Four funds that helped power our portfolios to all-time highs

Saltydog names the funds held for most of 2020, which have served its model portfolios well.

21st December 2020 12:37

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog names the funds held for most of 2020, which have served its model portfolios well.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It has been a difficult year heavily influenced by the Covid-19 pandemic that has forced the world into lockdown.

In the UK, we are now seeing large areas of the country facing tighter restrictions, just when we thought that we might be able to let them slip a little over Christmas.

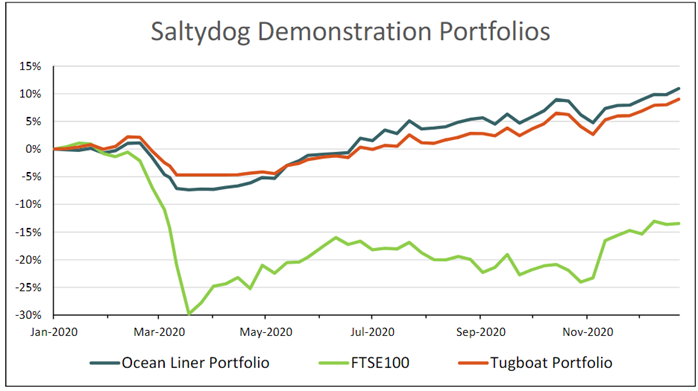

UK investors have also had a tough time, especially people focusing on the UK markets. The FTSE 100 and FTSE 250 both collapsed at the end of February, along with stock markets around the world, and they still have not fully recovered.

- How Saltydog invests: a guide to its momentum approach

- UK funds leading the pack, so we are buying

- We have bought two funds from the specialist sector

By avoiding the worst of the fall, and yet getting the benefit of the subsequent recovery, our demonstration portfolios have started this week at all-time highs. So far this year, the Tugboat is up 9.0% and the Ocean Liner is up 11.0%

Past performance is not a guide to future performance.

During the year we have swapped funds and moved from sector to sector as market conditions have varied, however there are a few funds that we have held for most of the year, and they all come from the Mixed Investment 40-85% Shares sector.

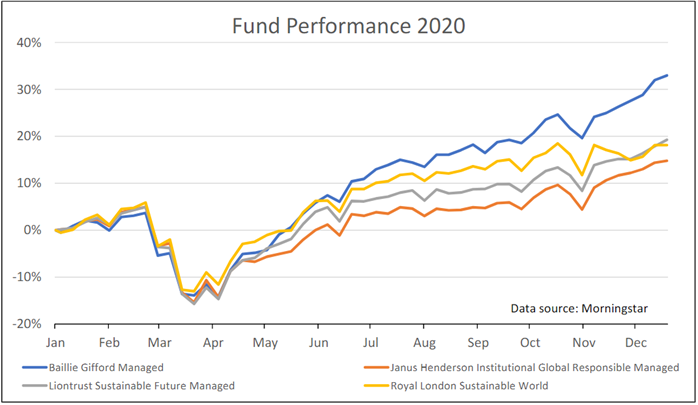

At the beginning of the year, both portfolios held the Liontrust Sustainable Future Managed, Janus Henderson Institutional Global Responsible Managed, and Royal London Sustainable World funds, having first gone into them in February 2019.

- Funds Fan: 2020’s top investments and trust insights

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

We sold them at the end of February/beginning of March 2020, along with most of the other funds that we were holding.

When we started reinvesting in April, they were the first funds that we went back into. In July, we added the Baillie Gifford Managed, which has outperformed the other three in recent months.

Past performance is not a guide to future performance.

Our holdings in these funds currently make up 48% of the Tugboat portfolio and 43% of Ocean Liner.

They regularly appear in our performance tables highlighting the leading funds and have served us well over the last couple of years. It will be interesting to see if the trend continues.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.