Investing post-Covid: strategies for a new world order

Key investment considerations are emerging, such as a reassessment of passives, and the strains of incom…

3rd July 2020 16:20

by Cherry Reynard from interactive investor

Key investment considerations are emerging, such as a reassessment of passives, and the strains of income loss.

John Templeton once said: “The four most dangerous words in investing are ‘this time it’s different’”. It’s perhaps bold to disagree with a billionaire, but it seems clear that the world that emerges post-Covid will not be the same as the world pre-Covid. At the very least, from an investment perspective, growth looks set to be slower and income harder to find, while a more extreme scenario could see swathes of companies vanish altogether. For investors, it may be time for a rethink.

The response to Covid-19 has been vast government intervention in economies. The UK government has paid people’s salaries, propped up businesses and sprayed money on health services, while central bankers have cut interest rates and resumed quantitative easing.

- Will the Covid-19 crisis and QE trigger the return of inflation?

The aim is to prevent widespread job losses and prolonged recession. It is not yet clear whether this has been successful. Economists are still debating whether the economic recovery will be V-shaped, U-shaped or, more worryingly, L-shaped.

These interventions have had a high price. UK government borrowing hit its highest level in 57 years in April and looks set to jump higher still. The US Treasury is scheduled to borrow $3 trillion from April to June to fund its recovery measures.

This changed backdrop will have a number of implications for the way people invest. Growth is likely to be scarce and some industries – airlines, travel, leisure – may be permanently impaired. Interest rates will remain low at the same time as many companies are cutting dividends, which will create challenges for those needing an income from their investments.

That said, there will be a number of industries that see bumper returns: few governments will now scrimp on healthcare, for example, while corporate spending on cloud-based technology would now seem to be a necessity rather than a luxury.

- Six ways Covid-19 could change the world forever

1) Active vs Passive

Perhaps the first question investors should be asking themselves in this environment is whether they want their stock market exposure to be based on size alone. Passive has been a good option in recent years, particularly for those who have taken exposure to the S&P 500 or MSCI global indices.

These have been dominated by the large technology companies, which have performed well over the past five years and could continue their dominance: they have deep pockets, technical knowhow and may emerge from this crisis even stronger. To play this trend, passive exposure to the US may still make sense post-crisis.

However, other passive options look more problematic. The FTSE 100, for example, is 10% weighted to oil and gas and just 1% weighted to technology. This hardly looks like a future-proof portfolio. The Eurostoxx 50 has a higher technology weight at 13%, but meaningful legacy weightings in oil and gas and some precarious- looking banks.

2) Home bias risk

This ‘future-proofing’ should extend to the geographic allocation of a portfolio. The UK economy may recover, but even when Covid-19 is behind it, Brexit is just around the corner. Some of the UK’s most powerful industries such as oil, and flagship companies such as Rolls-Royce, are facing an uncertain future. Part of the historic popularity of the UK market is down to its dividend culture, but almost half of UK companies have cut their dividends in the wake of the Covid-19 crisis.

- Dividend kings: reliable income shares hit by Covid cuts

As such, a ‘home bias’, particularly among larger companies, looks increasingly anachronistic. There is precious little growth to be found in the UK and some of its industries face structural weakness. Tom Rosser, investment research analyst at The Share Centre, says: “Over the long term, the total return from the UK market has been substantially driven by dividends. The price index has barely moved. As such, this is a big shock to the system. People tended to invest in the UK because of its reliable dividends. Investors need a better balance.”

Where else might they look? It is clear that many developed economies are seeing similar constraints to the UK. Rosser encourages “broad geographic exposure” to bring in new sectors and greater portfolio diversity. Fidelity believes Asia is likely to remain a growth hotspot.

Andrew McCaffery, global chief investment officer at the group, says: “Mainland China, Hong Kong, Taiwan and South Korea demonstrated organised, disciplined, well-resourced and targeted reactions to the outbreak and, as a result, appear to have it more under control than others and are beginning to re-open their economies.

“This puts Asia at an advantage as the rest of the world still organises its responses. However, there are deeper structural reasons why we think Asia is primed for economic leadership. Asia has higher economic growth, stable political regimes and wide-scale adoption of technology that will help it take a lead. Certain countries also have lower debt and supportive demographics.”

- Fund and trust tips for the post-pandemic ‘new normal‘

3) Powerful themes

Just as the Covid-19 crisis should prompt questions on whether a portfolio based on size makes sense, investors may also question the rationale behind a portfolio organised on geographic lines, even though this has been the norm for many years. After all, travel companies are unappealing wherever they are based. It may be time for investors to be bolder and instead look at the themes that are likely to grow.

Steve Freedman, senior product specialist at Pictet, suggests a number of options, some where there is already considerable momentum and some that are more speculative. He says: “Digitisation, for example, was already happening. The pendulum will not swing all the way back. The pandemic has accelerated the change in consumption patterns, as that portion of the population not on board has been forced to change.”

Michael Nicol, co-manager of the Kames Global Equity fund, agrees, believing that ways of working and communicating with customers, suppliers and colleagues is undoubtedly changing as the pandemic has forced a readjustment of working practices: “Technological development is the enabler of this progress. Our world will evolve further into the cloud, hosting ever smarter virtual applications that accelerate corporate productivity and efficiencies.”

- The winners of lockdown and the firms fit for a post-Covid world

Freedman says automation is another key theme: “It is likely that we will see some re-onshoring as a result of disruptions in supply chains brought about by Covid-19. This will need investment in automation to cope with higher wage costs. Companies need to reduce their dependency on humans.”

The argument against a thematic approach has been that it can leave portfolios narrowly focused. However, Richard Lightbound, chief executive officer EMEA & Asia at ROBO Global, which devised the index for the L&G ROBO Global Robotics and Automation ETF, says that themes are often more diverse than people think. Robotics and automation, for example, encompasses warehouse and logistics automation, alongside medical robots and 3D printing, precision feeding and watering in agriculture.

Lightbound believes investors are changing their approach: “We are seeing people broadening their horizons and taking these areas of opportunity more seriously.” He says these themes are designed to grow over time as new companies launch and the sector diversifies.

Healthcare is another area likely to see an influx of investment over the next few years. Nicol believes that the Covid-19 pandemic has highlighted issues of insufficient healthcare capacity and resilience, particularly in countries where the sector has seen cuts to spending in recent years. Freedman sees a shift in focus to preventative health with the aim of reducing the ‘at-risk’ population. Taxpayers may look to reduce the healthcare costs that arise from poor diet and lack of exercise, with higher levels of regulatory involvement for companies seen to contribute to poor health.

- How healthcare and biotech investment trusts can revive portfolios

4) The income dilemma

Income is likely to be another major challenge for investors in a post-Covid environment. It was already a problem, but cuts to interest rates and the resumption of quantitative easing make it even scarcer. The UK recently sold its first ever negative-yielding government bond, while the yield on a 10-year UK government bond stands at just 0.2%.

Government bonds may have a place in portfolios for diversification purposes, but they are no longer a meaningful source of income. With inflation factored in, investors are likely to lose money in real terms over a 10-year period.

Fortunately, after a period when they looked very expensive, corporate bonds appear to offer an option once again. Rosser says: “The US Federal Reserve has committed to buying investment-grade and even some high-yield bonds. This has helped support spreads.” Certainly, there is likely to be higher default risk, but there are areas that have been beaten up that now look good value. He points to areas such as financials, which look well-financed and stable, but have been hit hard in the recent rout.

He believes active management is important in this environment, and that a good strategic bond manager could be invaluable. The Share Centre currently has Artemis High Income, Janus Henderson Strategic Bond and Merian Global Strategic Bondon its Platinum 120 list.

Equities should be a good option in the face of falling fixed income yields. However, here too there are problems. Around half of UK companies have cut their dividends, including the largest dividend payer in the UK market, Royal Dutch Shell. Rosser suggests investors look at smaller company funds for income. Options could include a general trust with a high yield and smaller company exposure, such as Henderson UK Opportunities, or a specialist smaller company income fund such as Chelverton UK Equity Income.

The picture for income globally has been less difficult. Only around 15% of US companies have cut dividends, for example, and Asian companies have also shown more resilience. Going global also helps investors balance their portfolios away from some of the weaker sectors such as oil and gas that dominate the UK dividend scene. For real diversification, investors may want to consider emerging markets and even frontier markets – the Jupiter Emerging and Frontier Income trust has had a torrid time recently but could give some diversity of income.

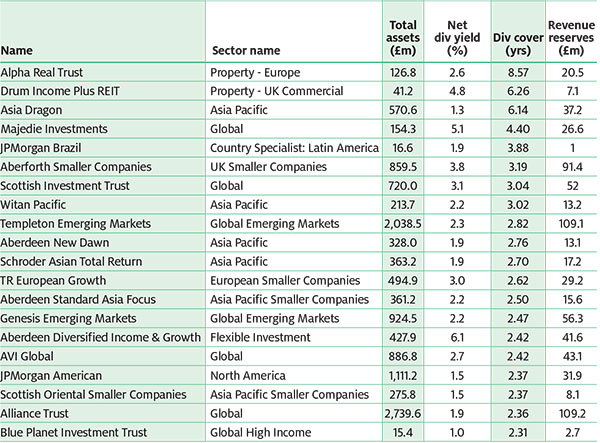

Investment trusts in general still have some real advantages in this environment. In many cases they have reserves to support their payouts to shareholders. There are 25 trusts with over two years of dividend cover (see table below for the top 20). Few have yet said whether they will be dipping into their reserves, but it seems likely.

This income scarcity also argues for exposure to alternatives, though here, too, investors need to tread carefully. Does the argument for commercial property still stand, for example, at a time when high-street retailers are going bust and companies may decide they need less office space? However, ‘real assets’ such as infrastructure should be under consideration.

Overall, it is perhaps more important than ever to ensure that an investment portfolio is pointed towards the future. The world may not change dramatically, but a number of trends have built momentum through this crisis and could be a strong source of growth in future.

Trusts with dividend coverage to strengthen portfolio income

Source: AIC using Morningstar as at 26 May 2020. Highest 20 dividend covers for funds with a yield of at least 1%.

ESG trend quickens

Awareness of the climate crisis had been building already, but Covid-19 has shone a spotlight on environmental degradation. Pollution levels have dropped and the human role in climate change has been laid bare. At the same time, those companies with poor governance – relying on cheap foreign labour, or vulnerable supply chains – have been brutally exposed. It seems inevitable that investors will want to ensure that these risks are properly managed, thereby accelerating the trend of investing through an environmental, social and governance lens.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.