The fund we have bought to dip our toe back into continental waters

The performance of this region has picked up in 2021, which Saltydog is aiming to take advantage of.

21st June 2021 12:30

by Douglas Chadwick from ii contributor

The performance of this region has picked up in 2021, which Saltydog is aiming to take advantage of.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week our demonstration portfolios bought the Schroder European Smaller Companies fund, our first investment in Europe this year.

When the spread of the Covid-19 pandemic forced down stock prices all around the world, the European markets took a hit along with everybody else. In the first quarter of 2020 the Paris CAC 40 went down by 26.5%, while the Frankfurt DAX lost 25%. They then began to recover, and in the second quarter the CAC 40 gained 12.3% and the DAX made 23.9%. On 11 June 2020, we invested in the Janus Henderson European Smaller Companies fund, which we held through until 5 November. In just under five months, it went up by 18%.

We then changed tack and started to favour funds from the UK Smaller Companies, UK All Companies, and UK Equity Income sectors.

- How Saltydog invests: a guide to its momentum approach

- Four funds that helped power our portfolios to all-time highs

- Funds Fan: 'Skin in the game', space launches and UK quality shares

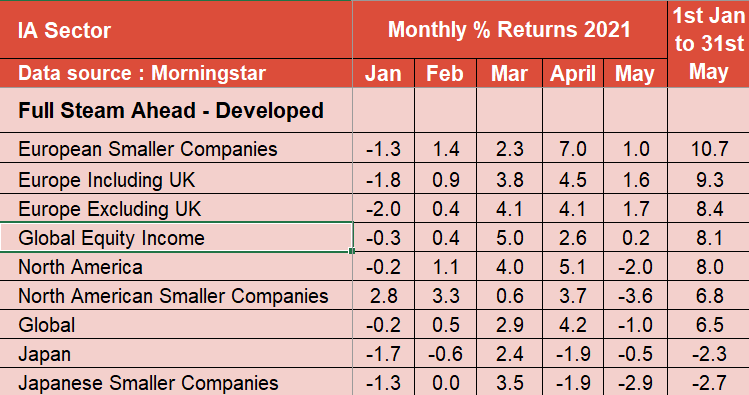

Each week we look at the relative performance of the Investment Association sectors, combining them into our own Saltydog groups, based on their historic volatility. The least volatile sectors are in our ‘Safe Haven’ group, then it’s ‘Steady as She Goes’ and finally the ‘Full Steam Ahead – Developed’ and the ‘Full Steam Ahead – Emerging’ groups.

European funds fall into three sectors. Europe including UK, Europe excluding UK, and European Smaller Companies. These are in our ‘Full Steam Ahead – Developed’ group along with the Japanese, American, Global and Global Equity Income sectors.

In the first five months of this year, the top performing sectors in this group are the three European ones, with European Smaller Companies leading the way.

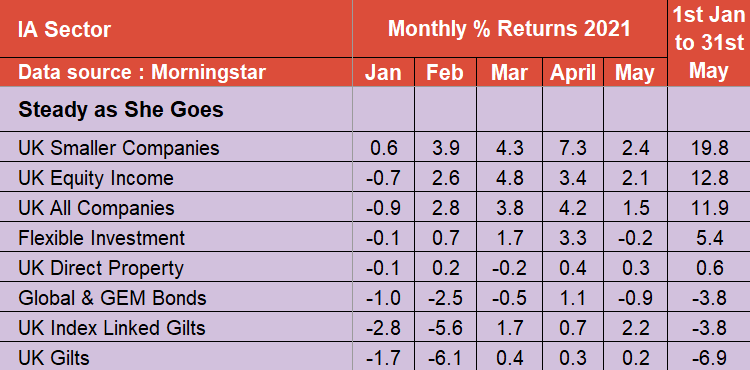

However, some of the sectors in the historically less volatile ‘Steady as She Goes’ group have done even better. The UK Smaller Companies sector is at the top of the table with a five-month return of 19.8%.

One of the rules that we apply to our portfolios is that we only invest in funds from the sectors in the more volatile groups if they are giving better returns. That is why we have been building up our positions in the UK Smaller Companies funds, but up until now have disregarded the sectors in the ‘Steady as She Goes’ group.

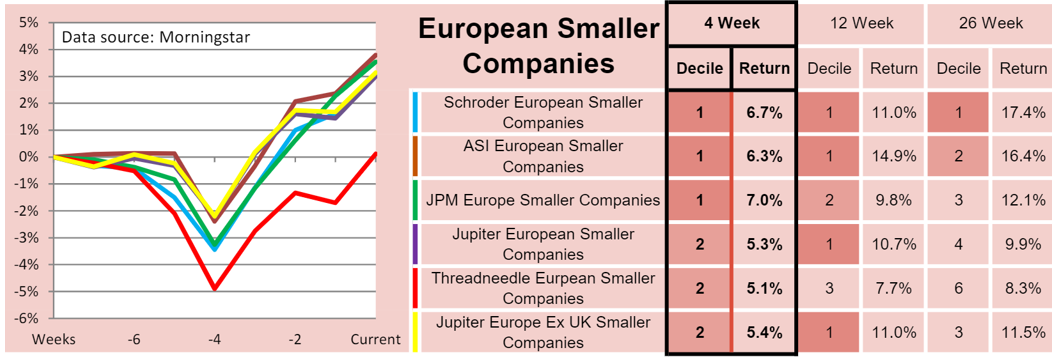

When we reviewed the data last week, the UK Smaller Companies sector was showing a four-week gain of 3.2%. UK All Companies was up 2.3% and UK Equity Income had made 1.8%. Not bad, but the European Smaller Companies sector was up 5.1% and the other European sectors were up 4.3%. The UK Smaller Companies is still ahead over 12 and 26-weeks, but this could be a sign that the tide is changing.

We have reduced our holding in the Franklin UK Smaller Companies fund, which we went into last November, and have invested in the Schroder European Smaller Companies fund, which currently sits at the top of our four-week shortlist.

If it does as well for us over the next few months as the Janus Henderson European Smaller Companies did this time last year, we will be very happy.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.