How to understand the liquidity risk of thematic ETFs

Narrative should not distract us from looking more closely at how exactly a fund tracks its theme.

19th August 2021 11:55

by Kenneth Lamont from ii contributor

A strong narrative should not distract us from looking more closely at how exactly a fund tracks its theme.

European thematic ETFs have surged in popularity since the beginning of the global Covid-19 pandemic. With more thematic ETFs to choose from than ever before, it’s never been more important that investors understand how these funds differ from one another and what the risks of investment are.

Thematic ETFs select stocks based on their exposure to one or more investment themes like Robotics and Automation, Energy Transition or Cyber Security. These funds may tap into macroeconomic or structural trends that transcend the traditional business cycle.

- Thematic ETFs: what investors need to know

- The ETFs Show: thematic investing is all about sectors of tomorrow

- iShares Clean Energy liquidity fears show wider thematic ETF issue

When evaluating investment merit, a strong narrative should not distract us from looking more closely at how exactly a fund tracks its theme. Two ETFs tracking the same theme can be built very differently and result in distinct performance outcomes. To better understand the nuances, we must look more closely at how a fund chooses and weights it’s stocks.

How does the fund select holdings?

Most thematic ETFs use one or more of the below approaches to select stocks.

- Revenue

The majority of thematic ETFs select stocks based on the revenues that companies derive from a defined set of activities. For example, an alternative energy fund may select constituents based on the percentage of revenues tied to solar, wind, or wave power.

This approach is logical, and the data is readily available.

A potential downside of a strictly revenue-based approach is that it is primarily backward-looking. This can leave investors gazing in the rearview mirror, which may be particularly problematic in rapidly developing areas such as technology.

Examples here include the hugely popular iShares Global Clean Energy ETF (LSE:INRG).

- Committee

In some cases, a committee of experts meets regularly to decide which stocks align with the desired theme, usually supplementing quantitative inputs like revenue sources with a more qualitative assessment. The committee can offer a "soft touch" approach, which allows the strategy to adapt to meet changes in the investment landscape. On the other hand, it means the strategy is reliant on the judgment of the committee and is therefore opaque. The committee is often lent credibility by being overseen by specialist organizations (like a trade association) or well-known experts in their fields.

An example of this approach is the L&G ROBO Global Robotics and Automation ETF (LSE:ROBO).

- Other

Some modern index providers use cutting-edge technology to scrape data from more obscure sources such as academic papers and patent submissions. The advantage of this approach, particularly in the fast-moving world of technology, is that it is forward-looking (patents signal intention). There are also claims that this approach can help generate an informational edge. A downside is the black-box nature of these strategies.

Thematic Index Weighting Criteria

After selecting stocks, an ETF must choose how to weight them. Given the narrow nature of most thematic funds’ selection universes, a standard market-cap-weighting approach will often result in large weightings in a small handful of stocks. To correct for this, most indexes have single stock, sector, or geographic weighting caps and/or floors. Another popular solution to this single-stock concentration problem is to equally weight constituents. Both approaches balance the influence of larger companies and result in a small-cap bias.

- The ETFs Show: environmental, China edtech, and cannabis fund

- China ETFs see a surge of buying – is buying the dip too risky?

- Top 10 most-popular investment funds: July 2021

Some funds implement more complex tiered or graded weighting approaches that prioritize firms that offer greater exposure to the underlying theme. For example, a specialized robotics company like US-based iRobot would be given a higher weighting than a huge conglomerate like Siemens (XETRA:SIE), for which robotics forms a smaller part of overall operations.

Liquidity

In their search of companies with the highest exposure to emerging themes and those with the highest growth potential, thematic funds often invest in the smaller, less liquid stocks.

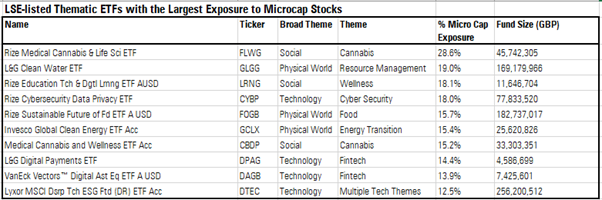

In the table, I have listed the thematic ETFs with the highest exposure to microcap stocks in Europe. The Rize Medical Cannabis & Life Sci ETF GBP (LSE:FLWG) for example has more than a quarter of fund assets invested in microcap stocks like Little Green Pharma Ltd (ASX:LGP), Australia's first locally-grown medical cannabis producer.

Micro-cap stocks can offer large upside potential, but a lack of liquidity means trading in and out at short notice can be costly.

The surge in popularity of thematic funds—and thematic ETFs, which tend to have narrow exposures and are compelled to buy and sell in line with index rules—has raised questions surrounding stocks' liquidity.

When evaluating the liquidity of a thematic fund, investors should look directly at fund holdings. Metrics like market capitalization of the stocks and average daily traded volume can be used to estimate how difficult it would be to sell holdings at short notice. A fund with large exposure to small- and micro-cap stocks is worth further scrutiny.

Kenneth Lamont is a senior analyst focused on manager research and passive strategies at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.