Time to take profits at these four winning stocks?

5th April 2023 09:44

by Rodney Hobson from interactive investor

Tipping this sector has generated big profits for our overseas investing expert Rodney Hobson, but conditions are much tougher. What will he do now? He also updates his oil sector tips.

Interest rates in the US have not peaked yet and a new upsurge in oil prices will make curbing inflation more problematic, just as inflationary pressures were expected to ease. The outlook is difficult for housebuilders, which risk being crushed between rising input prices and falling demand from cash-strapped buyers. Now could be the time to consider taking profits in the sector.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

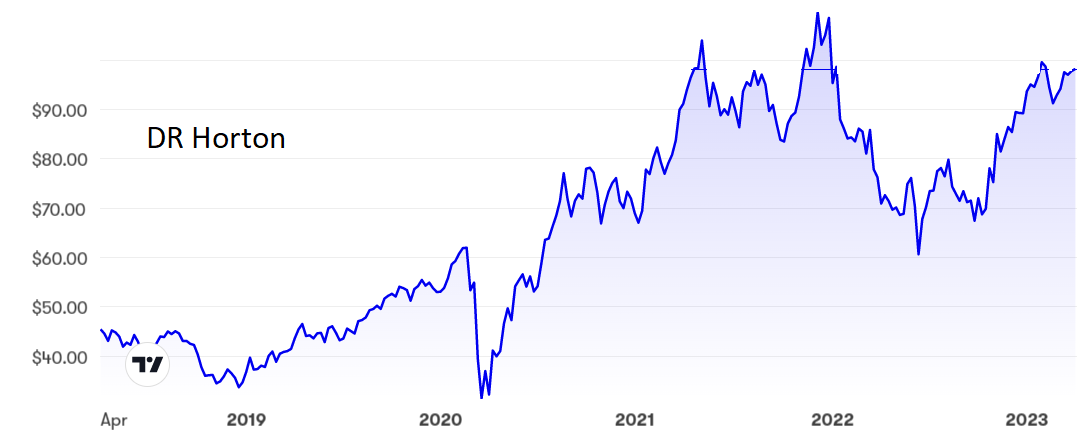

D.R. Horton Inc (NYSE:DHI), which dubs itself “America’s builder”, is a particular case in point. It has been the largest homebuilder in the US since 2002 and currently operates 109 sites in 33 states across the States. It builds for sale and for rental and also offers mortgage financing and acts as an insurance agency. While that does provide the security of a spread of operations, they are pretty much all tied to house prices.

Source: interactive investor. Past performance is not a guide to future performance.

Horton’s financial year ends in September. Its most recent figures show that net income decreased 16% to $958.7 million in its first quarter to the end of December despite a 2.9% rise in total revenue. Margins slipped from 21.4% in the previous first quarter to 17.5%.

Chair Donald R Horton admits that since the middle of last year demand for housing has fallen as interest rates have risen and economic uncertainty has grown, and that this situation is likely to persist for some time.

Such demand that remains is mainly for affordable housing. Unfortunately, Horton goes more for the expensive stuff. Unsurprisingly, the order book has contracted sharply and cancellations jumped from 15% to a rather alarming 27%.

On the plus side, there is still a quarterly dividend of 25 cents, although at the current share price just under $100, that gives a yield only a fraction over 1%.

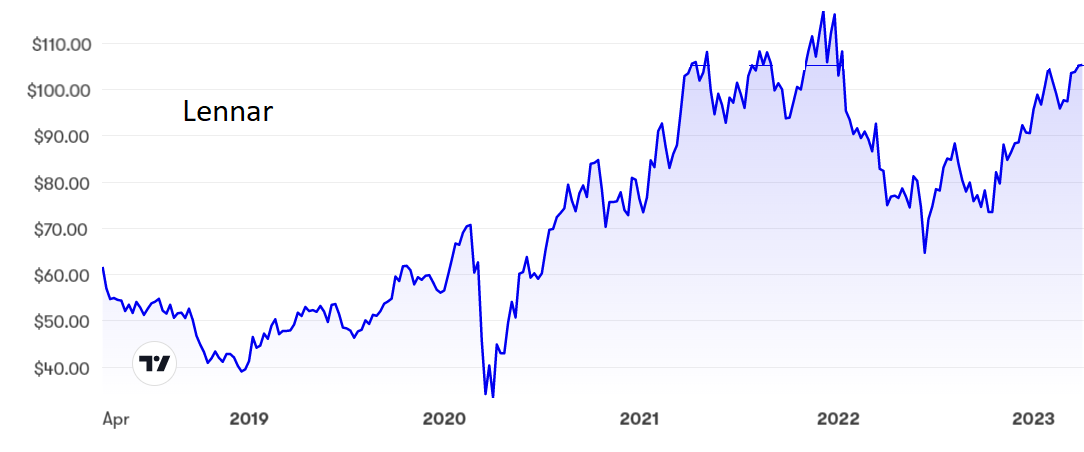

In contrast, Lennar (NYSE:LEN) shares have powered past $100 as it is perceived as having costs under better control. Yet disruptions to the supply chain and shortages of labour and raw materials have inevitably taken a similar toll, with earnings down 21% in Lennar’s first quarter despite revenue up 5%. Cancellation rates have doubled to 21% and the order book has shrunk, as at Horton. Analyst estimates for the current fiscal year to September are similarly gloomy.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I recommended the sector a year ago and anyone taking that advice will be deep in the money. However, the market has factored in a slower rise in US interest rates and that could prove to be slightly overoptimistic.

I would be inclined to take profits at Horton and look for an opportunity to buy back in around $70, which I think will provide a floor in a worst-case scenario. Similar advice applies to Lennar despite a slightly higher yield at 1.43%. Again, consider buying back in if the shares approach $70.

Elsewhere in the sector, I suggested taking profits at Taylor Morrison Home (NYSE:TMHC) in December. That advice was a little premature but after a recent surge to $38 the temptation to cash in is more pressing.

- 10 UK shares Warren Buffett might put in his ISA in 2023

- Six tips to retire using your ISA investments

I felt in December that KB Home (NYSE:KBH) was undervalued at $33. The shares are currently $40 and I now downgrade them from hold to sell.

Update: I recommended that investors buyExxon Mobil Corp (NYSE:XOM) and Chevron (NYSE:CVX) at the start of February and suggested both companies for inclusion in last-minute ISA buying a month later, reasoning that Western oil and gas majors would continue to benefit from price spikes and to pay attractive dividends.

How right that has proved to be. Opec+, which includes the Saudi-led grouping of oil producers plus other major players such as Russia and Mexico, has unexpectedly decided to cut production by more than one million barrels a day, sending the price of crude back towards $100 a barrel. Both companies saw their shares move sharply higher to stand around five-year highs. If you followed my advice, hold on.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.