How fund investors can play this contrarian opportunity

A Morningstar analyst gives an overview of this unloved area, outlining three fund options among its best ideas.

23rd September 2025 09:00

by Morningstar from ii contributor

Investors are finally warming up to European stocks again, but the landscape has changed significantly in the past decade. Neglected and out of favour throughout most of the past 10 years, interest in European equities funds and exchange-traded funds (ETFs) has picked up this year as investors cut back US exposure.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Some investors are also keen to capitalise on the opportunities arising from increased defence and infrastructure spending across the Continent.

While there are plenty of opportunities for investors, beneath the surface, the market has gone through meaningful transformation.

The state of play

We recently explored a comprehensive snapshot of Europe’s equity markets – encompassing more than €700 billion (£610 billion) in assets under management.

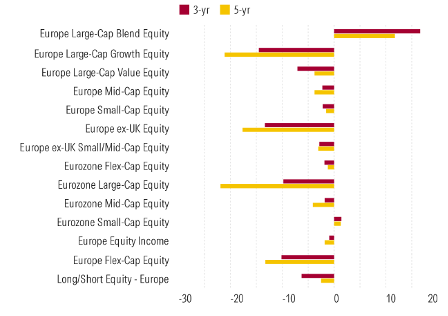

Analysing 14 Morningstar categories, the study revealed several crucial trends. Although investor inflows in the region are picking up - a welcome reversal after a long stretch of net redemptions - Europe still has a long journey ahead.

Over the trailing three- and five-year periods through the end of the second quarter of 2025, European equity categories experienced cumulative net outflows of approximately €55 billion and €80 billion, respectively.

Exhibit 1: Cumulative flows to European equity Morningstar categories

Source: Morningstar Direct. Data in EUR billion as of June-end 2025.

Downsizing

European equities’ lack of popularity extends beyond the asset flows figures, with fewer listings, fewer funds available, and fading relevance on the global stage. The number of funds and ETFs is shrinking rapidly, with 2024 setting a record for fund mergers and liquidations and 2025 on track to be the seventh consecutive year of contraction. This trend may well continue as the market structure suggests plenty of room for further consolidation.

In addition, the number of companies in the Morningstar Europe All Cap TME Index has shrunk by nearly a quarter since its peak in 2022, as companies move their primary listing to the US, hoping to access larger pools of capital. Moreover, IPOs are languishing.

As a result, Europe’s relevance in global indexes is fading - although US exceptionalism, as much as European weakness, is at play here. Europe’s weight in global indices is now close to 15%, or half of what it was in late 2008.

The Actives

Active management is under pressure in many places, and European equity funds are no exception. Recent inflows have gone predominantly into passive strategies – the same dynamic that we are seeing across most equity categories. Passive funds now account for nearly 40% of the European equity market, having tripled their assets under management over the last decade.

Active managers’ underperformance has been a major factor in this shift. There have been various challenges: stylistic headwinds, such as the underperformance of small- and mid-caps; sharp factor rotations, with market leadership shifting from quality to value, and momentum more recently; a market backdrop that saw performance being concentrated in a handful of industries, such as banks, over the recent five-year period through August 2025; and even the major rally in defence stocks caught managers wrong-footed as many avoid the space on environmental, social and governance (ESG) grounds.

- The UK income tracker fund the pros struggle to beat

- Why these funds are racing ahead of rivals and the wider market

The net effect is that fewer active managers are actually beating their benchmark. According to Morningstar’s Active/Passive Barometer, through to June 2025, active funds’ 10-year success rate (the percentage of funds that went on to both survive and outperform the passive composite return) in the Europe Large-Cap Blend Morningstar Category is at an all-time low.

That said, despite their recent challenges, there’s reason to believe that the future might look brighter for European equity investors. Even a shrinking market can still offer attractive investment opportunities. A selective approach is needed, but there are strategies that offer solid fundamentals.

Analysts identify the best by focusing on key factors such as the quality of the management team or the robustness and repeatability of their investment process. These are the critical elements for long-term success.

Morningstar manager research analysts cover more than 70 strategies from 30 different asset managers across all European-focused equity categories.

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

- City of London outperforms and extends dividend record to 59 years

Among our best ideas is BlackRock European Dynamic, a strategy led by Giles Rothbarth, who co-heads BlackRock’s sizeable, 20-plus strong European platform that underpins its broad strategy range.

Another option is Fidelity European, one of our top picks in the Europe ex-UK Equity Morningstar Category. The strategy is run by Sam Morse and Marcel Stötzel, who adopt a patient, balanced, and differentiated approach focused on dividend growth.

Lastly, M&G European Sustain Paris Aligned represents an attractive proposition with quality-focused European equity holdings that are aligned with the goals of the Paris Agreement. Lead manager John William Olsen has designed the process and run the strategy since 2014. With a concentrated, unconstrained, low turnover portfolio of thoroughly researched stocks, the fund has delivered attractive results throughout its history.

Francesco Paganelli, principal, manager research at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.