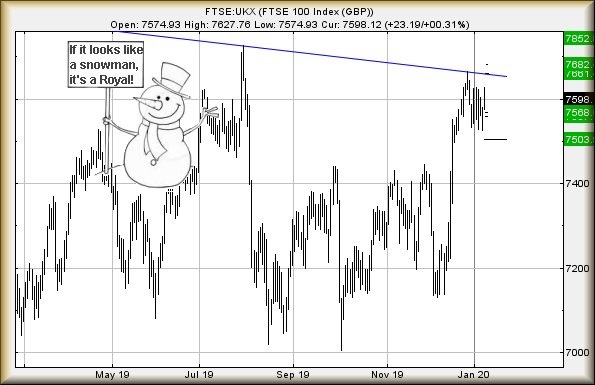

FTSE 100: A strange week, but 7,850 is still on

Largely ignoring Iran, investors are not panicking. Here's where our chartist thinks the index can go.

10th January 2020 09:06

by Alistair Strang from Trends and Targets

Largely ignoring the Iran issue, investors are not panicking. Here's where our chartist thinks the index can go.

FTSE for FRIDAY (FTSE:UKX)

By any standards, this has been a strange week. A combination of the markets, still not approaching decent trading volumes, along with this week's "Iran" headlines, gave a media impression the markets faces a meltdown.

Quite the reverse has happened. The FTSE 100 wants to reach 7,850 allegedly!

However, it's worth remembering (as if anyone could forget) this is January, traditionally a month packed full of contrary behaviour.

A month, topped off with The World Economic Forum (aka Ski Trip) in Davos, which often witnesses a dip in world markets prior to a surprise surge around the Davos event, and all sorts of exuberance during China's week long New Year holiday.

What has surprised (so far), is that events in Iran appeared to be providing a reasonable excuse for market reversal prior to the month end and Davos.

Instead, we've seen a series of pretty average days this week, followed by a Thursday which almost felt exuberant at times.

So, what's ahead for Friday?

Below 7,591 looks fairly troubling, apparently capable of reversal to an initial 7,568 points. If broken, secondary calculates at 7,557 points and this gets troubling, taking the UK index into a region where very little excuse is needed to crash it down to the 7,500 level.

If triggered, tightest stop is at 7,620 points.

The alternate scenario looks at the possibility of London trading above 7,634 points. Such a scenario apparently expects some growth to an initial 7,661 points.

If exceeded, secondary on the immediate cycle calculates at 7,682 points.

Visually, the initial target makes sense but the jury is out on the secondary, despite the longer term attraction from 7,850.

Despite this being the first complete week of 2020, market volumes are still rather low. Hopefully, next week witnesses some real flamboyance on the market.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.