Good times return for this respected global brand

12th April 2023 10:17

by Rodney Hobson from interactive investor

Struck hard by the pandemic, this $50 billion company’s latest results are impressive. Overseas investing expert Rodney Hobson thinks there’s more positive news to come.

International companies tend to fare better when their home base is doing well. Such is the hopeful scenario facing hotels group Marriott International (NASDAQ:MAR).

While all parts of the labour market in the US have held up surprisingly well during interest rate rises, it is leisure and hospitality that catches the eye: an average of 95,000 jobs were added in each of the six winter months when activity would normally be sluggish. Another 72,000 vacancies were filled in the sector in March.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The downside, from the employers’ side, is that these new recruits cost money. Average hourly wages rose 0.3% in March after a 0.2% rise in February, and with all parts of the US economy competing for workers the trend is set to spiral upwards rather than tail off. Food price inflation is also a worry. These are tricky times for a sector that is still struggling to recover fully from the devastating shutdowns around the globe during the pandemic.

Nonetheless, Marriott’s most recent figures for the final quarter of 2022 are highly encouraging. Revenue for the full year was up 50% on 2021 at $20.8 billion and net income more than doubled to nearly $2.4 billion despite the lingering impact of the Omicron variant of Covid-19.

There was an inevitable slowdown in growth in the final quarter as comparatives became much tougher, but revenue still rose 33% to $5.9 billion and net income 44% to $673 million.

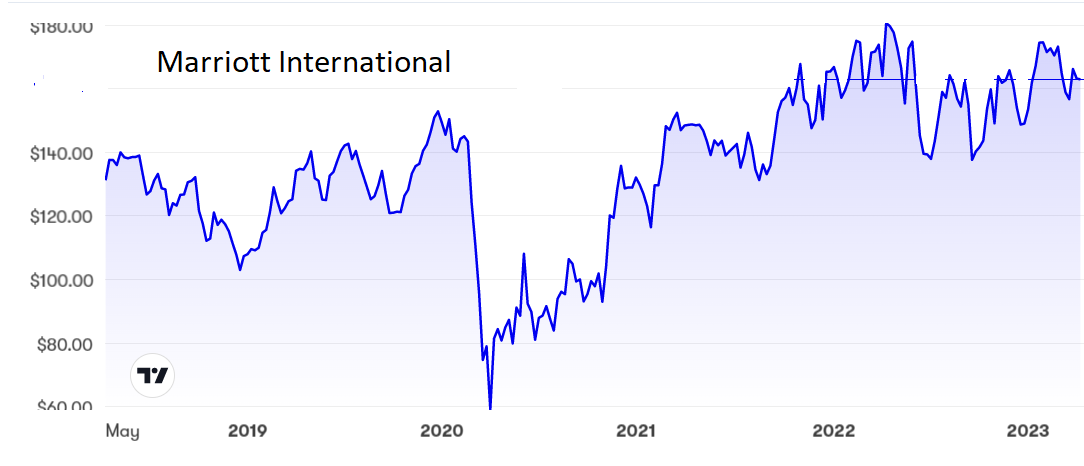

Source: interactive investor. Past performance is not a guide to future performance.

Chief executive Anthony Capuano put it in perspective: “Just two years after experiencing the sharpest downturn in our company's history, we reported record financial results."

First-quarter figures for this year, due out in May, are expected to show further significant improvement, especially as comparisons will be with an Omicron-affected quarter last time. However, Marriott warns that business people and holidaymakers are tending to book rooms at short notice, so visibility of earnings is less than in pre-pandemic days.

Marriott has the advantage of offering a well-known brand in its own name plus about 30 others, some with niche markets and one other famous name in Sheraton. Together they provide 1.5 million rooms in well over 100 countries, of which about one million are in the US.

- Time to take profits at these four winning stocks?

- 11 US shares for your ISA in 2023

- 10 UK shares Warren Buffett might put in his ISA in 2023

Expansion is continuing apace, despite withdrawal from Russia after the invasion of Ukraine. Last year Marriott signed on average two deals a day, adding 108,000 rooms to the portfolio. The acquisition of City Express, signed in October, will add about 17,000 rooms this year and will take Marriott into a more affordable segment of the market.

It claims it will become the largest hotel company in the Caribbean and Latin America. City Express owns 152 hotels in Latin America, mainly in Mexico, and the plan is to expand using Marriott’s expertise in growing regional brands.

Marriott shares responded well when the latest figures were released in February but the uncertainty continues to put a damper on the price. The shares understandably fell off a cliff when the pandemic struck and have recovered comparatively quickly to just above the pre-pandemic level of $150. A high of $180 a year ago proved to be too much too soon, although at the current $164 the shares are not too far off their best and they are edging sideways, with $140 looking a solid floor.

The price/earnings ratio of 22.5 reflects the market’s belief that improvements will continue, though investors may wish that, with the yield under 1%, more of the strong cash generation was put into the dividend rather than share buybacks.

Hobson’s choice: Buy below $170. The next push should be upwards and the $180 ceiling is there to be broken.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.