General Motors is moving up a gear

Our overseas investing expert considers the investment merits of four US stocks.

11th August 2021 11:08

by Rodney Hobson from interactive investor

Our overseas investing expert considers the investment merits of four US corporate giants including GM and Kraft Heinz.

Second-quarter results from US companies continue to pour in – and investors need to pick their way carefully through a minefield as some comparisons with last year’s April-June period are distorted by the effects of Covid-19 shutdowns.

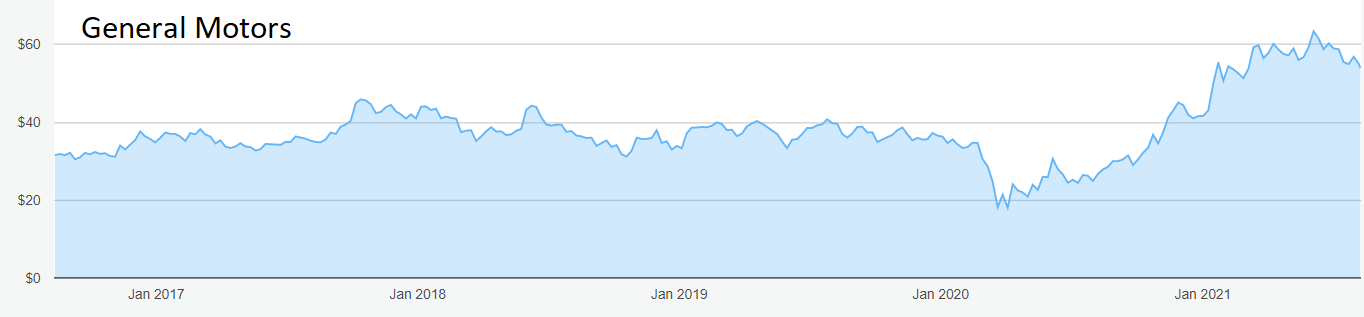

Life is certainly moving up a gear at vehicle maker General Motors (NYSE:GM). This time last year sales plummeted during the worst impact of the pandemic and GM made a $758 million (£548 million) net loss.

This year, the second-quarter swung it to a $2.84 billion profit as revenue more than doubled from $16.8 billion to $34.2 billion. Furthermore, GM raised its forecast for net income for the full year from $7.7 billion to $9.2 billion.

The motor industry is likely to be one of the major beneficiaries of US government measures to fire up the American economy.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- The US economy and its big companies are soaring

Some caution is required, given that vehicle sales were hit particularly badly last year, so a particularly spectacular rebound was to be expected.

Many companies and individuals will be anxious to upgrade cars and trucks that they intended replacing 12 months ago and that are now correspondingly older.

Likewise GM was naturally cautious in its earlier profits forecasts until it could be sure that life really was returning to normal, so an upgrade was almost inevitable.

Another concern is that GM, like other vehicle makers, will have to invest heavily as the industry moves away from petrol and diesel to hybrids and all-electric.

The company said it is increasing its investment in electric vehicles and self-driving technology from $27 billion to $35 billion in 2025.

Certainly the markets reacted to the figures with caution as the shares quickly shed 8%. They were as low as $18 at the start of April last year before racing away to an optimistic $63 in June this year.

A bout of profit-taking was inevitable and the current price is around $54, still well above the pre-pandemic peak of $46. There is no dividend.

Source: interactive investor. Past performance is not a guide to future performance

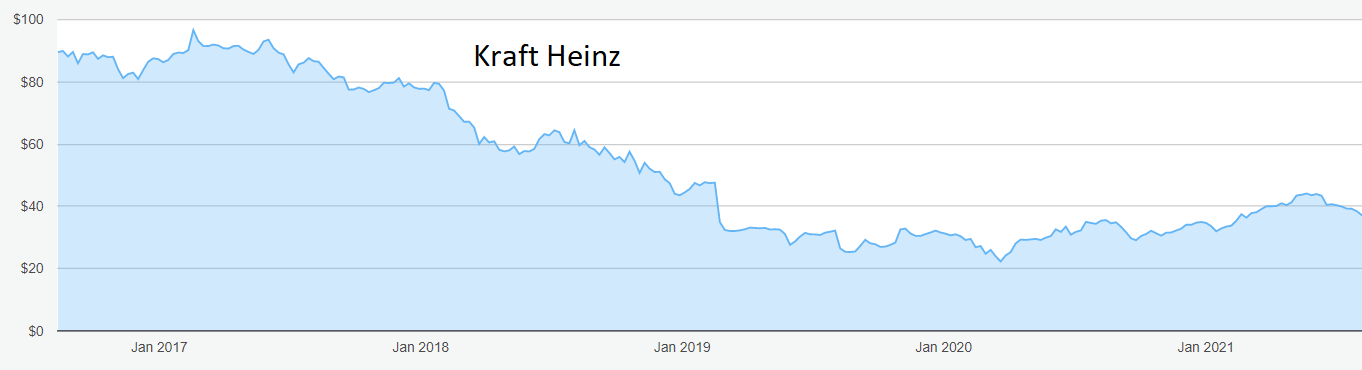

The opposite situation has occurred at Kraft Heinz (NASDAQ:KHC), which sold more of its food products such as cornflakes and soup a year ago to customers catering for themselves through self-isolation and the closure of restaurants.

This time sales slipped 0.5% year-on-year from $6.65 billion to $6.62 billion but were still 3.2% up on the same quarter of 2019.

More worrying is that writing down the value of brands means Kraft is still making a net loss and although the deficit narrowed dramatically from $1.65 billion to $25 million, that was entirely caused by the hefty writedowns on brands such Maxwell House last year.

There are further distortions caused by the return of price discounts on catering and retail sales that Kraft did not feel were necessary last year when sales were rolling along nicely anyway.

Kraft did make an underlying profit, which allowed the compensation of a 40 cents a share dividend in line with the previous nine quarters. That gives a yield of 4.3% at the current share price around $37.

Sales are likely to be down slightly in the third quarter but the full year should be stronger than originally expected and chief executive Miguel Patricio is confident the group will come out of the pandemic stronger than it went in.

The shares remain above the $30 I suggested buying at in the past but are slipping at the moment, which could open up a new buying opportunity.

Source: interactive investor. Past performance is not a guide to future performance

The ups and downs of the pandemic has had much less effect on electric power and natural gas company Duke Energy (NYSE:DUK) so comparisons with last year are correspondingly more meaningful.

Underlying earnings rose from $1.12 to $1.15 a share, beating expectations of a slight fall. Revenue edged up from $5.42 billion to $5.76 billion.

Projected earnings for the full year, of $5-5.30, were reaffirmed and the company expects earnings to grow 5-7% a year over the next four years.

Source: interactive investor. Past performance is not a guide to future performance

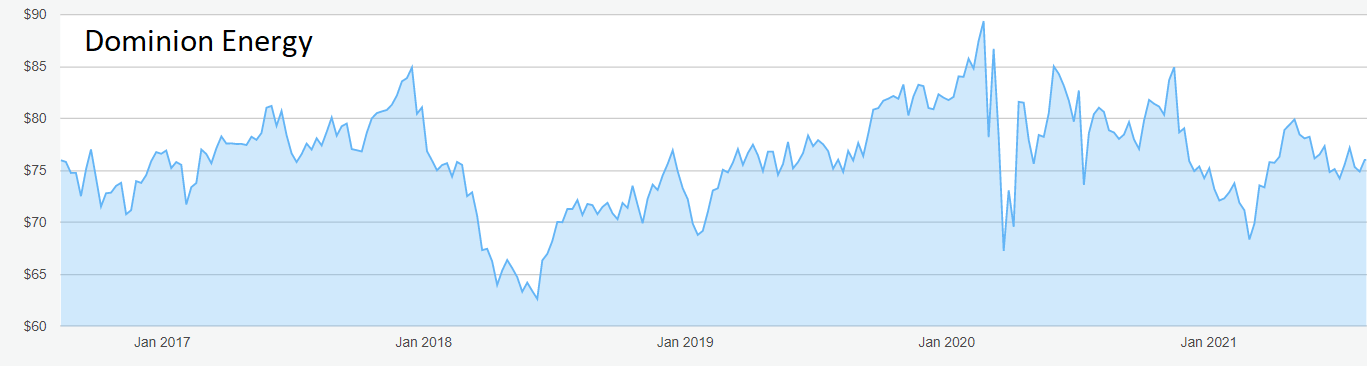

In contrast, Dominion Energy (NYSE:D) fell slightly short of expectations, although the operating earnings of 74 cents a shares was within the company’s own guidance range. Revenue of just over $3 billion, down 2.2%, was also underwhelming.

Another worry is a 16% rise in operating costs, including higher maintenance charges and the cost of buying gas.

Dominion shares are quite volatile, moving between $89 and $67 in the past 18 months, and are currently slipping at around $77.

The big plus point is a yield of 3.7% but with capital expenditure set to rise that may not be enough to prevent another dip below $70.

Source: interactive investor. Past performance is not a guide to future performance

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.