ISA tips from the UK’s first ISA millionaire

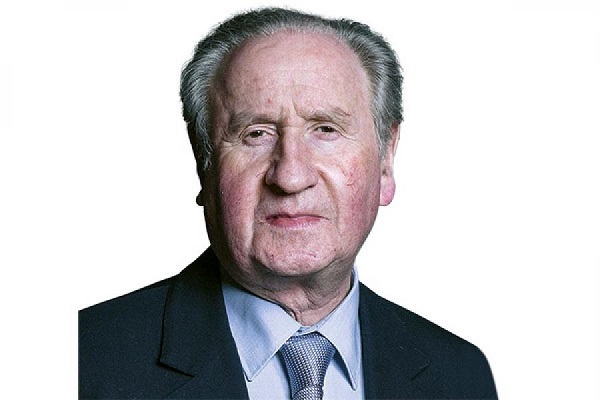

Every investor ought to have an ISA, says Lord Lee of Trafford. Here are his investment principles.

17th February 2020 11:06

by Jeff Salway from interactive investor

Every investor ought to have an ISA, says Lord Lee of Trafford. Here are his investment principles.

It’s sometimes said that investing can be so complicated that the best strategy is to keep it simple. One man who might agree is Lord Lee of Trafford, the Liberal Democrat peer and former Conservative MP. He is also known as the first ISA millionaire, having built a portfolio “brick by brick” in personal equity plans (Peps) and then individual savings accounts (ISAs).

In his 2014 book How To Make a Million – Slowly, Lord Lee set out the 12 guiding principles that he has followed throughout his investment career. These include buying shares at modest valuations, being prepared to hold on for the long term, understanding the companies you invest in, ignoring short-term share price movements and looking for cash-rich firms with low debt.

Yet Lord Lee’s investment principles can be set out in even clearer terms. “You need two things to be successful at investing: common sense and patience,” he suggests.

“The second is the most important, but unfortunately too many investors chop and change too often.”

Patience and pragmatism

Lord Lee is an ardent advocate of investing for the long term in companies that inspire confidence and meet certain criteria. He explains that his strategy has essentially been to invest in companies that are already established and trading at a profit. He says:

“I don’t invest in start-ups, biotech, exploration companies or – these days – contracting companies, because my belief is that the key to success lies in avoiding losses. By coming in when companies are established and paying dividends, there is less risk of them disappearing or collapsing.”

He makes it sound easy. But then Lord Lee is perhaps as famous these days for being the first ISA millionaire as he is for his other activities. John Lee was a stockbroker before entering politics in the 1970s. He was Conservative MP for Nelson and Colne from 1979 to 1983 and then Pendle from 1983, until he lost his seat in 1992. He became a Liberal Democrat in 2001 and was later made a life peer.

His 36 years in Westminster included a period as a junior minister in Margaret Thatcher’s government. It was during that spell, in 1987, that the government launched the Pep, the tax-free savings wrapper that 12 years later became the ISA.

Lord Lee could see the attraction of Peps from the start: they offered an opportunity to build a portfolio of stocks free of income or capital gains tax. “But I initially had difficulty finding a plan manager who would allow me to choose my own stocks, because most wanted you to choose from their selection. I always make my own decisions,” he says.

His first Pep investment was in Pifco, a Manchester company best known for the manufacture and sale of small electrical products. He says:

“After that I added a number of small-cap stocks and always reinvested my dividends in order to benefit from compounding. I originally hail from Manchester and my first experience of companies was regional smaller businesses, so I have tended to focus on smaller caps over the years.”

He invested his full annual allowance until 2003. He has since ceased paying in new money and simply lets the portfolio compound its way to further growth.

The investment strategy has remained steadfastly unchanged, as one might expect given how effective it has been. Lord Lee is a fully signed-up member of the ‘buy and hold’ school of investing, waiting patiently for profit growth and, invariably, benefiting from the many takeovers his holdings have been through.

In the early years he often invested in companies with a strong family or proprietorial element and a focus on “stewarding the business in a sensible way”. However, he admits:

“It’s more difficult now to find family businesses, and they won’t be around in the future to the extent that they were when I started investing.”

Other notable shifts in his 60-year investment career include the disappearance from the stock market of sectors such as rubber and tea plantation companies, regional brewers and textile firms. “There are now virtually no quoted rubber and tea plantation companies, the textiles sector has almost ceased to exist in a public sense, and most small brewers have been absorbed by the larger ones.”

There are typically between 15 and 20 stocks in his ISA portfolio, and a blend of small and more substantial holdings. It remains UK-focused, albeit with a global reach. Lord Lee seeks out companies with a substantial portion of their businesses in growing developing markets, in order to access the higher growth in those regions while still benefiting from UK corporate governance standards.

His search for companies isn’t restrained by specific metrics, but a company must possess certain characteristics to be considered for investment, such as board stability. “If I see a company has had, say, five different finance directors in five years or non-executives resigning every year, the warning lights will flash red,” he says. “And I look for optimistic statements from chief executives or chairmen.”

There is conservatism at the heart of his investment approach that befits his former political allegiances.

“I look for firms that are not substantially over-geared. One characteristic I do like in companies is having no borrowings and very positive cash positions. I like a touch of caution.”

So what messages does he have for investors? One of the main ones is the need to accept that even growing companies have times when profits plateau.

“If you believe in a company, you stay on board. Conversely, however, if you have made a mistake, you take the loss on the chin and move on. If every time you look at your portfolio you see a share that is making a loss, it reminds you of your failure and inhibits your confidence.”

He cites the example of HMV as a holding he sold out of where the losses would have been even greater had he held on. Dawson Holdings was a bigger disappointment.

He held on to it even as it lost out on distribution contracts to rivals such as Menzies and eventually “withered to almost nothing”.

Enduring potential

Recent moves include adding significantly to existing holdings in Legal & General (LSE:LGEN) and Aviva (LSE:AV.). “Before the election I took the view that there would likely be a Tory majority, so I didn’t make any radical changes, but I kept a little cash back.” Then on the day after the election he added to four of the smaller holdings, including Air Partner, the global aviation services group, palm oil producer MP Evans – where the board had revealed plans for a sizeable buyback – and Christie Group, a business services company he felt would benefit from a post-election improvement in confidence.

Lord Lee continues to be an evangelist for private investing and in 2019 published Yummi Yoghurt: A First Taste of Stock Market Investment!, a compact, accessible book aimed at introducing young people to investing. He is evangelistic about the benefits of the ISA wrapper, while acknowledging that anyone starting today would need to invest over a very long period to replicate the growth of 15-20 years ago.

However, he adds:

“There’s every opportunity for people to invest successfully if they reinvest dividends and build substantial funds, because the ISA is extremely attractive. Every investor ought to have an ISA. If they can put in a regular amount each year, reinvest the dividends and select fairly successfully, there is no reason why they shouldn’t build up a reasonably rewarding portfolio over the years.”

Lord Lee in five

My best investment was... In terms of pure appreciation, probably something like (marine engineering services provider) James Fisher or (ingredients manufacturer) Treatt, my biggest holding by far.

My worst investment and lesson learnt... I lost virtually all my investment in Dawson Holdings and should have come out when it wasn’t winning major distribution contracts. You never stop learning. You’ll never get them all right, but you’re looking to get far more right than wrong.

My alternative career would have been... I would have enjoyed being a political commentator. I enjoy media work and the investment writing I’ve done over the years, including my FT Money columns and my two books.

The one thing I would like to see change in financial services is... The ability of individual private investors to receive annual reports direct from companies, because reports get lost on fund managers’ desks. I would also like to see much greater involvement of private shareholders at AGMs.

In my spare time I like to... The stock market is still by far my biggest hobby and interest, but I also enjoy salmon fishing and a bit of antique collecting.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.