Funds for the buy-and-hold investor

To help the time-short DIY investor, Saltydog finds the funds achieving a 5% gain every six months.

19th August 2019 13:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

To help the time-short DIY investor, Saltydog finds the funds achieving a 5% gain every six months.

At Saltydog Investor we know that there are a considerable number of people who appreciate the value of our momentum approach to fund selection. Some however are time-short and believe they cannot direct the attention to their portfolio which is required by our approach, and so by default they fall into the 'buy-and-hold' trap of poor performance.

It is true that our system is quite intensive and does involve weekly updates and trading adjustments. This is what makes it different to the perceived wisdom of the ‘buy and hold’ mantra of the investment management industry.

Recent events have exposed this philosophy for what it is - a gravy-train for the industry at the expense of the investor. The investor deserves less 'religion' and more 'reason' to assist his or her decisions and fund choices.

Confronted by this dilemma for the time-short DIY investor, we decided to review our algorithms to see whether our results might be presented in a different more long-term way. The algorithm was instructed to look for those funds that had achieved a 5% gain every six months going back over the last three years.

Amazingly, on the first trial that we did, at the beginning of May, there were a small number that had achieved this and nearly 40 that had only missed out once. The time spell of six months was used so that short-term Trump tweet shocks would come and go without disturbing the true performance of the sectors and funds.

It was not surprising to see some well-known funds that feature regularly in our normal Saltydog approach. Neither was it a surprise to see that they came mainly from three sectors – Technology, Global and the United States. What was unexpected was the amount of gain that had been achieved by these funds over the three years.

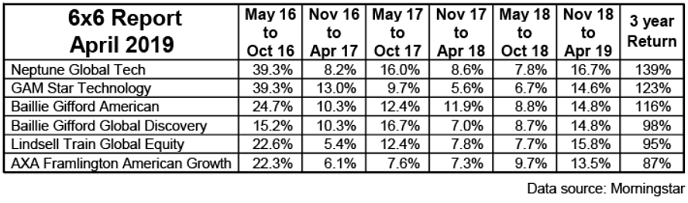

Here are the six funds that achieved a return of 5% or more in each of the six-month periods from the beginning of May 2016, through to the end of April 2019.

It is our intention to run this data (6x6) on a rolling three-month basis, each time looking back over the last three years. The more recent numbers will then give an indication of sectors and thereby funds which are moving in and out of favour.

Of course, because the information is delayed, it will not sound a quick alert of a major market collapse as the normal Saltydog system will do.

However, for the 'buy-and-hold' investor it would serve them well to modify their approach and trade when necessary, in order to stay away from the poor funds which will never feature in this data.

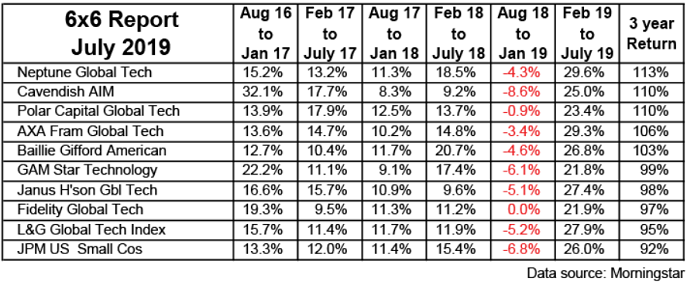

At the beginning of this month we revisited the data. This time there weren't any funds that achieved the 5% return in each of the six six-month periods, but around 60 that managed to hit it five out of six times. Here are the top ten from our latest report.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.