Energy funds are running out of steam

28th November 2022 13:54

by Douglas Chadwick from ii contributor

Saltydog Investor considers the prospects for energy funds as oil falls back to its pre-war price.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

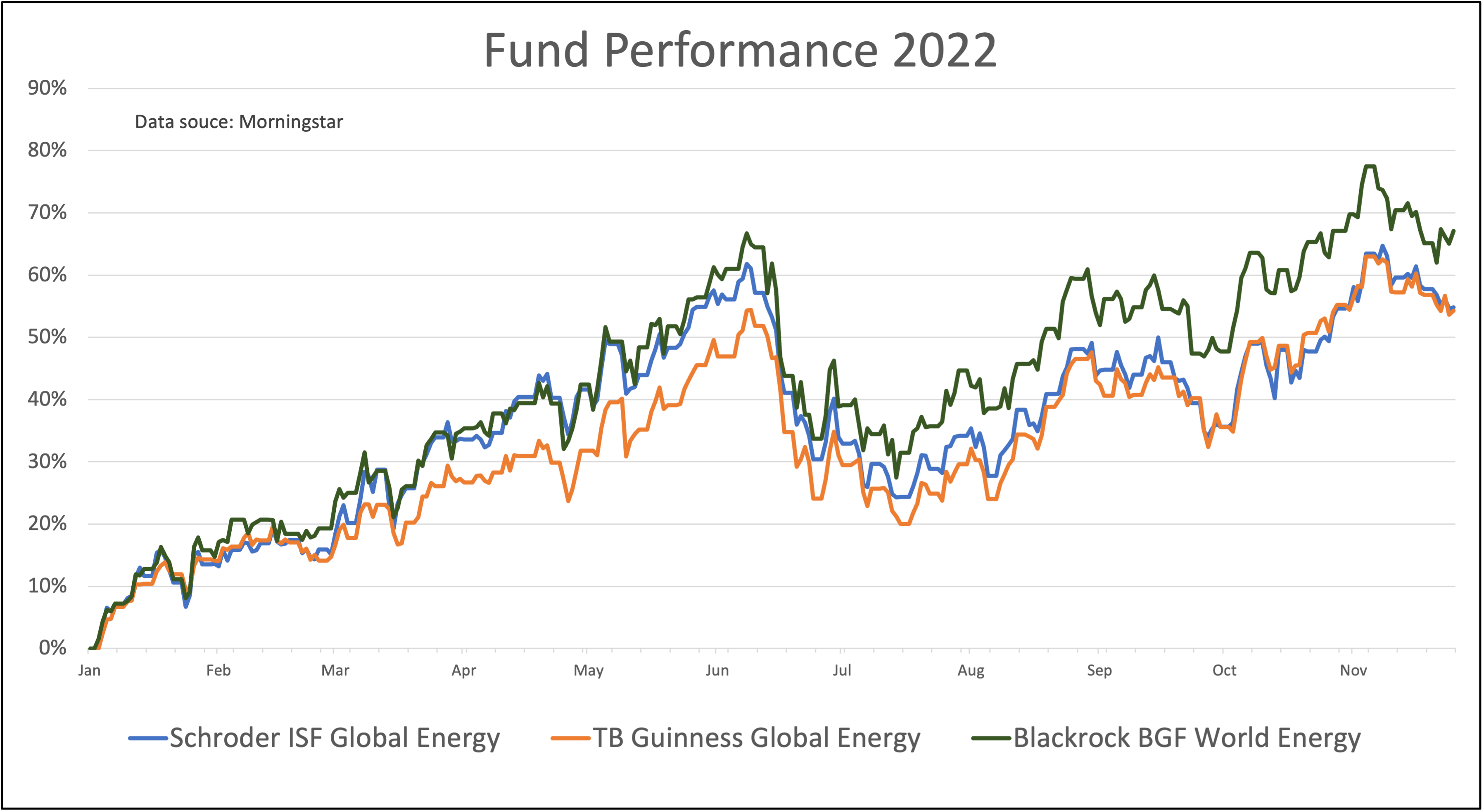

Funds investing in energy have had a good year and are currently showing year-to-date gains of more than 50%. This is pretty impressive when you think that most funds have fallen in value.

The reason why they have done well is relatively straightforward: demand for oil and gas has been increasing as economies have emerged from the Covid lockdowns and at the same time supply has been limited, in part due to the war in Ukraine.

I have written about these funds on several occasions, the last time was about a month ago. At the time, some of the funds from the Commodity & Natural Resources sector were sitting at the top of our Specialist table.

In our weekly fund analysis, we group together sectors that have had similar levels of volatility in the past. The least volatile sectors, the Money Markets, are in our “Safe Haven” Group, then as the volatility increases we have the “Slow Ahead” Group, then “Steady as She Goes” and finally the “Full Steam Ahead” and “Specialist” groups.

Specialist used to be just one sector that catered for funds that did not naturally fit into any of the other sectors, however last year the Investment Association (IA) created some new sectors for funds that had previously been in either the Specialist or Global sectors. We now group the Specialist sector with the thematic sectors, Latin America, India/Indian Subcontinent, Infrastructure, Healthcare, Finance & Financial Innovation, and Commodities & Natural Resources.

- Ten growth funds the pros have been sticking by despite style rotation

- The big risk fund managers are braced for in 2023

At the end of October, the leading fund in this group was BlackRock BGF World Energy with a four-week return of 12.2%. The next three funds were TB Guinness Global Energy, BlackRock Natural Resources, and JPM Natural Resources. They were all in decile one over four weeks and either decile one or two over 12 weeks.

Since then they have dropped down our rankings. Although when we looked last week they were still in the top two deciles over 12 weeks, they had not done so well over the previous four. The BlackRock BGF World Energy fund had moved from decile one to decile nine. This is what they look like now.

Specialist & Thematic Sectors

| Fund | SubZone (If Applicable) | 4 Week | 12 Week | 26 Week | ||||

| Decile | Return | Decile | Return | Decile | Return | |||

| BlackRock BGF World Energy | Natural Resources | 9 | -0.1% | 1 | 3.6% | 3 | 8.8% | |

| TB Guinness Global Energy | Natural Resources | 6 | 4.1% | 1 | 7.0% | 2 | 12.7% | |

| BlackRock Natural Resources | Natural Resources | 6 | 4.2% | 2 | 2.4% | 4 | 4.5% | |

| JPM Natural Resources | Natural Resources | 4 | 5.7% | 2 | 3.2% | 4 | 5.3% | |

Data source: Morningstar. Past performance is not a guide to future performance.

At the beginning of October, OPEC+ announced that it was reducing its global output by two million barrels per day, and the price of oil had started to rise again, and by early November Brent crude was heading back towards $100 per barrel, up from around $85 at the beginning of September. We thought that it might have further to run, but that has not been the case. Over the past few weeks, the price has been falling and it is currently just over $80.

This has been reflected in the performance of the BlackRock BGF World Energy and TB Guinness Global Energy funds, from the Commodities & Natural Resources sector, and also the Schroder ISF Global Energy fund, which is still in the Global sector. Their largest holdings are still in the big multinational oil companies.

Past performance is not a guide to future performance.

We have invested in all these funds at some point this year, but at the moment have only a small position in the BlackRock BGF World Energy fund. If we do not see it pick up in the near future, then we will have to consider selling it.

There is still talk of an energy crisis, and the cost of fuel at the petrol pumps remains high, but it does not currently reflect the global oil price, which is back to where it was before Russia invaded Ukraine. The natural gas price is still higher than it was at the beginning of the year, but is around 30% lower than it was at its peak in August. Global energy prices could actually be coming down.

The energy funds may continue to perform well, but I think it is unlikely that they are going to continue to go up at the rate that they did in the first six months of the year, and they could well have stalled for the time being.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.