The first fund we’ve bought since the crash

Saltydog analyst has just dipped his toe back into the markets. Here’s the thinking behind his decision.

6th April 2020 12:08

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst has just dipped his toe back into the markets. Here’s the thinking behind his decision.

Stepping back into the markets

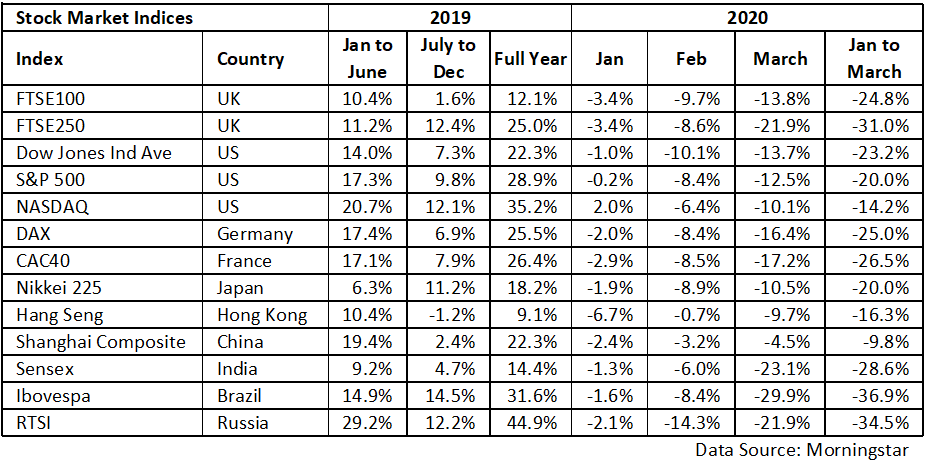

I'm sure that it will come as no surprise that March ended up being one of the worst months on record for global equity markets. Nearly all the major stock market indices that we track saw double-digit losses - the exceptions were the Shanghai Composite, down 4.5% and the Hong Kong Hang Seng, down 9.7%.

In the first three months of the year, the UK’s headline index, the FTSE 100, has fallen by 25%, and there are plenty of other indices down by 20% or more.

On a more positive note, the month finished much better than it started. In the last week of March, the FTSE 100 went up by 6.2% and the FTSE 250 by 8.7%. In the US there was an even stronger rally. On the 24 March, the Dow Jones Industrial Average had its best day for nearly 90 years, gaining over 11%, and ended the week up 12.8%. The S&P 500 rose by 10.3% and the Nasdaq made 9.1%.

Unfortunately, many of these indices dropped back a little during the first week of March, but over the last fortnight they’re all still showing gains.

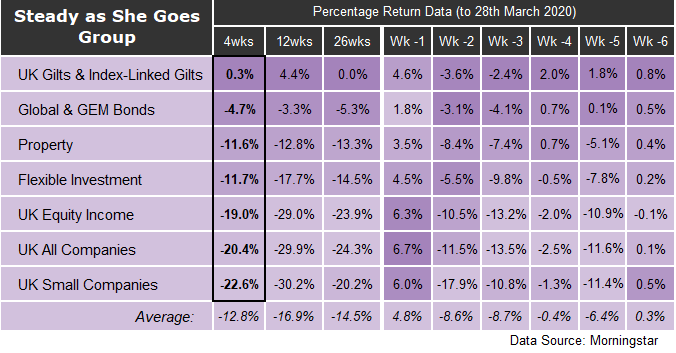

When we reviewed our sector analysis last week it also showed a pickup, with all sectors making gains in the previous week, something that we haven't seen for a couple of months.

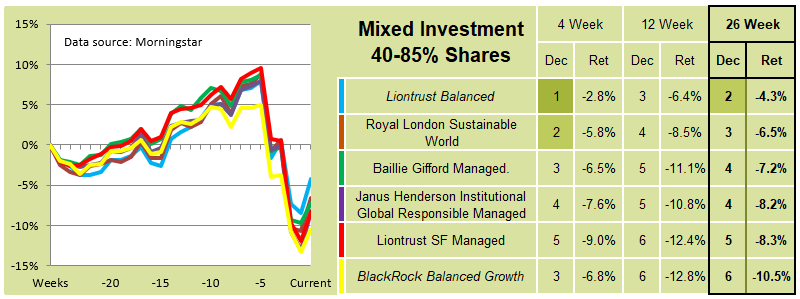

In our Saltydog 'Slow Ahead' Group, the Mixed-Investment 40-85% Shares, £ High Yield, and UK Equity & Bond Income sectors all went up by more than 4%. As is often the case, the sectors that fell the most have also seen the fastest recovery.

The same was true in the 'Steady as She Goes' Group. Although the UK Equity Income, UK All Companies, and UK Smaller Companies sectors were still at the bottom of the table, based on their four-week returns, they all gained at least 6% between the 21 and 28 March.

The sectors in the 'Full Steam Ahead' Groups didn't go up quite as much. The best, Japan, including Japanese Smaller Companies, went up by 4.6%.

Having sold most of our investments at the end of February/beginning of March, the next question is when to step back into the markets?

For the moment we are trying to imagine which sectors we will be invested into in 12 months’ time, that is assuming the world has moved on by then. I see no reason why technology funds in all their shapes and forms will not continue to be at the forefront, with biotech and energy funds leading the charge.

I also think it will be a mistake to ignore the “Greta” effect, and the desire of many people to improve the world's environment. Sustainability and good ethical governance are now mainstream issues, and there are funds that provide a good return for people wishing to invest into these areas.

At Saltydog, our demonstration portfolios were invested in three such funds for most of last year.

- Royal London Sustainable World Trust, which went up 30% in 2019.

- Liontrust Sust Future Managed, which went up 25% in 2019.

- Janus Henderson Institutional Global Responsible Managed, which went up 25% in 2019.

These funds also appeared in last week’s data tables.

Although they’re still significantly down on where they were a month ago, they have all picked up from the lows that they recorded on the 23 March.

After one good week, it is too early to say that things won't get worse again. We're still a long way from knowing when business will be back to normal and what the long-term cost to the economy will be.

However, at some point markets have to turn, and maybe the worst-case scenario has already been costed in.

In our most defensive portfolio, the Tugboat, we're still 100% in cash and will wait until we see a more sustained uplift before starting to reinvest. Then we’ll use the Japanese philosophy of taking small steps quickly, and no great leaps into the unknown!

However, in the Ocean Liner, which is slightly more adventurous, we have decided to dip our toes back into the markets. We've made a modest investment into the Royal London Sustainable World Trust, but still have more than 95% of the portfolio’s total value in cash.

Having sold relatively early we're significantly ahead of where we would have been if we hadn't made any changes, and we're willing to take a chance with a limited portion of our money. If markets fall further, we'll only lose a small amount, but, if they go up, then we'll be in a good position to start to add to our holdings.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.