This iconic stock has discovered a recipe for success

With US earnings season almost done and dusted, overseas investing expert Rodney Hobson reflects on the outcomes for these three big hitters. He’s a buyer of one stock, but worries about the other two.

8th November 2023 08:03

by Rodney Hobson from interactive investor

Many American companies have reported that third-quarter profits were down on the same three months last year. Time to see which are doing well and which are really struggling.

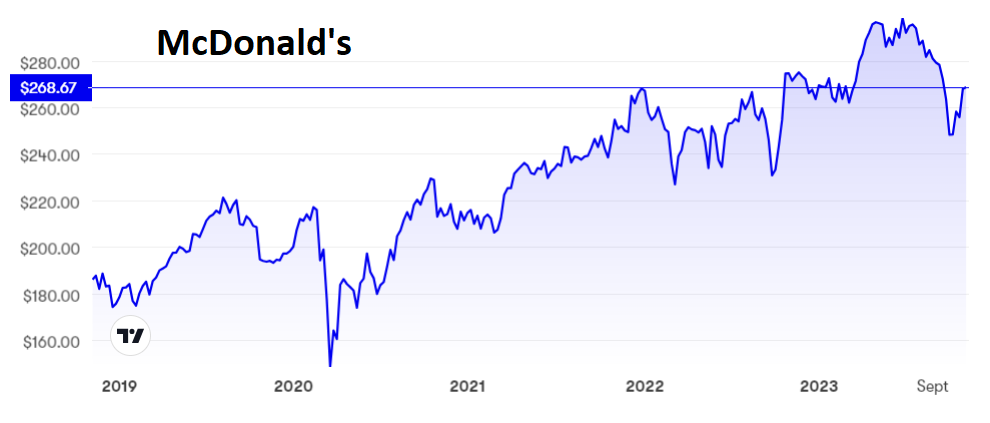

Best of the bunch was surely fast food chain McDonald's Corp (NYSE:MCD), which managed to increase revenue, profits and the dividend, a rare feat at the moment among well-known names. Cutting costs and successfully raising prices is a recipe for success.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Quarterly revenue was up 14% to $6.7 billion, taking revenue growth for the first nine months of the year to 11%. Same store sales rose 8.8%, with strong demand in the US, Canada, the UK and Germany. Sales figures beat expectations, a feat that McDonald’s is making a habit of. Net income jumped 17% to $2.3 billion.

The quarterly dividend of $1.67 is 10% higher than a year ago.

Unsurprisingly, the shares jumped 1.7% to $260 on release of the figures, and they have since pushed further ahead towards $270, where the price/earnings (PE) ratio is admittedly a little toppy at 23.6 and the yield is respectable if unexciting at 2.27%. Both figures assume that the good times will continue to roll, and with customers prepared to stomach rises in menu prices and with 1,500 store openings this year, it is difficult to argue with that perception.

Source: interactive investor. Past performance is not a guide to future performance.

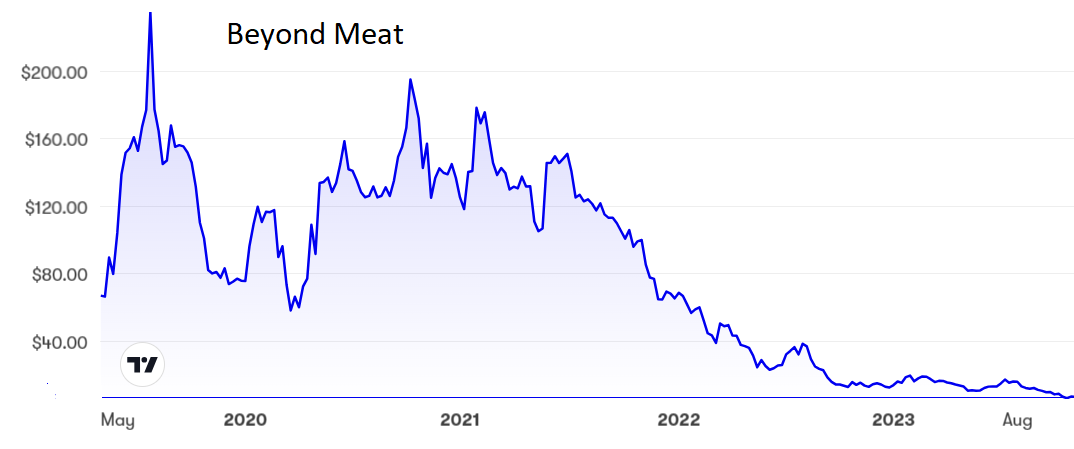

In sharp contrast, it goes from bad to worse at Beyond Meat Inc (NASDAQ:BYND), which I and many other commentators once thought was going to be the next big thing. This vegetarian food producer supplies plant-based patties to McDonald’s but has not made price rises stick. Instead, people have preferred to move back to cheaper meat-based products.

Beyond Meat had expected to return to revenue growth in the third quarter but actually saw the figure slump well below analysts’ expectations, prompting a downgrade of full-year forecasts plus a decision to reduce staffing by 65 mainly non-production employees, about 8% of the overall total.

- American stocks preparing for a profits boom

- ii view: Buffett’s Berkshire Hathaway holds more cash than ever

Wild optimism that the company was at last getting to grips with its problems sent the shares up 20%, but they still trade around $7 compared with a peak of $235 in 2019 when going vegan was all the rage.

Source: interactive investor. Past performance is not a guide to future performance.

The long shadow of Covid hangs heavily over another one-time stock market favourite, biotech group Moderna Inc (NASDAQ:MRNA). It wrote $3.1 billion off the value of its excess and obsolete Covid-19 vaccine stocks, but even that did not account for all of a swing from $1 billion profit last time to a $3.6 billion loss in the July-August quarter. Revenue at $1.83 billion was little more than half last year’s level.

The outlook is not good. Sales are projected to fall heavily next year, with most revenue coming in the second half, before a pick-up in 2025. The chances are that even those undemanding targets will be watered down before this year is out. Shareholders cannot even count on the group breaking even in 2026, as is now promised.

- Why US shares are attractive plus an outlook for 2024

- Terry Smith adds tech stock owned by Smithson to flagship portfolio

Manufacturing has been scaled back but, despite a rise in Covid cases of late and the occasional emergence of a new strain, the hope that this part of the business, the only bit actually generating any sales, will become profitable again next year stretches credibility. Everything rests on a new vaccine for respiratory disease in older patients coming through in 2025.

Moderna shares peaked at $450 a little over two years ago, but have since crashed back as rapidly as they rose. They now stand at just over $70, the level they were at in the summer of 2020.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: McDonald’s attempted to break above $300 this summer. That barrier could well be broken before the year is out. I recommended the shares at $260 in March and still retain my buy stance up to $290.

I have given Beyond Meat the benefit of the doubt for too long. Last March, when the shares seemed to be bottoming out at $15, I suggested they could be a buy for risk takers. This company is clearly a risk too far. Bite the bullet and sell.

I twice advised selling Moderna shares before suggesting in May that they were settling around $120. I should have stuck to my sell stance, which I reinstate at $72. The situation has deteriorated sharply over the past five months.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.