huge impact on the profitability of a property portfolio.

Additionally, the reduction in the tax relief landlords can claim, as well as a tightening of mortgage lending rules, has impacted the income that an investor can receive. As shown below, the growing impact of the tax burden on buy-to-let properties is making this a far less attractive avenue.

Could this be the end of Kirsty and Phil?

Source: Shawbrook Bank – The current buy-to-let market

Alongside reduced income, there is uncertainty surrounding the impact of Brexit on property prices. The UK housing market slowed again last month, and saw the largest monthly drop in prices since July 2012, according to Nationwide's latest house price index.

As one might anticipate, prices in London have been hit the worst and are expected to fall by 1.6% this year and 0.1% next year, according to a Reuters poll of about 30 analysts. Across the rest of the country, the average price of a home in August was £214,745, down 0.5% from £217,010 the previous month, while annual growth slowed to 2% from 2.5%.

Now what?

A common starting point for many equity income investors is the AIC Dividend Heroes list. To achieve this accolade, investment companies need to have increased their dividends consecutively for 20 years or more. This is no mean feat, and currently only 21 trusts have been able to achieve it.

Looking at the full list, there are some heroes that aren't perhaps that heroic (for an income investor) after all. Scottish Mortgage - whilst nobody is questioning its excellence as a growth fund - is a prime example. The managers have achieved an impressive 35 years of dividend rises, however, a yield of 0.7% makes it an unlikely choice for income investors.

In other cases, the opposite problem occurs; consecutive dividend increases are often achieved at the cost of growth. Merchants Trust for example, has also achieved 35 years of dividend increases and is currently yielding over 5%. However, in NAV total return terms it has trailed the UK Equity Income peer group dramatically over the past five (c.15% underperformance) and 10 years (c.45% underperformance), suggesting that the managers are too focused on the dividend and achieving a high income, when perhaps they are neglecting the capital side of the total return equation.

We believe that investment trusts are a great place for income-seeking investors. Indeed, a vast proportion of the recent inflows into investment trusts have been due to the income benefits the structure allows for.

Investment trusts are a suitable structure for income investors, then, and with that basis as a starting point we decided to look at the whole investment trust universe and identify those which - in our view - stand out as true dividend 'heroes'.

Criteria

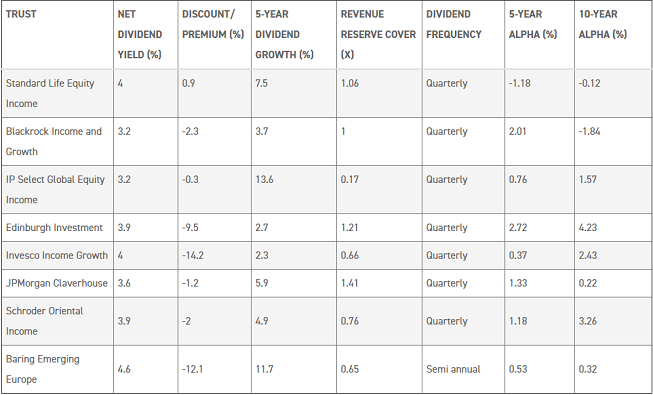

As we allude to above, delivering only a rising income doesn't confer heroic status. There are many other factors to consider – but for us, the most important aspects to include in our analysis were the current yields, revenue reserve cover, and the overall performance of the trust relative to its respective benchmark.

Alongside these factors, we also took the dividend growth, the dividend frequency, and the current discount/premium into consideration, as well as the likely volatility of the discount going forward.

Most categories were measured against the FTSE All-Share average, or relative to a more comparable benchmark. For example, when assessing the current net dividend yield, we compared each trust to the FTSE All-Share average of 3.78%.

However, whilst evaluating the alpha of the trust, we used the Morningstar best fit index. Additionally, we used economic indicators to compare the trust's data, for example while looking at the trust's five-year dividend growth, we compared the performance relative to the relevant rate of inflation.

Unsurprisingly, the majority of the most attractive trusts are included within the Global Equity Income Sector and the UK Equity Income Sector, although we also found attractive opportunities in the Emerging Markets and Asia Pacific sectors.

From our quant and qualitative screen, we identify eight trusts that stood out across the metrics as 'true dividend heroes' - three of which also appear in the AIC's list.

Real Dividend Heroes

Source: Kepler Partners, Morningstar

JPMorgan Claverhouse

JPMorgan Claverhouse has gained a well-established reputation for offering investors consistent and growing dividends, through investing in income-gearing companies within the UK. Run by William Meadon and Callum Abbot, the trust has often been referred to as a "get rich slow" fund, targeting an attractive yield while aiming to outperform its benchmark index, the FTSE All-Share, by 2% a year.

This was one of the stand out trusts throughout our analysis, and the trust performs strongly across most of our key 'safe yielders' metrics. With a robust yield of 3.6% (3.54% over the past 12 months), the trust has managed to grow its dividend by close to 6% over the past five years. This is 2% greater than the average in the FTSE All-Share.

Another key attribute for JPM Claverhouse is the revenue reserve. With last year's dividend 1.41x covered by the revenue reserves, the trust has offered one of the greatest margins of safety in the investment trust universe. There is no doubt that maintaining deep revenue reserves has helped the trust increase its dividend consecutively for over 45 years. This exceptional track record has helped the trust gain the coveted title of an AIC hero.

Edinburgh Investment

Edinburgh Investment Trust is another trust with a portfolio comprised of predominantly UK stocks. The manager Mark Barnett, a legend within the investment trust universe, utilises a value approach to picking stocks, taking a contrarian perspective on many companies, sectors and themes.

The aim of the trust is to outperform the FTSE All-Share on an NAV basis, while providing an attractive dividend that grows faster than inflation. In NAV terms, the trust has delivered above and beyond that goal, returning close to 60% over five years (16% outperformance), and c.170% over 10 years (c.65% outperformance).

In dividend terms, the trust again has exceeded its objectives. Currently yielding 3.9%, the trust has achieved a five-year dividend growth rate of 2.7%, relative to the five-year CPI inflation rate of 1.5%. The revenue reserves on the trust also stand out, with the last full-year dividend covered by the revenue reserve 1.21x. This helps to give investors confidence that the dividend will be able to continue to grow at a progressive rate.

Although the discount has narrowed slightly in recent times to (-7.8%), it is still wider than the sector average of -3.8%.

Invesco Income Growth

Invesco Income Growth is another trust, similar to Edinburgh Investment Trust, that aims to produce above-inflation dividend growth, but also capital growth in excess of the FTSE All-Share.

The manager, Ciaran Mallon, runs the portfolio conservatively, aiming to add alpha through active stock picking and meticulous analysis of company balance sheets. Ciaran does not like to speculate on the macro environment, and the result is a trust that is well spread across sectors.

The manager has achieved the first goal of growing income extremely well, justifying its position in our safest yielders top picks. Currently yielding 4%, the trust has grown its dividend at a rate of 2.3% over the past five years, 0.8% greater than the five-year average CPI rate of inflation. Adding to this, the trust has desirable revenue reserves, currently covering the last dividend.

The trust lagged a bull market in 2016 and 2017, which makes its three and five-year performance numbers look poor, but 2018 has been a much better year so far. This has meant that despite the performance in 2018 being greater than the sector average, the discount has continued to widen. Currently, the discount sits at 15%, making it the cheapest in the UK Equity Income sector.

BlackRock Income & Growth

BlackRock Income and Growth sits in the UK Equity Income sector, but has twin aims of providing a rising dividend and growth in capital over the long term. The managers have an over-riding focus on earnings and free cashflow, aiming to select companies which in their view have business models that enable strong progression in both. For the team, free cashflow is the fundamental backdrop for sustained dividend growth. They don't want to see portfolio companies paying dividends "at all costs", as they believe this will be at the expense of future growth.

Given the managers' philosophy rests on the bedrock of finding companies which will generate high and sustainable levels of free cashflow, they say they would be disappointed if they held too many stocks which had unexpected dividend cuts. Indeed, an analysis we reproduced in our last update on BRIG showed that during 2017, the team only held three out of the c. 20 stocks that cut their dividends that year.

This year appears to be panning out well again in income terms, with the trust's revenues up 8.8% over the same period last year at the time of the interim results (30 April 18). This is in-line with their prior track record on revenue generation, and we calculate that the team has generated earnings per share growth of 8.7% per annum since they were awarded the mandate.

The team believes that this is testament to their focus on cash generation, robust balance sheets and trusted management to ensure the long-term sustainability of the dividend. As a result, since 2012 the board has been able to pay a rising level of dividends, delivering a compound annual growth of 4.7% and, at the same time, building up revenue reserves, which (as at the last report and accounts) constitute a year's dividend (6.6p per share). This means that the board has plenty of room for manoeuvre should the portfolio suffer an earnings shock.

Standard Life Equity Income

The objective of Standard Life Equity Income is to deliver investors above-average income, while also providing real growth in capital and income for investors. This is achieved by investing in a diverse range of stocks and sectors, consisting mainly of quoted UK equities.

One of the key features of this trust is its income profile, which has been carefully managed since Thomas Moore took over the portfolio is 2011. Currently, the trust is yielding 4%, 0.3% greater than the weighted average in the sector.

The trust has a strong long-term track record of dividend growth, never cutting the dividend since inception in 1991. What's more, this year will be the 18th consecutive year the trust has increased its dividend. Over the past five years the trust has grown its dividend at a rate of 7.5%, the fourth-fastest rate of the 28 trusts in the sector. However, Thomas admits that he and the board have had to be patient over recent years, as he rotated the portfolio to its current unconstrained form and built up the once depleted revenue reserves.

The last full year dividend was 1.1x covered by earnings, and the board had amassed a revenue reserve cover of 0.83x. Putting this into perspective, the revenue reserve cover was 0.6x when Thomas took charge.

IP Select Global Equity Income

The aim of IP Select Global Equity Income (IVPG) is to achieve a growing level of income return each year, with capital appreciation over the long term, through a concentrated but diversified portfolio of global equities. The trust actively uses the unique advantages of the closed-end structure to do this, and what particularly stands out is the trust's willingness to smooth pay-outs through capital.

The portfolio is relatively concentrated and is currently comprised of close to 50 stocks. The management team search for high-quality companies at attractive valuations, offering attractive yields, sustainable income and capital upside.

Currently, the trust yields a handsome 3.2%, and trades just below par. The stand out attribute across the matrix is the five-year dividend growth, which at 13.6% is almost double the amount of any other of the recommended trusts. Over the same period, the trust has generated strong levels of alpha, and this is true over a ten-year period also.

Schroder Oriental Income

Schroder Oriental Income owns a portfolio of around 80 stocks held across a diverse range of countries and sectors across the Asia Pacific region. The bulk of the funds are invested in emerging Asia, but the trust also invests in Australia and has a small but significant weighting in Japan. The trust therefore offers attractive diversification of income to UK investors.

The trust has a total return objective and aims to outperform the index with a bias toward higher quality more mature companies. However, providing a growing dividend is a priority, and the trust has done so for the last 11 years, with the dividend covered each year. Over the past five years dividend growth has been a shade under 5%.

The trust currently yields 3.9%, putting it among the highest earners in the sector and on a comparable footing with many UK equity income focused trusts. The board have a sizeable revenue reserve of 0.76 times the last dividend to draw on should portfolio earnings disappoint.

Matthew pursues a conservative approach which, combined with the trust's focus on income paying stocks, means it may be left behind during strong growth rallies – as it was in 2017 – but it tends to do better when markets stutter. The trust has outperformed the index by a considerable margin over the long term.

Baring Emerging Europe

Baring Emerging Europe aims to achieve long-term capital growth, principally through investing in companies whose revenues are expected to be derived from Emerging Europe. Currently the manager sees this area to be amongst the cheapest on a global basis, and is finding plenty of opportunities with attractive growth prospects.

Offering a yield of 4.6%, the manager employs a high-conviction stockpicking approach and has a proven track record of outperformance. BEE has beaten its benchmark in six of the last eight years, all the while growing its dividends at an astonishing rate of close to 12% (over the past five years).

The trust makes full use of the structural benefits of investment trusts, and has built up a decent revenue reserve cover of 0.65x. Additionally, in 2016 the board decided to allow income to be paid from capital, and this facility helped pay a large proportion of last year's dividend.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.