Five popular star stocks: buy, hold or sell?

10th November 2021 09:03

by Rodney Hobson from interactive investor

These companies have all become household names and most have been great share tips. Our overseas investing expert tells us what he’d do with them now.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Third-quarter updates from United States companies generally continue to surprise on the upside. But despite the news pushing American indices to new heights, it is well worth looking at the latest announcements to seek companies with further genuine prospects.

The ill wind of the pandemic has brought a lot of good to pharmaceutical groups Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA), but investors should focus on how long the wind will blow.

- Invest with ii: Top UK Shares | Most-traded US Stocks | Open a Trading Account

Sales of Pfizer’s Covid-19 vaccine have exceeded expectations despite the challenging conditions under which it must be stored, so the group’s total sales more than doubled in the third quarter from $10.3 billion to $24.1 billion. More than half came from the Covid vaccine. Group pre-tax profits soared from $570 million to $7.8 billion.

- Why I’m buying ‘value’ stocks and other top tips

- Ian Heslop's outlook for the US stock market in 2022

- ii COP26 hub: see tips, news, comment and analysis from our experts

That is great while it lasts, but it is a concern when any company is heavily reliant on just one product, especially one that, we hope, will see demand drop off as the pandemic passes. In the short term, however, use of the vaccine could actually increase, since the US has just authorized its use for the 28 million American children aged five to 11.

Pfizer raised revenue guidance for the full year to more than $80 billion, nearly twice the level achieved in 2020, but expectations for non-Covid revenue will come in at the bottom end of the $45-47 billion range indicated previously.

Source: interactive investor. Past performance is no guide to future performance

The group’s overreliance on Covid treatments could actually become more pronounced as clinical trials for its pill to reduce hospitalisations and deaths have proved highly effective in high risk groups – much more effective that Merck’s (NYSE:MRK) pill, which was developed for influenza and is only 50% effective for Covid-19.

While Pfizer rightly hails its pill as a big step towards ending the pandemic, it is thus working hard to do itself out of business in the long term. Shareholders must hope that another blockbuster treatment can be found for some other ailment in the not-too-distant future to replace the Covid-19 bonanza.

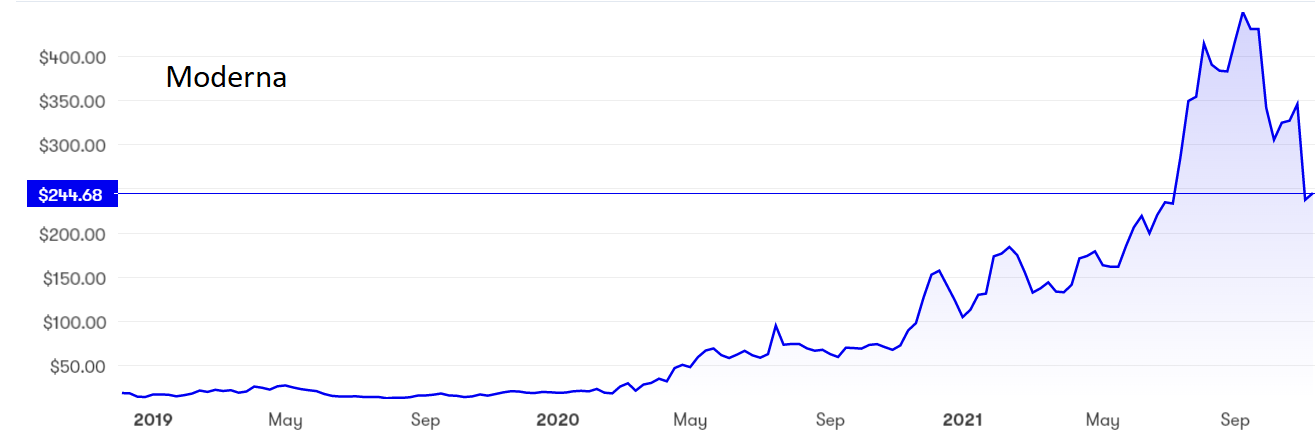

Moderna, in contrast, downgraded its forecasts for its Covid-19 vaccine, taking the shine off a swing from a group net loss of $233 million for the quarter last year to a net profit of $3.33 billion this time. The group is even more dependent on one product than Pfizer, since its Covid-19 vaccine accounted for sales of $4.81 billion out of a total $4.97 billion in the quarter.

Source: interactive investor. Past performance is no guide to future performance

Many investors took a punt on Moderna right at the start of the pandemic as it looked likely to beat rivals in producing a vaccine. Instead, it came third behind Pfizer and AstraZeneca (LSE:AZN). Shares are on the slide and, if the pandemic is brought under control next year, it is hard to see what Moderna can do to fill a yawning chasm in sales. Its flu vaccine has only just completed Phase 1 tests.

Avis Budget (NASDAQ:CAR) reported a 96% year-on-year surge in revenue, with net income multiplying 15 times from $45 million in the third quarter of 2020 to $674 million this time. Clearly some caution is required, as last year’s figures were heavily affected by pandemic shutdowns in various countries where Avis operates.

Such caution has not, however, been in evidence among investors who drove the share up 200% immediately after the figures were announced. Even when a dose of realism set in later that day, the shares had doubled. Avis shares bumped around the $40 level for four years before going into overdrive this year and now threaten to burst above $300.

The big attraction is a shortage of new vehicles for sale at a time when travel is coming back into fashion, forcing more drivers to hire. That situation is likely to last well into next year but, when the shortage of computer chips eases, probably in the second half of 2022, the position could well reverse. Meanwhile, Avis is improving its green image by considering offering electric cars for hire, although none have yet been ordered.

Source: interactive investor. Past performance is no guide to future performance

One further concern is that hedge fund SRS Investment Management, which has a 16.3% stake through direct holdings and equity swaps, could be tempted to take some profits. Now that the latest update has been released, a standstill agreement preventing SRS from selling shares is suspended.

Fast food chain McDonald's (NYSE:MCD) had such a great quarter that it increased its quarterly dividend by 7% and resumed its share buyback scheme. Clearly the ending of lockdown restrictions has helped, as net income was 22% higher than a year earlier at $2.25 billion and was way ahead of the $1.61 billion earned pre-pandemic in 2019. Revenue was 14% higher than in the comparable months of either 2020 or 2019.

- Bill Ackman: an industry as certain as food and oxygen

- Bill Ackman: why I've bet $100 billion on this event

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

McDonald’s is faring well across the globe and it has made price rises stick in its key US market, with customers willing to buy more at higher prices. Sales growth for the full year is expected to be close to 20%, with operating margins well clear of 40%, helped by the continuing introduction of new ranges.

The food is not to everyone’s taste and the restaurants lack ambience, but there is a great appetite for cheap and cheerful that McDonald’s continues to satisfy in increasingly varied ways.

Source: interactive investor. Past performance is no guide to future performance

On the surface, it looks as if customers have also been flocking back to Starbucks (NASDAQ:SBUX). In what was the coffee shop chain’s final quarter, the 14 weeks to 3 October, it reported record revenue up 31% at $8.15 billion. That was even better than the robust performance earlier in the financial year and allowed Starbucks to say it would spend $20 billion over the next three years on dividends and share buybacks.

Reaction to the figures was surprisingly subdued. Profits were heavily distorted by a $864.5 million gain from a disposal, but the underlying improvement from $442.4 million to $1.58 billion was still impressive.

The big worry is that Starbucks has lost staff and is now forced to raise wages, which will squeeze profits. It could come under greater pressure from American staff in the near future because 100 workers at three outlets are voting on whether to join a trade union. This could lead to widespread unionisation in a chain that currently has no union representation in the US. Previous attempts to set up union branches have failed but pressures caused by the pandemic, such as arguments with customers over mask wearing, and a tightening labour market could make the difference this time.

Source: interactive investor. Past performance is no guide to future performance

Hobson’s choice: The remarkable surge in Moderna shares took them to unsustainable heights and they have fallen back heavily. It is not too late to sell at a profit or cut losses, depending on when you bought. I would much rather hold on at Pfizer even though shares are at a record level, well above the $35 I tipped them at in January and August last year. Take profits at Avis. The shares have run up way too high and there could be a car crash ahead as life finally returns to normal.

I first tipped McDonald’s when the shares were below $200 and twice this year suggested they were still a buy below $237. They are now around $255 and still worth buying. Starbucks is worth holding on to at around $115, a profit of more than 50% since I tipped the shares in March. They have been as high as $128 in July and could well reach that peak again.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.