I still rate this high-yield Warren Buffett stock a buy

Its next set of results are expected to show an improvement, and overseas investing expert Rodney Hobson thinks there could be upgrades. It’s just one of the reasons he’s backing this famous business.

3rd July 2024 08:23

by Rodney Hobson from interactive investor

Mixed messages have come out of food and beverage group The Kraft Heinz Co (NASDAQ:KHC) so far this year. However, it has stuck to its full-year guidance and the tasty yield is another positive factor at this favourite stock held by fabled investor Warren Buffett.

Kraft’s next figures, to the end of June, will be released later this month but shareholders will be hoping for better signs of progress than they got in the final quarter of last year and the first one this year.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Net income slipped 3.9% to $804 million in the three months to the end of March, with net sales 1.2% lower at $6.4 billion. Adverse changes in foreign currency exchange rates did not help but were far from being the full story. The sales mix was less favourable and there was also a small decrease in volumes.

However, Heinz has been buying back shares so the profits are being spread less thinly. Adjusted earnings per share actually rose 1.5% and the dividend has been maintained at 40 cents per share each quarter.

At least the dire results in the final quarter of 2023, when net sales fell 7.1% and profits slumped 15%, were not repeated even though Heinz is currently up against strong comparatives in the first nine months of last year before it all turned sour.

The group still expects full-year organic net sales growth, though admittedly only 2% at best, with earnings per share up a meagre 1-3%, more if share buybacks continue. That suggests a decent pick-up as the year progresses and does allow for some upgrading of expectations. Heinz had already indicated that it expected volumes to pick up in the second half of this year and comparatives will get easier.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- What to expect from the US election: four scenarios

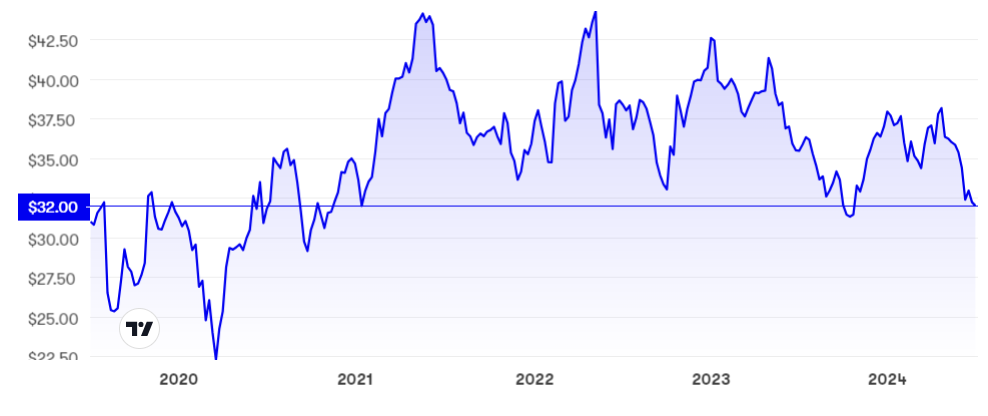

At around $32 the shares are back where they were five years ago. Since then, they have bounced between $22 and $44 but the current level has proved to be a floor for the past four years. The price/earnings ratio at 14 is really comfortable for a company of this quality, and the 5% yield is high for an American stock.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have tipped Heinz at $40 and $38 in the past so I must admit the company has not performed as well as I had hoped. Quarterly sales figures have been patchy over the past four years, but major issues such as supply chain disruptions and high inflation look to be mercifully in the past. That juicy yield has provided adequate compensation and there is the comfort of knowing that we have to eat – and so do people in the 190 countries across America, Europe and emerging markets that Heinz serves.

I rate Heinz a buy up to at least $36, where there could be resistance. If the next set of results are favourable, as I think they will be, then the shares should be heading back above $40 before the summer is out.

Heinz is a big favourite with institutional investors, which is a clear vote of confidence, and the nine biggest shareholders own just over half the business, leaving comparatively few shares to be actively traded. Continued share price volatility is therefore quite likely, making this a stock for traders as well as for longer term investors.

Update: Nothing succeeds like failure at aircraft manufacturer Boeing Co (NYSE:BA), where the chief executive has received a 45% pay rise for presiding over continued chaos. Now the workforce has put in a request for a mere 40%. Meanwhile, a Ryanair Boeing has dropped 2,000 feet at alarming speed for no obvious reason. The shares are inexplicably back up to $186. Sell while you can get out.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.