Hornby and Stanley Gibbons: Old-school investing makes comeback

Kids are less interested in stamps and train sets, but these two retro stocks are regaining popularity.

28th November 2019 14:48

by Graeme Evans from interactive investor

Kids are less interested in stamps and train sets, but these two retro stocks are regaining popularity.

Gadgets now dominate present wish-lists, but that's not stopped Hornby (LSE:HRN) and Stanley Gibbons (LSE:SGI) showing there's still a place for model train sets or stamp collecting this Christmas.

The pair struck an upbeat tone in half-year results today, with both keen to demonstrate they've moved on from recent difficulties and can revive their ailing stock market fortunes.

It's early days in both cases, but today Hornby shares were up more than a penny to 33.6p and Stanley Gibbons jumped 11% to 2.5p. That's a boost for Phoenix Asset Management, which controls the funds that own 74.7% of shares in Hornby and has a majority stake in Stanley Gibbons after the collectibles business was in breach of debt covenants in 2018.

For Hornby, its shares are up almost 30% since August as optimism grows that the strategy of Lyndon Davies - who became chief executive two years ago - is paying off. He has “pulled the handbrake on discounting”, sought to invest more in “razor-sharp marketing” and forged much stronger relationships with suppliers, retailers and manufacturers.

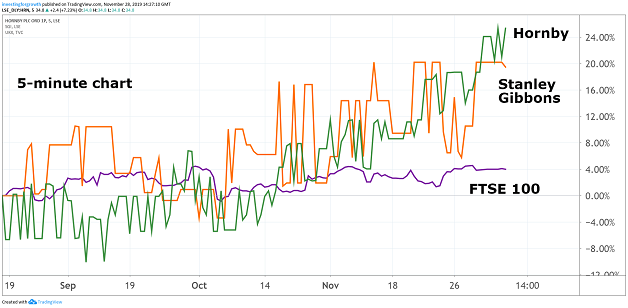

Source: TradingView Past performance is not a guide to future performance

He said today:

"Revenue is growing, losses are narrowing and we are shifting gears in our journey back to profitability and beyond.”

Revenues were 15% higher at £15.9 million in the six months to September 30, with an improvement in the gross margin to 41% from 39% a year earlier reflecting an end to the previous discounting strategy.

New product development and R&D costs caused overheads to rise 8% to £9.1 million, although operating losses still reduced to £2.5 million from £3 million previously.

Much will now depend on Christmas sales and whether new Hornby and Scalextric products developed by the company's mix of “experienced and enthusiastic” professionals have re-engaged the target audience.

The challenge, though, is that there are now very few toy and model shops, compared with the approximate 44,000 or so in Hornby's heyday two decades ago. Manufacturing runs are also now much smaller, meaning the company has to be much smarter to make good returns from its capital expenditure.

The priorities for Davies also include improving the Hornby's digital shopfront and doing more to engage with customers through social media. Overall, however, he thinks that Hornby is showing progress.

He said:

“We have fixed the engine which is now purring nicely. The thinking now is about tuning the engine and ideally adding a couple of superchargers.”

There was also optimism from Stanley Gibbons today after the stamp and coin dealership reported an improvement in underlying trading and the first signs that legacy issues were now behind it. This was shown by a 34% rise in half-year sales to £6.7 million and 72% reduction in losses from continuing operations.

The collectibles market for stamps and coins has remained strong despite the economic uncertainties, with the company able to take advantage of this through two of the strongest brands in the world in Stanley Gibbons and Baldwin's.

Redevelopment of the company's flagship store and headquarters on London's Strand will get underway early next year, while spending has also included new websites for both brands.

The moves come 20 months since a refinancing led by Phoenix signalled the start of an ambitious plan to transform the group, following the debt woes triggered by problems setting up an e-commerce platform.

Chairman Harry Wilson said:

“While most of the legacy issues are behind us, we have not become complacent and recognise that there is still a lot to do to rebuild trust from our clients and the market.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.