The fund that’s caught our eye in this rising market

Saltydog Investor is paying close attention to Indian shares, as the economy grows and welcomes foreign investment.

29th August 2023 10:07

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Only three of the Investment Association (IA) sectors that we monitor managed to record one-month gains in May, June and July: the two Money Market sectors and India/Indian Subcontinent.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

We are not quite at the end of August yet, but so far it has been another challenging month. The Money Markets sectors have made further gains and some of the smaller bond sectors are also up over the month. However, most sectors are down, and the worst, China/Greater China, has fallen by 8.4%. India/Indian Subcontinent is the only equity-based sector that is ahead of where it was at the end of July, with a month-to date return of 0.9%

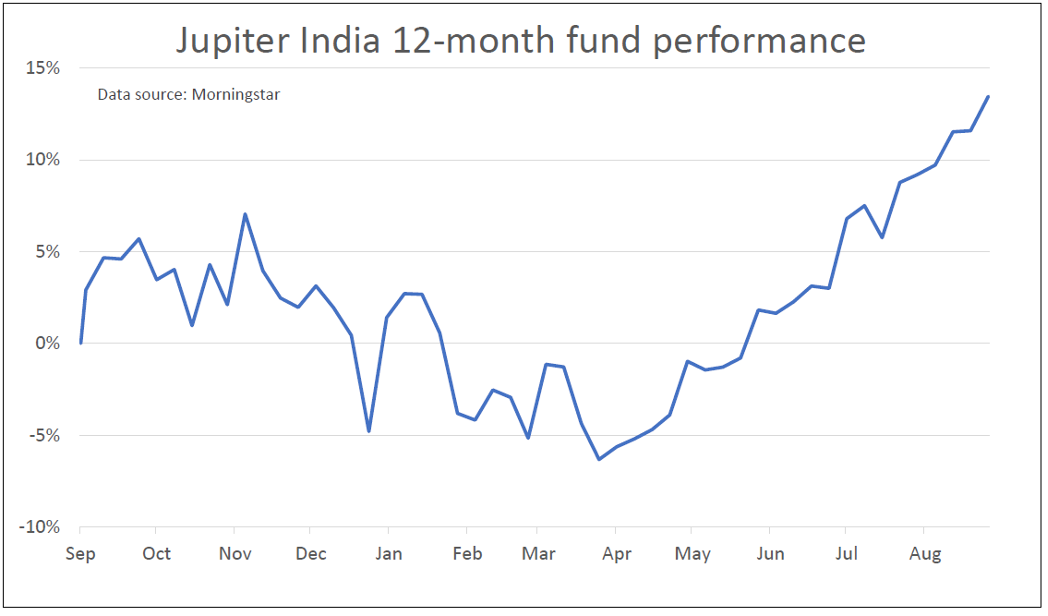

We track several funds that invest in India and over the past few months they have been more consistent than most. The best has been Jupiter India. When we looked last week, it was showing a four-week gain of 2.6%. It was up 9.6% over 12 weeks and 15% over 26 weeks. We were concerned that it might have got caught up in the general maelstrom that has affected most funds in the last few weeks, but it has been surprisingly resilient.

Past performance is not a guide to future performance.

Before “FAANG” (Facebook, now Meta Platforms Inc Class A (NASDAQ:META), Amazon.com Inc (NASDAQ:AMZN), Apple Inc (NASDAQ:AAPL), Netflix Inc (NASDAQ:NFLX), and Alphabet Inc Class A (NASDAQ:GOOGL)-owned Google) was the buzzword on Wall Street (now replaced by the Magnificent Seven), the BRIC economies were the talk of the town.

Just over 20 years ago, Brazil, Russia, India and China were identified as four economies best placed for growth. It later turned into the BRICS when South Africa was added.

At the time, they had various important things in common, including:

- Large populations

- A wealth of natural resources

- Rapidly expanding economies

It was clear that in the future they would transform the global economic landscape due to their potential for growth, and their political influence would increase.

Even now, the emerging markets offer tremendous opportunities as they are still forecasting growth rates as high as 7% to 8% and their economies are now more resilient. They no longer rely on cheap manufacturing, but now have enormous consumer markets of their own.

The problem for investors is that although they may do well in the long run, investing in these countries is not for the faint-hearted. The funds investing in them can be very volatile.

Over the past 20 years, China has probably been the star performer. However, as it has become more powerful, the West, which had initially been fuelling its growth, has become more concerned about its rising dominance. Is it now becoming a threat?

China is not renowned for its international cooperation, or its adherence to internationally agreed standards in either business or social issues. Investor sentiment may now be moving in favour of other emerging markets.

Russia has failed to modernise and integrate with the West. Since invading Ukraine, it has become un-investable from a Saltydog point of view.

Maybe, this could be India’s time to shine?

- Ian Cowie: home to my first 10-bagger trust, this market is just getting started

- Which emerging market region should investors back – China, India or Vietnam?

- Why India could be the next superstar in your portfolio

Since becoming prime minister in 2014, Narendra Modi and his government have taken a number of steps to improve the financial situation in India, including:

- Introducing the Goods and Services Tax (GST), which has simplified the tax system and made it easier for businesses to operate

- Launching the Pradhan Mantri Jan Dhan Yojana (PMJDY), a government financial inclusion programme, which has provided financial services to millions of Indians who previously did not have access to any

- Establishing the National Infrastructure Pipeline (NIP), which is a $1.4 trillion (£1.1 trillion) investment plan to improve India's infrastructure

- Promoting “Make in India”, a campaign to encourage foreign investment and boost manufacturing in India

- Launching the Startup India initiative, which provides financial and other support to start-ups.

These measures have helped boost economic growth and create jobs in India. It is currently one of the world’s fastest-growing economies. Although much of this comes from its exports, it also benefits from having a large domestic market, a relatively young population, and an expanding middle class with rising levels of wealth.

However, there are still challenges to overcome, such as high levels of poverty and inequality.

Next year there is a general election, which increases political uncertainty, and although the prime minister remains popular there is no guarantee that he will get re-elected for a third term.

We will be reviewing last week’s fund performance over the next couple of days and will consider adding the Jupiter India fund to our portfolios, assuming that it still has the wind in its sails.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.