F&C IT switches to defensive mode amid volatile markets

25th July 2022 10:50

by Kyle Caldwell from interactive investor

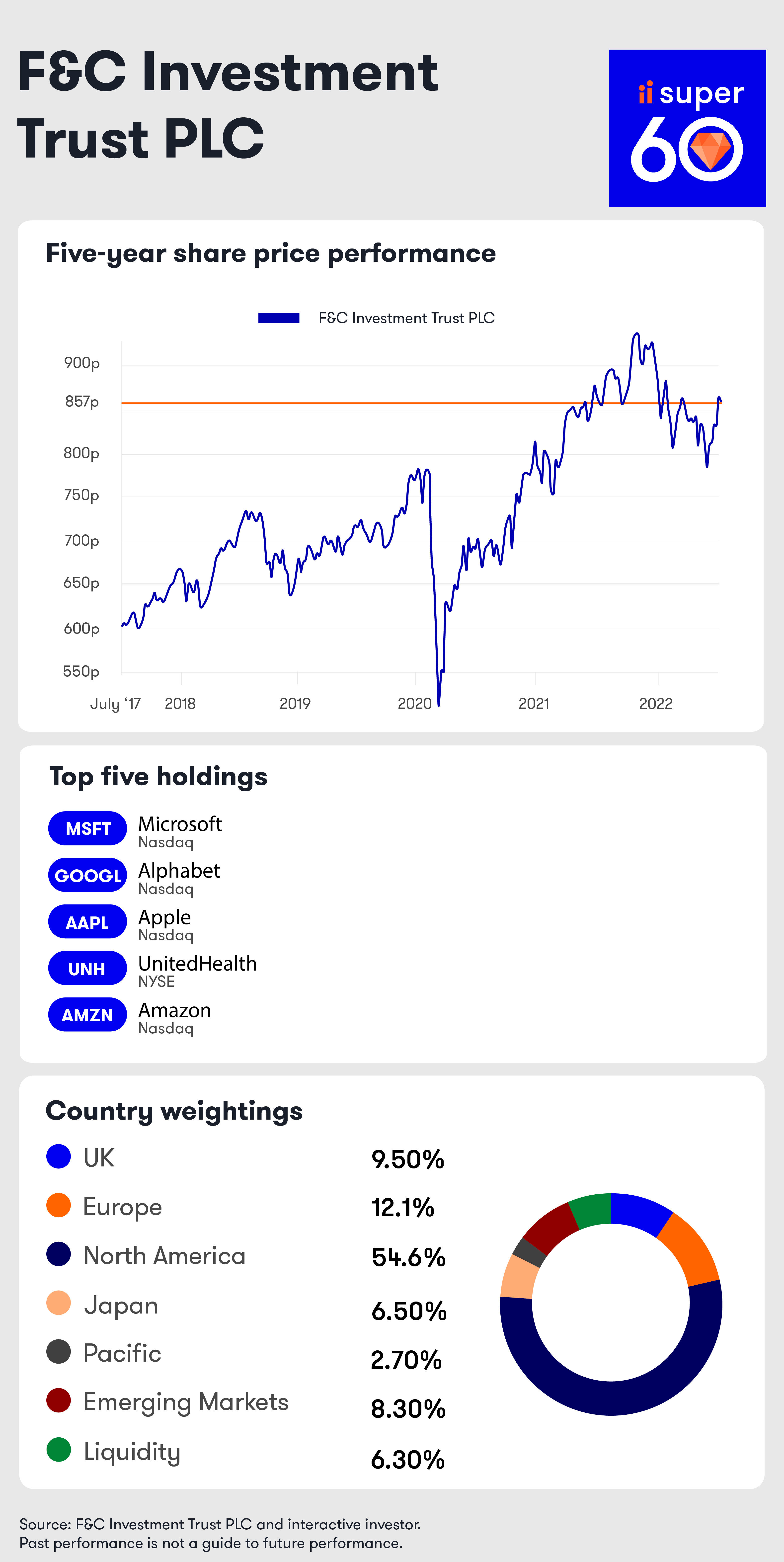

Britain’s oldest investment trust has been boosting cash levels and selling equities with high price tags.

F&C Investment Trust (LSE:FCIT) has been responding to volatile markets by boosting cash, along with cutting exposure to US shares and global smaller companies.

Britain’s oldest investment trust, which was established in 1868 and has a market capitalisation of around £4.5 billion, struck a cautious tone on the short-term outlook for markets. In its half-year report, released this morning, fund manager Paul Niven said that while “opportunities are emerging” markets are “likely to see further volatility in returns”.

He said: “With a relatively high holding of cash and diversified exposure across a range of different equity strategies, we believe that the company is appropriately positioned for the difficult market conditions that we expect.

“Given our longer-term perspective, we expect to be in a strong position to take advantage of investment opportunities as they emerge and to benefit from a recovery in equitymarkets in due course."

Niven said “substantial reductions” have been made to “more expensive parts of the equity market”, predominately US larger company growth shares. He has also sold out of global smaller company shares on the grounds that such companies “are less likely to perform well in an environment of rising inflation”.

Cash has been increased by almost £300 million (from £53 million at the start of the year to £352 million), and gearing levels reduced. Niven explained: “Some of this (cash) increase reflects the funding of our £140 million private placement notes and we will use some of the proceeds to pay down a seven-year euro denominated loan of €72 million (£61 million) in July.

“Nonetheless, the effect of our allocation changes was to reduce our net gearing levels to 6.5% with debt at par and 4.3% when we adjust for the fair value of our debt.”

- Battle of the big three multi-manager trusts: who comes out on top?

- Looking to invest a £1,000? Watch our video

- Top investors share their biggest investment lessons

In terms of opportunities, Niven has been turning to higher yielding stocks in anticipation of “better performance to be driven by relative valuations from this area”.

In the six-month period to the end of June, F&C Investment Trust posted a net asset value (NAV) loss of 9.6% versus a loss of 10.7% for its benchmark, the FTSE All-World Index.

The share price return was –11.8%, due to a widening of its discount from 7.3% to 9.6% over the six-month period.

The trust, which is a “dividend hero”, looks set to keep raising income once again for shareholders, although it flagged that it will need to tap into its reserves.

The half-yearly report noted: “Despite a strong recovery from the pandemic, there remains significant uncertainty with respect to our full-year income but, at this point, it is unlikely that our earnings will cover the full-year dividend payment to shareholders.

“Therefore, as was the case in 2021, we expect to fund a proportion of the annual payment from our revenue reserve, which continues to represent over one year's worth of annual dividends.”

Beatrice Hollond, chair of the trust, said: “The board intends to increase dividends in real terms for shareholders over the long term and our current aim is to raise our dividend again this year. If we do so, this will be the 52nd consecutive rise.

“Whilewe expect that the immediate outlook will continue to present a challenge, our portfolio is sufficiently diversified to provide protection from over-exposure to any one themethat is driving markets."

- The investments that will keep growing – even during a recession

- Watch our video on how to invest £10,000

- Reasons why the bear market is far from over

F&C Investment Trust is one of three global multi-manager trusts that offer a one-stop shop for investing, along with Witan (LSE:WTAN) and Alliance Trust (LSE:ATST).

All three aim to provide long-term growth, as well as being Association of Investment Companies (AIC) “dividend heroes”, having raised their dividends every year for more than 20 years.

F&C is the most diversified of the three, with around 400 holdings. Typically, 10% is in unquoted securities.

The trust is a member of interactive investor’s Super 60 list. Niven is responsible for the asset allocation and level of gearing. He divides the portfolio into a range of global and regional strategies.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.