ii view: Informa is growing well

Media company Informa has completed the integration of UBM and the benefits are shining through.

24th July 2019 11:31

by Keith Bowman from interactive investor

Media company Informa has completed the integration of UBM and the benefits are shining through.

Half-year results to 30 June 2019

- Revenue up 47.1 % to £1.4 billion

- Adjusted profit up 48% to £435.7 million

- Underlying adjusted profit up 8.2%

- Interim dividend up 7.1% to 7.55p per share

Chief executive Stephen Carter said:

"A year on from the acquisition of UBM, the enlarged Informa Group is performing to plan, delivering a further period of growth in revenue, adjusted operating profit, free cash flow and dividends. On track to deliver our targets for 2019 and provides a strong foundation for consistent future growth and performance."

ii round-up:

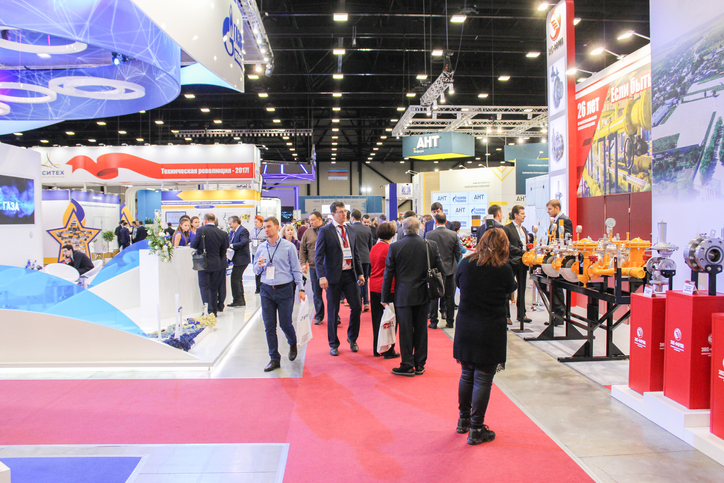

Formed in 1998, Informa (LSE:INF) is an international exhibitions, events, information services and scholarly publishing group. It employs over 11,000 staff in over 30 countries, and operates across five divisions: Connect, Intelligence, Markets, Tech and Taylor & Francis.

It works with customers in many specialist markets like life sciences, artificial intelligence, health & nutrition, aviation and beauty & aesthetics.

After buying rival UBM, it has been busy integrating the new business.

That integration is now complete, with the benefits of the UBM purchase shining through. Both revenue and profits grew nicely. All five divisions reported sales growth, with profit improvements seen for the majority.

Management's confidence in the outlook was underlined with a 7.1% increase in the half-year dividend payment.

The shares rose by over 5% in early stock market trading.

ii view:

Informa's diverse business and solid track record have helped underpin investor confidence, while absorbing UBM marks another positive milestone. Outlook comments remain upbeat in tone and a progressive dividend policy is attractive.

A forward price earnings (PE) ratio of over 15 and above the 10-year average of 13 add some caution, as does a 35%-plus rally in the share price year to date. But clearly progress is being made, and today's results topped analyst expectations with positive full-year guidance reiterated. For now, investors will likely stick with the shares.

Positives:

- Purchase of UBM gives exposure to Asia

- Dividend payment increased for 10 consecutive years

Negatives:

- PE ratio above 10-year average

- Return on equity at 12.9% is below three-year average of 19.1%

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.