Gold is soaring and these funds are rising the most

Saltydog Investor examines the reasons for the gold price surge and looks at the funds benefiting the most.

15th April 2024 14:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

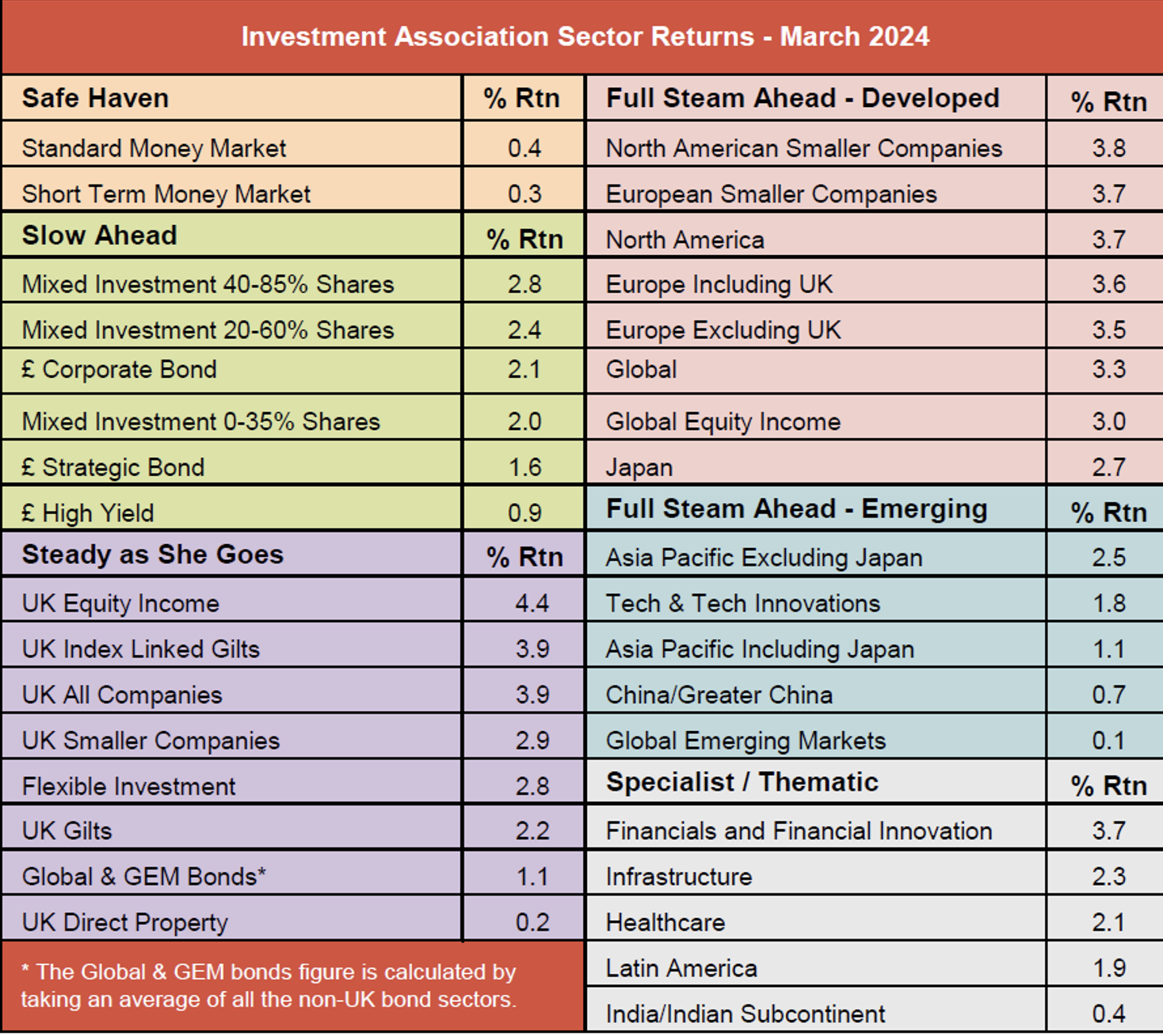

In the UK, unit trusts and OEICs (open-ended investment companies) are classified by their Investment Association (IA) sector. There are now more than 50 sectors, each with a precise definition governing what fund managers can and cannot do. The IA monitors the funds to ensure that they are sticking to the rules.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Morningstar provides performance data for most of the sectors, and we include this in our regular Saltydog analysis. However, there are a few sectors (including Specialist, and Commodities and Natural Resources) where average sector returns are not calculated because they feel “performance comparisons may be inappropriate due to the diverse nature of funds in the sectors”.

We have also found that we cover only a handful of funds in some sectors and so we sometimes group them together.

Last month, all sectors went up, something we have not seen since 2019.

Data source: Morningstar. Past performance is not a guide to future performance.

The best-performing sector was UK Equity Income, with a one-month return of 4.4%. Due to this, you would have expected one of last month’s top funds to have come from this sector.

However, as I said earlier, average performance data is not provided for all sectors. The best-performing funds last month were actually the gold funds, which are in the Specialist sector, and funds from the Commodities and Natural Resources sector. Neither sector features in the sector performance table above.

The top fund from the UK Equity Income sector was JOHCM UK Equity Income, up 7.8%, while the Ninety One Global Gold fund gained 22.2%.

Saltydog’s top 10 funds in March 2024

| Fund name | Investment Association sector | Monthly return |

| Ninety One Global Gold | Specialist | 22.2 |

| BlackRock Gold and General | Specialist | 19.8 |

| WS Ruffer Gold | Specialist | 19.3 |

| SVS Sanlam Global Gold & Resources | Specialist | 16.6 |

| JPM Natural Resources | Commodities and Natural Resources | 9.7 |

| WS Guinness Global Energy | Commodities and Natural Resources | 9.5 |

| BGF World Energy | Commodities and Natural Resources | 9.2 |

| BlackRock Natural Resources | Commodities and Natural Resources | 9.0 |

| Premier Miton UK Smaller Companies | UK Smaller Companies | 8.8 |

| VT De Lisle America | North America | 8.6 |

Data source: Morningstar. Past performance is not a guide to future performance.

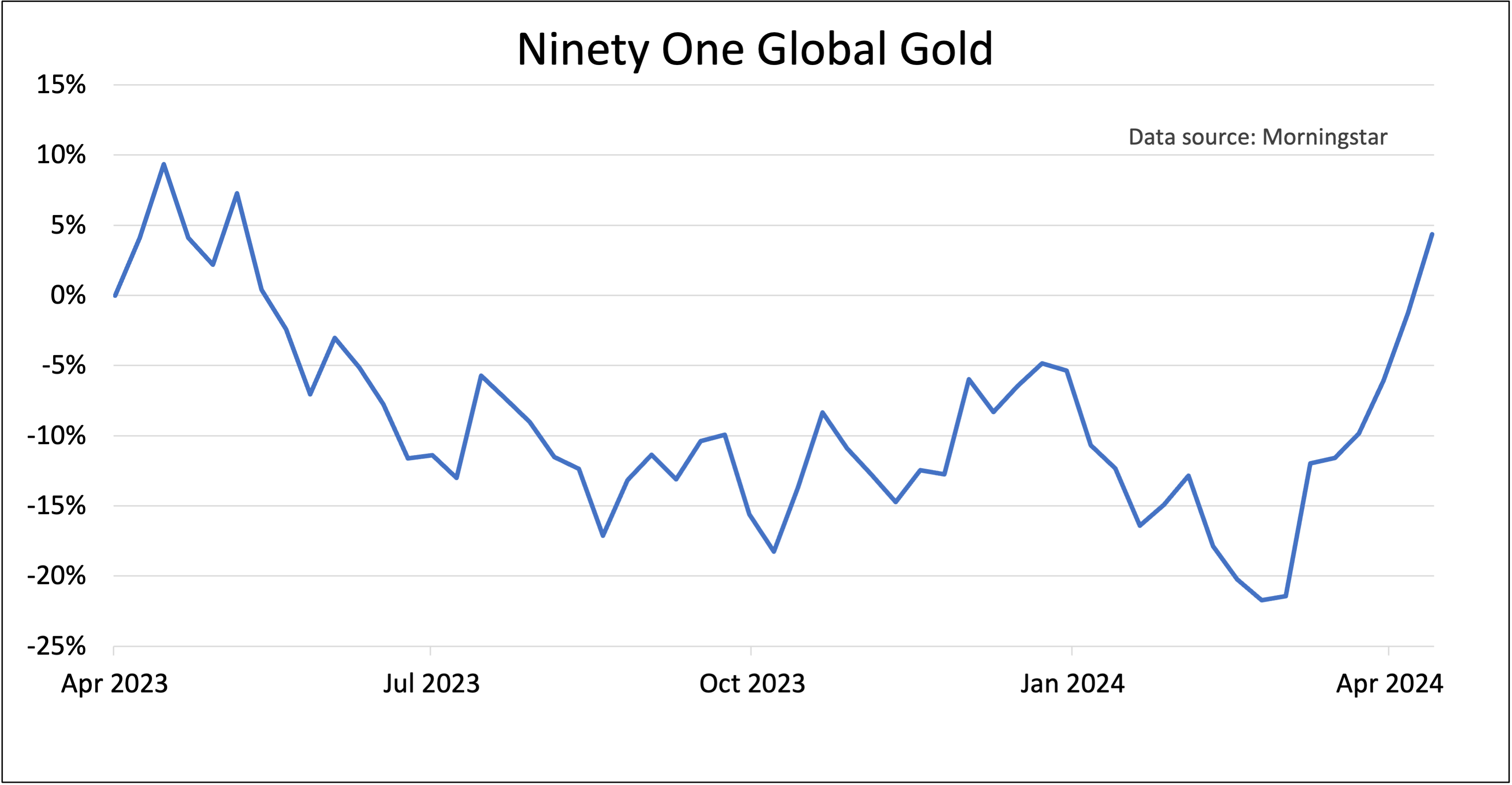

The gold funds have also had a good start to April. In the past two weeks, the Ninety One Global Gold fund has gone up by more than 10%.

Unlike some exchange-traded funds (ETFs), these funds do not just hold physical gold. This is an extract from the Ninety One Global Gold fund’s objectives and investment policy:“The fund invests primarily (at least two-thirds) in the shares of companies around the world involved in gold mining and in related derivatives (financial contracts whose value is linked to the price of the shares of such companies). The fund may invest up to one-third of its assets in the shares of companies around the world that are involved in mining for precious metals other than gold, non-precious metals and minerals and related derivatives.”

This means that the fund’s performance is not linked directly to the price of gold. However, it is closely correlated.

In March, the spot price of gold went above $2,200, for the first time ever, and has continued to rise in April. At the end of last week, it briefly surpassed $2,400.

There are various possible reasons why.

Gold is traditionally considered a “safe-haven” asset and a reliable store of value, particularly during periods of geopolitical uncertainty. Wars in Ukraine and Gaza, coupled with impending elections, most significantly in the US, have fuelled demand for gold.

Another factor supporting prices has been central bank gold-buying since 2022, especially by China, which has bolstered demand for the precious metal. This trend continued throughout 2023 and has carried over into 2024.

- Gold’s hitting new highs – why it’s rising and how to invest in it

- Stockwatch: the best way to play a new bull market in gold?

Jewellery demand is also increasing especially in the emerging economies. India used to be the world’s largest consumer of gold jewellery but was overtaken by China in 2009. As the wealth of these populations grows and their middle classes expand, the demand for gold jewellery is likely to increase.

And then there’s the inverse relationship between gold and interest rates. As rates rise, the demand for gold typically diminishes, as investors find higher returns in bonds and fixed-interest securities. Conversely, when interest rates fall, gold prices tend to rise. With inflation approaching government targets, expectations of interest rate cuts by central banks have spurred investor confidence, contributing to gold's recent performance.

Although gold is considered “safe” that does not mean its price is stable. The shares in the companies involved in mining it are even more volatile. While the Ninety One Global Gold fund may have performed spectacularly well over the past couple of months, it has only got back to where it was this time last year.

With the gold price up at all-time highs it may still have further to go, but past experience would suggest that it might be a bumpy ride.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.