Important information: Your money will be invested, and the value of your investments can go down as well as up. You may get back less than you invested. Additional product, transactional and platform charges will apply upon investment. We cannot provide tax or legal advice.

You can’t predict the future. But you can plan for it. Whether you want to make sure you’ve saved enough money or just want to check you’re on the right track, ii Advice can help.

Our team of expert advisers will help you manage your wealth, make smarter investment decisions, and feel confident with the path you’re on - all for a fair, flat fee.

It all starts with a friendly, no-obligation introductory call where you can ask questions and see if ii Advice is the right fit for you.

So when you’re ready, let’s talk.

After just a few video calls from the comfort of your own home, you won’t just have a plan for your money; you’ll have a plan for your life.

Whether you’re planning, approaching, or are in retirement, you want to know you’ve got the money to get you there - let’s help you prepare.

It’s not just about your future. It’s about your family’s future too. Make sure your money can help you support all your loved ones.

Rest easy knowing you’ve got a robust, stress-tested plan for whatever comes next. It’s like having a GPS for your life.

With ii Advice, you pay a fair, flat fee of £100 a month, providing personal recommendations and investment accounts based on your unique situation.

We’ll also recommend investments suited to your financial goals, which will have a separate investment fee. Together, this keeps our pricing as simple as possible.

Couples can plan for their future together for £150 a month. You can find out more about our pricing in our guide to ii Advice.

| Individual | Couple | ||

| Getting Started | Initial advice fee | £0 | £0 |

|---|---|---|---|

| Plan set up | £0 | £0 | |

| Ongoing | Ongoing advice fee | £100 per month | £150 per month |

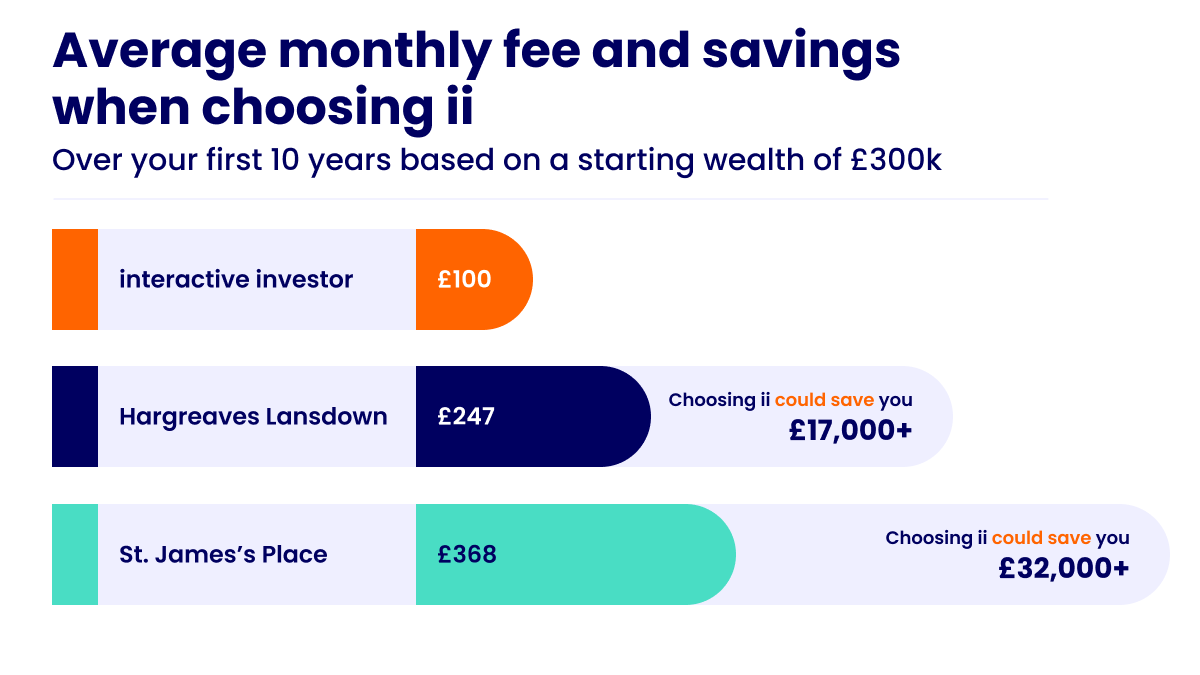

Many financial planning providers charge a percentage fee on your assets. That means the more you have, the higher your costs.

With our flat fee, our advice always costs the same, no matter the value of your investments. And that difference adds up over the years - potentially saving you £1,000s.

It’s clear, transparent pricing that can help you keep more money and reach your goals sooner.

Please note, this is only an estimate. Actual costs may vary depending on performance of underlying investments. Other services may offer a different scope of advice services and the option of in-person meetings.

How we calculated this comparison:

Average monthly fee includes initial advice charges, ongoing advice charges and platform fees, based on published charges as of November 2025 for Hargreaves Lansdown and St. James’s Place financial advice services. This projection does not include investment fees, which would be an additional charge. The calculations are based on an individual investor with a starting pension of £300,000, assume annual investment growth of 5.0% and have been adjusted for inflation, assumed to be 2.5%. ii advice and platform fees start at £100 per month and are assumed to increase with inflation.

How much you’re charged impacts your long-term financial planning. That’s why we do fees differently. Our flat fee means your advice will cost the same, no matter the value of your pot.

Modern financial advice requires modern solutions. Calls with our advisers are done over video, so you can fit them around your life and chat from your own home.

Our advisers are here when you need them. As well as helping to get your plan up and running, they’ll check in at least once a year to make sure it still suits your needs.

This is Justin. He has 30 years’ experience in financial services, helping people decide that next best step for them. Justin is part of our expert advice team dedicated to helping you create a plan for your life.

Our advisers aren’t only skilled professionals, but they’re also real people who care about building a clear picture of what your future financial position could be – and how to help you get there.

Talk to a friendly member of our team in a free, no-obligation call. Find out how we work, ask any questions you have, and decide whether our service is the right fit for you.

Once you’re ready, we’ll help you find a time for a video call with our advice team. They’ll help figure out what’s important to you and start shaping your financial plan to suit your goals.

Your adviser will build your financial plan and review it with you. Once you’re happy, they’ll put it into action – you can sit back confident that it’s all in hand. We’ll check in annually to make sure it’s still meeting your needs.

Everyone’s needs are different. If you’re looking for financial peace of mind and want someone to keep you heading in the right direction, ii Advice might be exactly what you’re after.

If this describes you, book your free call and let’s have a chat:

Your advice isn’t just supported by the experience of our advice team. It’s supported by ii’s long-standing history of helping investors make the most of their money.

We also draw on the heritage of our parent company, Aberdeen, so you benefit from nearly 200 years of financial expertise.

You can get a feel for what ii Advice is like with our free introductory call.

Book your call with our helpful Customer Support team; they’ll happily talk to you about your financial needs and give you plenty of time to ask questions. We want you to feel confident that we’re the right choice for you.

ii Advice is not independent, but our advisers are fully impartial. While we recommend investments offered by Aberdeen, of which we are part of, our advisers will only recommend solutions that are suitable for you.

They also aren’t paid more money based on how much you have with us. It’s the same no matter how much you have in your pot.

We’re happy to help anyone who wants a clear financial plan. But it’s not going to be for everyone.

| Who we're for | Who we're not for |

|---|---|

| Individuals and couples with straightforward long-term financial planning needs - normally planning up to, in to, and through retirement. | People with complex financial needs, including trusts, philanthropic endeavours, or complex investment vehicles like Venture Capital Trusts and Enterprise Investment Schemes. We're also not well-suited if you're only looking for an annuity or life assurance. |

| People aged 18 and over. | People under 18, companies, or trusts. |

| UK tax residents. | US citizens and non-UK tax residents. |

| People who want to meet their adviser through video chats in the comfort of their own home. | People who prefer meeting their adviser in person. |

| People who are happy to manage their advice online. | People who prefer a paper-based advice service. |

| People who want a straightforward, low-cost investment solution. | People looking for a complex, bespoke or sustainable investment solution. |

| People looking for an ongoing advice service. | People looking for one-off or transactional advice or looking to implement recommendations themselves. |

If you're unsure, just get in touch. We'll guide you through everything and help you work out whether we're a good match.

All ii Advice fees are collected monthly. The fee for your advice is simply taken from your underlying pensions and investments, giving you one less thing to worry about.

There is an investment fee that is deducted from the price of your funds on a daily basis. Your investments may also incur transaction costs as and when they occur. These are the costs of buying and selling assets within the fund itself.

We’ll show you an estimate of these before you decide to go ahead with your financial plan. And remember, there’s no upfront fee.

With ii Advice, we aim to keep your monthly fee as low as possible. The fee is made up of a few different aspects:

These make up your monthly fee of £100 for individuals and £150 for couples. Investment charges will also apply - for a more detailed look, see our guide to ii Advice.