Gold: buy the dip, or mind the drop?

It’s been a hugely popular asset to buy this year, but the price of gold has fallen sharply since peaking at almost $4,400 an ounce. Analyst John Ficenec discusses the pros and cons of owning the yellow metal.

29th October 2025 12:17

by John Ficenec from interactive investor

Gold has tumbled from record highs as the US and China make progress on a trade agreement and inflation fears begin to cool. With the price now in correction territory we take a look at whether it has further to fall or now is the time to buy the dip.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

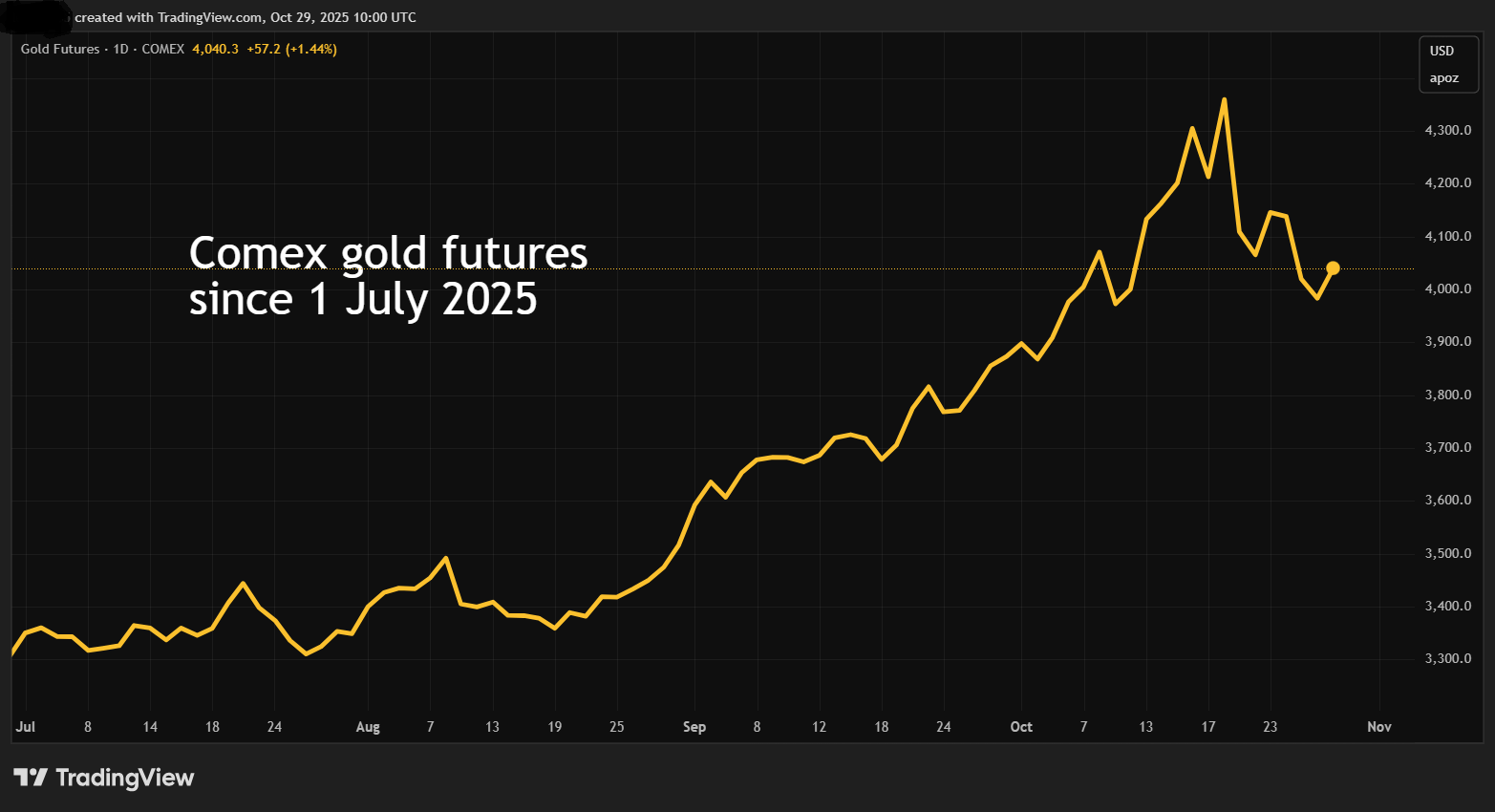

Comex gold futures traded as low as $3,901 an ounce on 28 October, an 11% fall from last week’s all-time high just shy of $4,400, pushing the yellow metal into correction level. One of the main factors driving the market recently is easing tension between two of the largest economies in the world.

Source: TradingView. Past performance is not a guide to future performance.

US President Donald Trump is at the Pacific Rim summit in South Korea this week and told reporters ahead of a scheduled meeting on Thursday with Chinese premier Xi Jinping: “I have a lot of respect for Xi. I think we’re going to come away with a deal.”

US Treasury secretary Scott Bessent said that American and Chinese officials had agreed a “substantial framework” ahead of the talks.

Gold prices had been driven higher by rising global tension this year. “Global markets have navigated a volatile start to the year marked by trade tensions, unpredictable US policy shifts and frequent geopolitical flashpoints. The robust investment activity we have seen in the first half of 2025 underscores gold’s role as a hedge against economic and geopolitical risks,” said Louise Street, senior markets analyst at the World Gold Council.

Inflation, inflation, inflation

Inflation destroys money, so it’s no surprise that gold performed well this year, with inflation above target in both the UK and US, and tariff increases causing a price shock globally. However, the latest figures in both the UK and US surprised markets by showing inflation cooling, suggesting we may have passed the peak.

US inflation dropped to 3% for the first time since January. In the UK, the September Consumer Price Index (CPI) came in unchanged at 3.78% compared to the same 12 months last year, against an expectation of a rise to 4%. Analysts at Deutsche Bank called it possibly “the biggest surprise of the year”.

- Gold investing: what, why and how to invest

- The funds and trusts that look beyond gold to add defensive ballast

It may not seem like much, but these data points remove a key support for gold. More importantly, falling inflation opens the door to a cascade of fiscal policy that knocks out more props from underneath the gold market.

Lower inflation allows the US Federal Reserve to be more aggressive in cutting interest rates, it also allows the Bank of England to cut rates sooner than expected. Cutting central bank reserve rates reduces the cost of borrowing, and when debt is cheaper, more value flows to equity.

So, what we have is risk off from the US and China trade talks combined with a fundamental shift in the world economic story supporting gold prices. With gold at record prices, it’s understandable why investors would take some profits and re-allocate to better value elsewhere.

Rate cliff

Nowhere has this been clearer than in longer-dated government borrowing rates that have fallen sharply from their highest levels in over a decade. The US 30-year Treasury yield has fallen from almost 5% in early September to around 4.5%, and in the UK the 30-year gilt has tumbled from 5.7% in early September to 5.15% and is approaching the lowest level since January.

Source: TradingView. Past performance is not a guide to future performance.

The benchmark US 10-year rate is now back below 4% for the first time this year, and the UK 10-year gilt at 4.38% is the lowest it has been since December 2024.

Source: TradingView. Past performance is not a guide to future performance.

Buy the dip, or mind the drop?

It could be that this is not just profit taking; rather it is the beginning of a fundamental shift in gold price support that will continue to see prices weaken. Inflation is expected to fall for the next 18 months, and if China and the US do reach a trade agreement, then it will further embolden equity investors.

- Should investors rethink gold’s safe-haven status?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

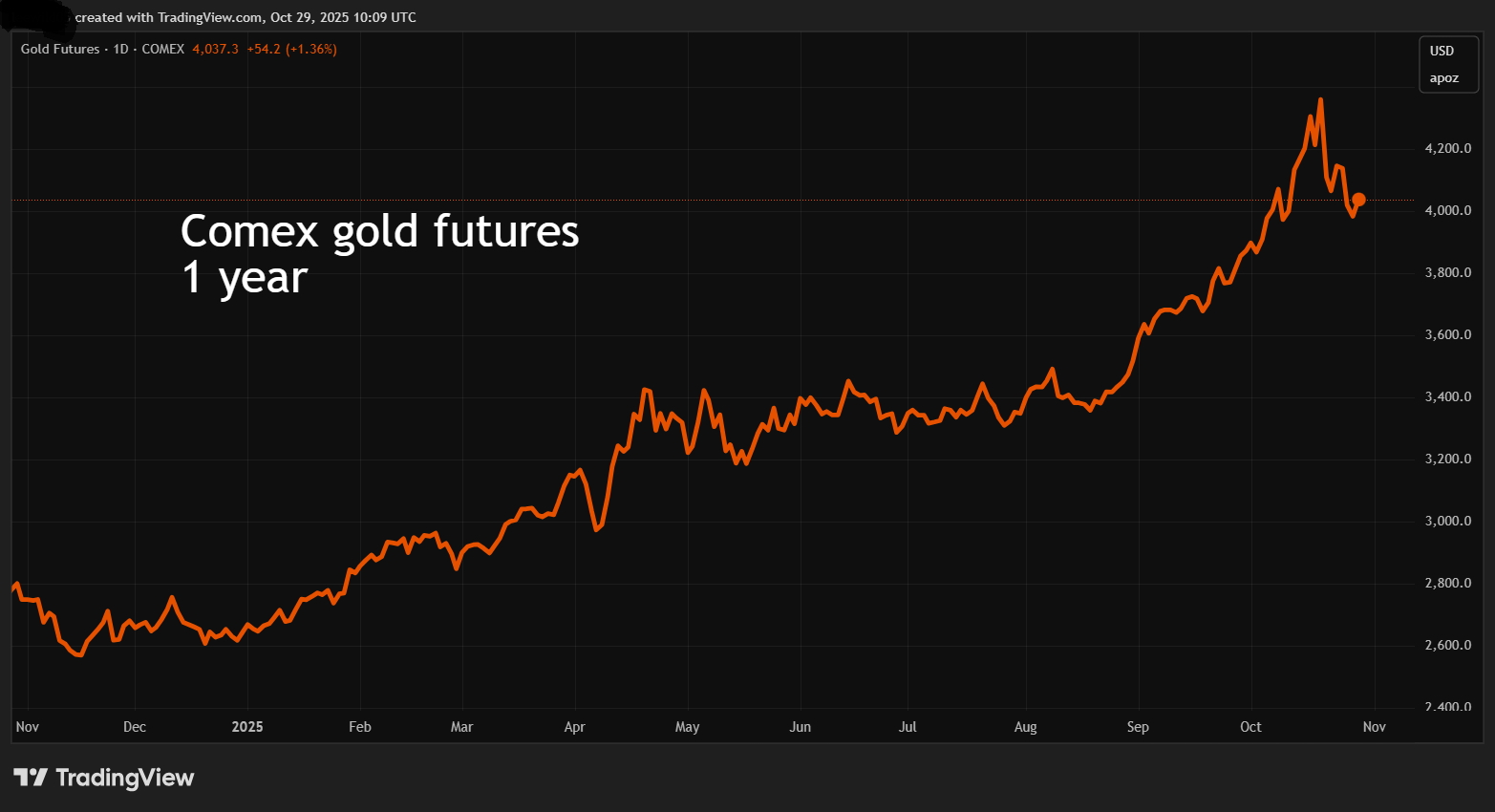

The gold price won’t crash, but it wouldn’t be a surprise to see it fall back to a more reasonable level. As Jim Reid, head of macro and thematic research at Deutsche Bank points out, recent gold prices were higher than their previous inflation-adjusted peak in January 1980, meaning that it has never been more expensive. Also, gold prices are still up around 55% so far this year, the strongest annual performance since 1979, when gold prices more than doubled after the oil shock triggered a huge wave of inflation.

Source: TradingView. Past performance is not a guide to future performance.

However, support for gold at around a $3,000 to $3,500 level is still strong, with demand rising at double digits, driven by buying in China, India and Europe, according to the latest data from the World Gold Council.

Central banks continue to diversify away from the US dollar and increase gold holdings. The most recent World Gold Council survey showed 95% of respondents believe that global central bank gold reserves will increase over the next 12 months.

So, while gold fever has sent prices to extreme levels, and it wouldn’t be a surprise to see at least a period of consolidation, the current supply/demand dynamics demonstrate why gold should always make up around 5-10% of a well-balanced portfolio of investments.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.